Costco 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 vs. 2006

Gross margin was $6.64 billion, or 10.52% of net sales in 2007, compared to $6.22 billion, or 10.55%

of net sales in 2006. Excluding the unusual items affecting net sales and gross margin in 2007,

adjusted gross margin as a percentage of adjusted net sales was 10.58%, or an increase of three

basis points as compared to 2006. This increase was primarily due to a 24 basis point increase in

certain merchandise departments, largely food and sundries, as well as smaller increases in certain

warehouse ancillary businesses, costco.com and our international operations, offset by a decrease in

our hardlines and softlines categories of approximately 15 basis points. In addition, increased

penetration of the Executive Membership two-percent reward program and increased spending by

Executive members negatively affected gross margin by six basis points.

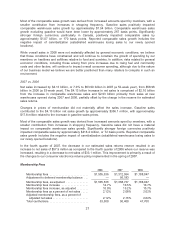

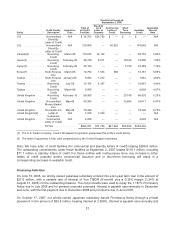

Selling, General and Administrative Expenses

2008 2007 2006

Selling, general and administrative

expenses (SG&A) ................... $6,953,804 $6,273,096 $5,732,141

Unusual items ........................ — (46,815) —

SG&A, as adjusted .................... $6,953,804 $6,226,281 $5,732,141

SG&A as a percent of net sales ......... 9.80% 9.94% 9.72%

Adjusted SG&A as percent of adjusted net

sales ............................. 9.80% 9.80% 9.72%

2008 vs. 2007

SG&A totaled $6.95 billion, or 9.80% of net sales in 2008, compared to $6.27 billion, or 9.94% of net

sales in 2007. Excluding the unusual items affecting net sales and SG&A expenses in 2007, adjusted

SG&A as a percentage of adjusted net sales was 9.80% in 2007. Warehouse operating and central

administrative costs positively impacted adjusted SG&A comparisons, on a net basis, by approximately

seven basis points, primarily due to decreased payroll and benefits costs as a percent of adjusted net

sales. Stock-based compensation expense negatively impacted adjusted SG&A comparisons by three

basis points, primarily due to a higher closing stock price on the date that our October 2007 RSU grant

was valued as compared to previous grants. Additionally, we recorded a $15.9 million reserve in

connection with a litigation settlement and accrued approximately $9 million for compensation

adjustments we made to employees enrolled in our medical and dental plans related to a decision to

share a portion of the health plan’s savings that we achieved. These two items negatively impacted

adjusted SG&A comparisons by four basis points.

2007 vs. 2006

SG&A totaled $6.27 billion, or 9.94% of net sales in 2007, compared to $5.73 billion, or 9.72% of net

sales in 2006. Excluding the unusual items affecting net sales and SG&A expenses in 2007, adjusted

SG&A as a percentage of adjusted net sales was 9.80%, an increase of eight basis points. Of this

increase, three basis points were primarily due to an increase in stock-based compensation, and a net

five basis points were due to an increase in warehouse payroll and benefits costs. The payroll increase

was largely attributed to hourly rate increases that went into effect in March 2007 and a lower overall

comparable warehouse sales increase.

29