Comcast 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

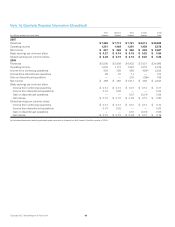

Note 11: Share-Based Compensation

Our Board of Directors may grant share-based awards, in the form

of stock options and RSUs, to certain employees and directors.

Employees are also offered the opportunity to purchase shares of

Comcast stock at a discount through payroll deductions as part of

our Employee Stock Purchase Plan.

Compensation expense recognized related to stock option awards,

RSU awards and employee participation in the Employee Stock Pur-

chase Plan are summarized in the table below:

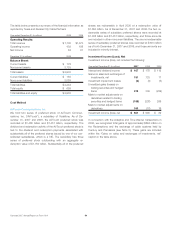

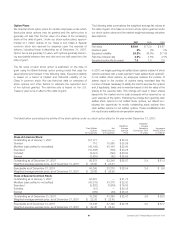

Year ended December 31 (in millions) 2007 2006 2005(a)

Stock options $74 $ 120 $ 10

Restricted share units 79 62 57

Employee stock purchase plan 11 8—

Total share-based compensation

expense $ 164 $ 190 $ 67

Tax benefit $56 $66 $25

(a) Amounts reflect expense prior to the adoption of SFAS No. 123R.

As of December 31, 2007, there was unrecognized pretax com-

pensation expense of $259 million and $251 million related to

nonvested stock options and nonvested RSUs that will be recog-

nized over a weighted average period of approximately two and

one half years. The amount of share-based compensation cap-

italized or related to discontinued operations was not material to

our consolidated financial statements.

Any tax benefits realized upon the exercise of stock options or the

issuance of RSU awards in excess of that which is associated with

the expense recognized for financial reporting purposes are pre-

sented as a financing activity rather than as an operating activity in

our consolidated statement of cash flows. The excess cash tax

benefit classified as a financing cash inflow for each of the years

ended December 31, 2007 and 2006 was $33 million.

In connection with the Stock Split, all outstanding share-based

awards were modified as required under the terms of our equity

plans. This modification did not change the fair value of out-

standing awards. Before this modification, compensation costs

related to awards granted before the adoption of SFAS No. 123R

were recognized under an accelerated recognition method. As a

result of the Stock Split modification, the remaining unrecognized

compensation costs related to all awards are recognized on a

straight-line basis over the remaining requisite service period. The

impact of this change was not material to our consolidated finan-

cial statements.

Before January 1, 2006, we accounted for our share-based

compensation plans in accordance with the provisions of APB

No. 25, as permitted by SFAS No. 123, and accordingly did not

recognize compensation expense for stock options with an exer-

cise price equal to or greater than the market price of the under-

lying stock at the date of grant. Had the fair-value-based method

as prescribed by SFAS No. 123 been applied, additional pretax

compensation expense of $166 million would have been recog-

nized for the year ended December 31, 2005. The pretax com-

pensation expense includes the expense related to discontinued

operations, which for the year ended December 31, 2005 was $4

million. Had the fair-value-based method as prescribed by SFAS

No. 123 been applied, the effect on net income and earnings per

share would have been as follows:

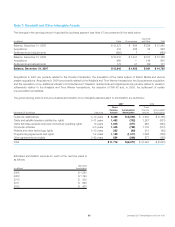

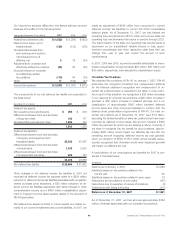

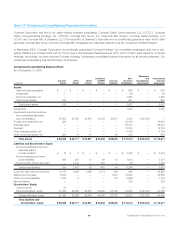

(in millions, except per share data) 2005

Net income, as reported $ 928

Add: Share-based compensation expense included

in net income, as reported above, net of related

tax effects 42

Less: Share-based compensation expense determined

under fair-value-based method for all awards, net of

related tax effects (150)

Pro forma, net income $ 820

Basic earnings per common share:

As reported $ 0.28

Pro forma $ 0.25

Diluted earnings per common share:

As reported $ 0.28

Pro forma $ 0.25

Comcast 2007 Annual Report on Form 10-K 60