Comcast 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other 2007 Acquisitions

In August 2007, we acquired the cable system of Patriot Media

serving approximately 81,000 video subscribers in central New

Jersey. In June 2007, we acquired Rainbow Media Holdings’ 60%

interest in Bay Area SportsNet and its 50% interest in Sports

Channel New England, expanding our regional sports networks.

The completion of this transaction resulted in our 100% ownership

in Sports Channel New England and 60% ownership in Bay Area

SportsNet. The results of operations of Patriot Media, Bay Area

SportsNet and Sports Channel New England have been included

in our consolidated financial statements since their acquisition

dates and are reported in our Cable segment. In April 2007, we

acquired Fandango, an online entertainment site and movie-ticket

service. The results of operations of Fandango have been included

in our consolidated financial statements since the acquisition date

and are reported in Corporate and Other. None of these acquis-

itions were material to our consolidated financial statements for the

year ended December 31, 2007.

Other 2006 Acquisitions

E! Entertainment Television

In November 2006, we acquired the 39.5% of E! Entertainment

Television (which operates the E! and Style programming networks)

that we did not already own for approximately $1.2 billion. We have

historically consolidated the results of operations of E! Entertainment

Television. We allocated the purchase price to property and equip-

ment, intangibles and goodwill.

Susquehanna

In April 2006, we acquired the cable systems of Susquehanna

Cable Co. and its subsidiaries (“Susquehanna”) for a total pur-

chase price of approximately $775 million. These cable systems

are located primarily in Pennsylvania, New York, Maine and Mis-

sissippi. Before the acquisition, we held an approximate 30%

equity ownership interest in Susquehanna that we accounted for

as an equity method investment. On May 1, 2006, Susquehanna

Cable Co. redeemed the approximate 70% equity ownership in-

terest in Susquehanna held by Susquehanna Media Co., which

resulted in Susquehanna becoming 100% owned by us. The re-

sults of operations of these cable systems have been included in

our consolidated financial statements since the acquisition date

and are reported in our Cable segment. We allocated the purchase

price to property and equipment, franchise-related customer rela-

tionship intangibles, nonamortizing cable franchise rights and

goodwill. The acquisition of these cable systems was not material

to our consolidated financial statements for 2006.

2005 Acquisitions

Motorola

In March 2005, we entered into two joint ventures with Motorola

under which we are developing and licensing next-generation pro-

gramming access security (known as conditional access) tech-

nology for cable systems and related products. In addition to

funding approximately 50% of the annual cost requirements, we

paid $20 million to Motorola and have committed to pay up to $80

million to Motorola based on the achievement of certain mile-

stones. Motorola contributed licenses to conditional access and

related technology to the ventures. These two ventures are both

considered VIEs, and we have consolidated both of these ven-

tures as we are considered the primary beneficiary. Accordingly,

we recorded approximately $190 million in intangible assets, of

which we recorded a charge of approximately $20 million related

to in-process research and development in 2005 that has been in-

cluded in amortization expense.

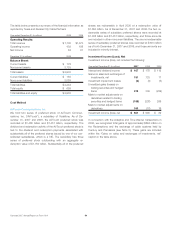

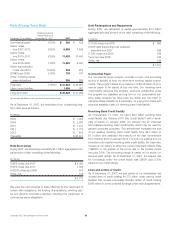

Note 6: Investments

The components of our investments are presented in the table

below:

December 31 (in millions) 2007 2006

Fair value method

Cablevision Systems Corporation $ 126 $ 146

Discovery Holding Company 251 161

Embarq Corporation 569

Liberty Capital 582 490

Liberty Global 582 439

Liberty Interactive 477 539

Sprint Nextel 26 493

Time Warner Inc. —1,052

Vodafone —61

Tax exempt municipal securities 621 —

Other 31 63

2,701 3,513

Equity method

Insight Midwest 1,877 560

SpectrumCo, LLC 1,352 1,291

Texas and Kansas City Cable Partners —2,968

Other 453 575

3,682 5,394

Cost method, primarily AirTouch 1,678 1,675

Total investments 8,061 10,582

Less current investments 98 1,735

Noncurrent investments $ 7,963 $ 8,847

Comcast 2007 Annual Report on Form 10-K 52