Costco 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

chairman, or non-employee directors, except in April 1997 both the chief executive officer and the

chairman received, as part of a broad grant to hundreds of employees, one grant subject to imprecision

that may have benefited each by up to approximately $200. Other grants subject to imprecision were

made to a director who serves as executive vice president and chief financial officer and to a director

who had no role in the determination of any grant date, but who serves as senior executive vice

president and chief operating officer.

Given the lack of historical documentation, it was not possible to precisely determine the amount of the

adjustments that should be made. Based on the recommendation of the special committee, which was

based on the documentation that was available, the Company, as of the end of 2006, recorded an

adjustment to transfer $116,157 from retained earnings to paid-in capital, representing previously

unrecorded after-tax compensation expense, and to increase the deferred tax asset account by

$31,480. In those cases where the committee was unable to identify the likely grant date of the options,

the latest date on which the decision could have been made was used. The Company also recorded

$1,701 for the estimated federal income tax consequences stemming from the probable disallowance

of compensation deductions claimed related to the subject option grants. The Company informed the

SEC of the special committee’s investigation and conclusions. A grand jury investigation concerning

the review is ongoing, as are two shareholder derivative actions, one of which challenges the

Company’s prior disclosures concerning the investigation. See Note 10 for additional information.

The special committee and management do not believe that the net effects of this adjustment were

material, either quantitatively or qualitatively, in any of the years covered by the review. In reaching that

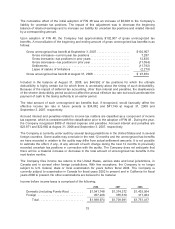

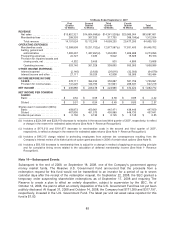

determination, the following quantitative measures were considered:

Year

Net after tax

effect of

adjustment

Reported net

income(1)

Percent of

reported net

income

2005 ................................ $ 3,954 $1,063,092 0.37%

2004 ................................ 6,430 882,393 0.73%

2003 ................................ 9,092 721,000 1.26%

2002 ................................ 14,872 699,983 2.12%

1996-2001 ........................... 81,809 2,769,678 2.95%

Total ............................. $116,157 $6,136,146 1.89%

(1) Excludes cumulative effect of accounting change related to membership fees of $118,023 (net of

tax) reported in fiscal 1999.

Accounting for Reinsurance Agreements

The Company adjusted its beginning retained earnings for 2006 related to a correction in the historical

accounting treatment of certain finite risk arrangements. Because of the limited amount of risk transfer

included in the agreements, historical premium payments should have been accounted for as a deposit

asset rather than expensed over the policy term.

Deferred Tax Liability Adjustment

The Company also adjusted its beginning retained earnings for 2006 for a historical misstatement in

deferred taxes related to unreconciled differences in the detailed records supporting the deferred tax

liability for depreciation of property and equipment. These differences had accumulated over a period

of several years. This resulted in an overstatement of the tax basis and a corresponding

understatement of the Company’s net deferred tax liability.

82