Comcast 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

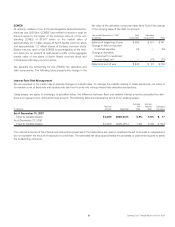

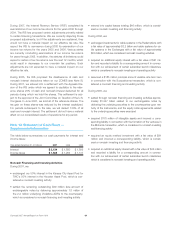

During 2007, the Internal Revenue Service (“IRS”) completed its

examinations of our income tax returns for the years 2000 through

2004. The IRS has proposed certain adjustments primarily related

to certain financing transactions. We are currently disputing those

proposed adjustments, but if the adjustments are sustained, they

would not have a material impact on our effective tax rate. We

expect the IRS to commence during 2008 its examination of our

income tax returns for the years 2005 and 2006. Various states

are currently conducting examinations of our income tax returns

for years through 2005. In addition, the statutes of limitations could

expire for certain of our tax returns over the next 12 months, which

could result in decreases to our uncertain tax positions. Such

adjustments are not expected to have a material impact on our

effective tax rate.

During 2005, the IRS proposed the disallowance of cash and

noncash interest deductions taken on our ZONES (see Note 8).

During 2007, we entered into a settlement with the Appeals Divi-

sion of the IRS under which we agreed to capitalize to the refer-

ence shares 25% of cash and noncash interest deducted for all

periods during which we held the shares. This settlement is sub-

ject to the approval of the Joint Committee on Taxation of the U.S.

Congress. In June 2007, we sold all of the reference shares. The

tax gain on these shares was reduced by the interest capitalized.

For periods subsequent to the sale, we will deduct 100% of all

cash and noncash interest. The settlement did not have a material

effect on our consolidated results of operations for any period.

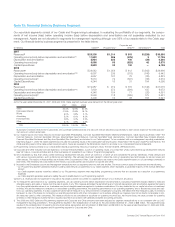

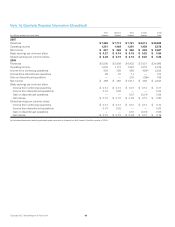

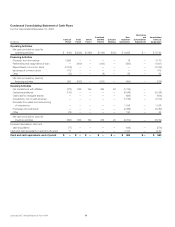

Note 13: Statement of Cash Flows —

Supplemental Information

The table below summarizes our cash payments for interest and

income taxes:

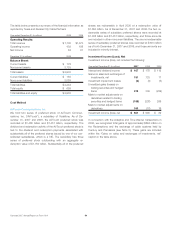

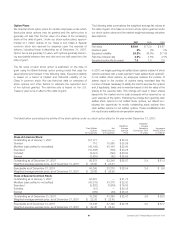

Year ended December 31 (in millions) 2007 2006 2005

Interest $ 2,134 $ 1,880 $ 1,809

Income taxes $ 1,638 $ 1,284 $ 1,137

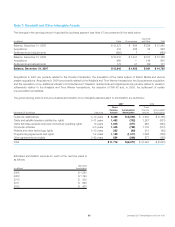

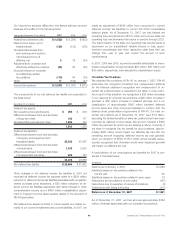

Noncash Financing and Investing Activities

During 2007, we:

• exchanged our 50% interest in the Kansas City Asset Pool for

TWC’s 50% interest in the Houston Asset Pool, which is con-

sidered a noncash investing activity

• settled the remaining outstanding $49 million face amount of

exchangeable notes by delivering approximately 1.8 million of

the 2.2 million underlying Vodafone ADRs to the counterparty,

which is considered a noncash financing and investing activity

• entered into capital leases totaling $46 million, which is consid-

ered a noncash investing and financing activity

During 2006, we:

• exchanged investments for cable systems in the Redemptions with

a fair value of approximately $3.2 billion and cable systems for ca-

ble systems in the Exchanges with a fair value of approximately

$8.5 billion, which are considered noncash investing activities

• acquired an additional equity interest with a fair value of $21 mil-

lion and recorded a liability for a corresponding amount in connec-

tion with our achievement of certain subscriber launch milestones,

which is considered a noncash investing and operating activity

• assumed a $185 million principal amount variable-rate term loan

in connection with the Susquehanna transaction, which is con-

sidered a noncash financing and investing activity

During 2005, we:

• settled through noncash financing and investing activities approx-

imately $1.347 billion related to our exchangeable notes by

delivering the underlying securities to the counterparties upon ma-

turity of the instruments, and the equity collar agreements related

to the underlying securities were exercised

• acquired $170 million of intangible assets and incurred a corre-

sponding liability in connection with the formation of the ventures in

the Motorola transaction, which is considered a noncash investing

and financing activity

• acquired an equity method investment with a fair value of $91

million and incurred a corresponding liability, which is consid-

ered a noncash investing and financing activity

• acquired an additional equity interest with a fair value of $45 million

and recorded a liability for a corresponding amount in connec-

tion with our achievement of certain subscriber launch milestones,

which is considered a noncash investing and operating activity

Comcast 2007 Annual Report on Form 10-K 64