Costco 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

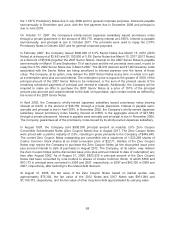

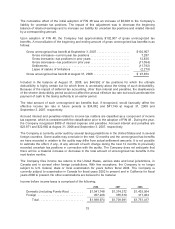

The deferred tax accounts at the end of 2008 and 2007 include current deferred income tax assets of

$260,879 and $214,723, respectively, included in deferred income taxes and other current assets;

non-current deferred income tax assets of $5,121 and $10,063, respectively, included in other assets;

current deferred income tax liabilities of $738 and $0, respectively, included in other current liabilities;

and non-current deferred income tax liabilities of $113,538 and $122,089, respectively, included in

deferred income taxes and other liabilities.

The effective income tax rate on earnings was 35.83% in 2008, 36.68% in 2007 and 37.01% in 2006.

During 2008 and 2007, the Company distributed $104,351 and $119,588, respectively, in earnings

from its Canadian operations.

The Company has not provided for U.S. deferred taxes on cumulative undistributed earnings of certain

non-U.S. affiliates, including its 50% owned investment in the Mexico corporate joint venture,

aggregating $1,235,489 and $1,046,747 at the end of 2008 and 2007, respectively, as such earnings

are deemed indefinitely reinvested. Because of the availability of U.S. foreign tax credits and

complexity of the computation, it is not practicable to determine the U.S. federal income tax liability or

benefit associated with such earnings if such earnings were not deemed to be indefinitely reinvested.

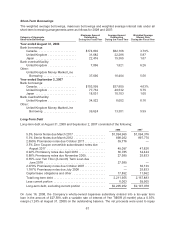

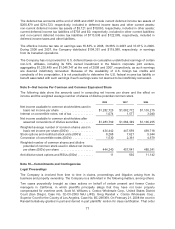

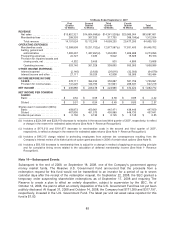

Note 9—Net Income Per Common and Common Equivalent Share

The following data show the amounts used in computing net income per share and the effect on

income and the weighted average number of shares of dilutive potential common stock.

2008 2007 2006

Net income available to common stockholders used in

basic net income per share ..................... $1,282,725 $1,082,772 $1,103,215

Interest on convertible notes, net of tax ............. 1,074 1,577 3,040

Net income available to common stockholders after

assumed conversions of dilutive securities ......... $1,283,799 $1,084,349 $1,106,255

Weighted average number of common shares used in

basic net income per share (000’s) ............... 434,442 447,659 469,718

Stock options and restricted stock units (000’s) ....... 8,268 7,621 5,944

Conversion of convertible notes (000’s) ............. 1,530 2,361 4,679

Weighted number of common shares and dilutive

potential of common stock used in diluted net income

per share (000’s) per share ..................... 444,240 457,641 480,341

Anti-dilutive stock options and RSUs (000s) .......... 11 692 11,142

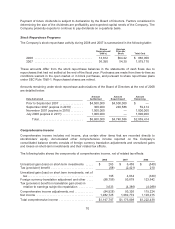

Note 10—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company is a defendant in the following matters, among others:

Two cases purportedly brought as class actions on behalf of certain present and former Costco

managers in California, in which plaintiffs principally allege that they have not been properly

compensated for overtime work. Scott M. Williams v. Costco Wholesale Corp., United States District

Court (San Diego), Case No. 02-CV-2003 NAJ (JFS); Greg Randall v. Costco Wholesale Corp.,

Superior Court for the County of Los Angeles, Case No. BC-296369. On February 21, 2008 the court in

Randall tentatively granted in part and denied in part plaintiffs’ motion for class certification. That order

77