Costco 2008 Annual Report Download - page 44

Download and view the complete annual report

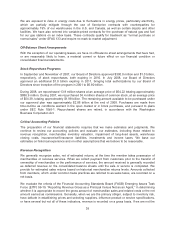

Please find page 44 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pronouncements that address fair value measurements under SFAS 13, from the scope of SFAS 157.

In February 2008, the FASB issued FASB Staff Position No. 157-2 (FSP 157-2), which provides a

one-year delayed application of SFAS 157 for nonfinancial assets and liabilities, except for items that

are recognized or disclosed at fair value in the financial statements on a recurring basis (at least

annually). We are required to adopt SFAS 157 as amended by FSP FAS 157-1 and FSP FAS 157-2 on

September 1, 2008, the beginning of our fiscal 2009. The adoption is not expected to have a material

impact on our consolidated financial statements.

In October 2008, the FASB issued FASB Staff Position No. FAS 157-3, “Determining the Fair Value of

a Financial Asset in a Market That Is Not Active” (FSP 157-3), which clarifies the application of SFAS

157 when the market for a financial asset is inactive. Specifically, FSP 157-3 clarifies how

(1) management’s internal assumptions should be considered in measuring fair value when observable

data are not present, (2) observable market information from an inactive market should be taken into

account, and (3) the use of broker quotes or pricing services should be considered in assessing the

relevance of observable and unobservable data to measure fair value. The guidance in FSP 157-3 is

effective immediately and will apply to us upon adoption of SFAS 157.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities, Including an Amendment to FASB No. 115” (SFAS 159). Under SFAS 159, entities

may elect to measure specified financial instruments and warranty and insurance contracts at fair value

on a contract-by-contract basis, with changes in fair value recognized in earnings each reporting

period. The election, called the fair value option, will enable entities to achieve an offset accounting

effect for changes in fair value of certain related assets and liabilities without having to apply more

complex hedge accounting provisions. SFAS 159 will be effective for us September 1, 2008, the

beginning of our fiscal 2009. We do not intend to elect the fair value option for any of our existing

financial assets or financial liabilities; therefore, this statement is not expected to have a material

impact on our consolidated financial statements.

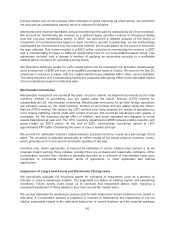

In June 2008, the FASB issued Staff Position EITF 03-06-1, “Determining Whether Instruments

Granted in Share-Based Payment Transactions Are Participating Securities” (FSP EITF 03-06-1). FSP

EITF 03-06-1 provides that unvested share-based payment awards that contain nonforfeitable rights to

dividends or dividend equivalents (whether paid or unpaid) are participating securities and shall be

included in the computation of earnings per share pursuant to the two-class method in SFAS No. 128,

“Earnings per Share”. Our unvested RSUs are not eligible to receive dividends; therefore EITF 03-06-1

will not have any impact on our consolidated financial statements.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated

Financial Statements, an Amendment of Accounting Research Bulletin No 51” (SFAS 160). SFAS 160

establishes accounting and reporting standards for ownership interests in subsidiaries held by parties

other than the parent, changes in a parent’s ownership of a noncontrolling interest, calculation and

disclosure of the consolidated net income attributable to the parent and the noncontrolling interest,

changes in a parent’s ownership interest while the parent retains its controlling financial interest and

fair value measurement of any retained noncontrolling equity investment. SFAS 160 is effective for

financial statements issued for fiscal years beginning after December 15, 2008, and interim periods

within those fiscal years. Early adoption is prohibited. We must adopt these new requirements in our

first quarter of fiscal 2010.

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations” (SFAS 141R), which

establishes principles and requirements for the reporting entity in a business combination, including

recognition and measurement in the financial statements of the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest in the acquiree. SFAS 141R applies prospectively to

business combinations for which the acquisition date is on or after the beginning of the first annual

42