Comcast 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

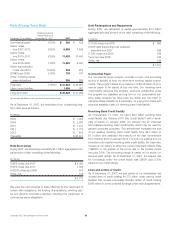

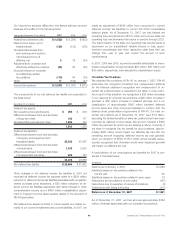

We sponsor various retirement investment plans that allow eligible

employees to contribute a portion of their compensation through

payroll deductions in accordance with specified guidelines. We

match a percentage of the employees’ contributions up to certain

limits. For the years ended December 31, 2007, 2006 and 2005,

expenses related to these plans amounted to $150 million, $125

million and $115 million, respectively.

We also maintain unfunded, nonqualified deferred compensation

plans, which were created for key executives, other members of

management and nonemployee directors (each a “Participant”).

The amount of compensation deferred by each Participant is

based on Participant elections. Account balances of Participants

are credited with income generally based on a fixed annual rate of

interest. Participants will be eligible to receive distributions of the

amounts credited to their account balance based on elected

deferral periods that are consistent with the plans and applicable

tax law. Interest expense recognized under the plans totaled

$65 million, $50 million and $40 million for the years ended

December 31, 2007, 2006 and 2005, respectively. The unfunded

obligation of the plans total $672 million and $554 million as of

December 31, 2007 and 2006, respectively. We have purchased

life insurance policies to fund a portion of this unfunded obligation.

As of December 31, 2007 and 2006, the cash surrender value of

these policies, which are included in other noncurrent assets, was

approximately $112 million and $40 million, respectively.

Other

For select key employees, we also maintain collateral assignment

split-dollar life insurance agreements for which we have a con-

tractual obligation to bear certain insurance-related costs. Under

some of these agreements, our obligation to provide benefits to

the employee extends beyond retirement. We expect to record a

liability of approximately $130 million related to the adoption of

EITF 06-10 as of January 1, 2008, by an adjustment to retained

earnings.

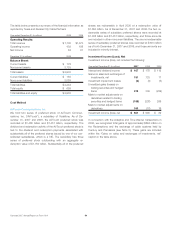

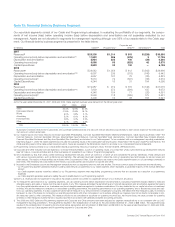

Note 10: Stockholders’ Equity

Common Stock

Our Class A Special common stock is generally nonvoting. Holders

of our Class A common stock in the aggregate hold 66

2

⁄

3

%ofthe

aggregate voting power of our common stock. The number of

votes that each share of our Class A common stock has at any

time depends on the number of shares of Class A common stock

and Class B common stock then outstanding. Each share of our

Class B common stock is entitled to 15 votes, and all shares of

our Class B common stock in the aggregate have 33

1

⁄

3

%ofthe

voting power of all of our common stock. The 33

1

⁄

3

% aggregate

voting power of our Class B common stock will not be diluted by

additional issuances of any other class of our common stock. Our

Class B common stock is convertible, share for share, into Class A

or Class A Special common stock, subject to certain restrictions.

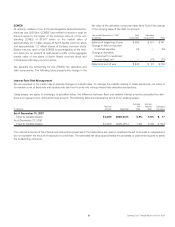

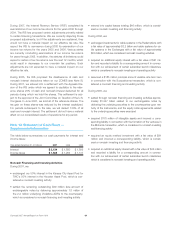

Stock Split

On January 31, 2007, our Board of Directors approved a three-

for-two stock split in the form of a 50% stock dividend (the “Stock

Split”) which was paid on February 21, 2007 to shareholders of

record on February 14, 2007. The stock dividend was in the form of

an additional 0.5 share for every share held and was payable in

shares of Class A common stock on the existing Class A common

stock and payable in shares of Class A Special common stock on

the existing Class A Special common stock and Class B common

stock with cash being paid in lieu of fractional shares. The number of

shares outstanding and related prices, per share amounts, share

conversions and share-based data have been adjusted to reflect the

Stock Split for all periods presented.

Board-Authorized Share Repurchase Program

During 2007, 2006 and 2005, we repurchased under our Board-

authorized share repurchase program approximately 133 million,

113 million and 119 million shares, respectively, of our Class A

and Class A Special common stock for aggregate consideration of

$3.102 billion, $2.347 billion and $2.290 billion, respectively.

In October 2007, the Board of Directors authorized a $7 billion

addition to the existing share repurchase program. As of

December 31, 2007, we had approximately $6.9 billion of avail-

ability remaining under the share repurchase authorization, which

we intend to fully utilize by the end of 2009, subject to market

conditions.

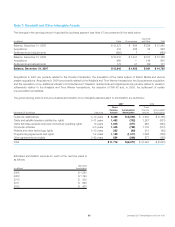

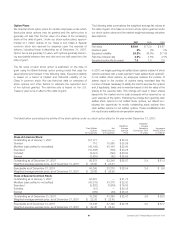

Accumulated Other Comprehensive Income (Loss)

The table below presents our accumulated other comprehensive

income (loss), net of taxes for the years ended December 31,

2007 and 2006:

(in millions) 2007 2006

Unrealized gains (losses) on marketable

securities $27 $ 165

Unrealized gains (losses) on cash flow

hedges (110) (121)

Unrealized gains (losses) on employee

benefit obligations 24 (5)

Cumulative translation adjustments 3(5)

Accumulated other comprehensive

income (loss) $ (56) $34

59 Comcast 2007 Annual Report on Form 10-K