Comcast 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Programming Segment Revenues

Programming revenues for 2007 and 2006 increased as a result of

continued growth in advertising driven by strong ratings, and growth

in affiliate and international revenue. For 2007, 2006 and 2005,

approximately 11% to 13% of our Programming segment revenues

were generated from our Cable segment. These amounts are elimi-

nated in our consolidated financial statements but are included in

the amounts presented above.

Programming Segment Operating, Selling, General and

Administrative Expenses

Operating, selling, general and administrative expenses consist

mainly of the cost of producing television programs and live events,

the purchase of programming rights, the marketing and promotion

of our programming networks, and administrative costs. Program-

ming expenses for 2007, 2006 and 2005 increased as a result of an

increase in the production of, and programming rights costs for,

new and live-event programming for our programming networks,

including the PGA Tour on The Golf Channel and the NHL on

VERSUS, as well as a corresponding increase in marketing ex-

penses for this programming. We have invested and expect to con-

tinue to invest in new and live-event programming that will cause our

Programming segment expenses to increase in the future.

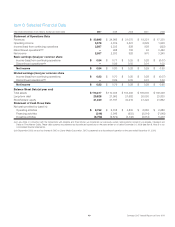

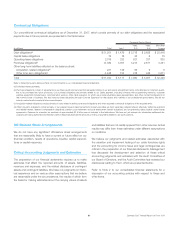

Consolidated Other Income (Expense) Items

Year ended December 31 (in millions) 2007 2006 2005

Interest expense $ (2,289) $ (2,064) $ (1,795)

Investment income (loss), net 601 990 89

Equity in net (losses) income

of affiliates, net (63) (124) (42)

Other income (expense) 522 173 (53)

Total $ (1,229) $ (1,025) $ (1,801)

Interest Expense

The increases in interest expense for 2007 from 2006 were primar-

ily the result of increases in our average debt outstanding. The

increase for 2006 from 2005 was primarily the result of an increase

in our average debt outstanding and higher interest rates on our

variable-rate debt, as well as $57 million of gains recognized in

2005 in connection with the early extinguishment of some of our

debt facilities.

Investment Income (Loss), Net

The components of investment income (loss), net for 2007, 2006

and 2005 are presented in a table in Note 6 to our consolidated

financial statements. In connection with the Adelphia and Time

Warner transactions, we recognized investment income of approx-

imately $646 million for the year ended December 31, 2006.

We have entered into derivative financial instruments that we

account for at fair value and which economically hedge the market

price fluctuations in the common stock of substantially all of our

investments accounted for as trading securities. The differences

between the unrealized gains (losses) on trading securities and the

mark to market adjustments on derivatives related to trading secu-

rities, as presented in the table in Note 6, result from one or more

of the following:

• we did not maintain an economic hedge for our entire invest-

ment in the security during some or all of the period

• there were changes in the derivative valuation assumptions such

as interest rates, volatility and dividend policy

• the magnitude of the difference between the market price of the

underlying security to which the derivative relates and the strike

price of the derivative

• the change in the time value component of the derivative value

during the period

• the security to which the derivative relates changed due to a

corporate reorganization of the issuing company to a security

with a different volatility rate

Equity in Net (Losses) Income of Affiliates, Net

The decrease in equity in net losses of affiliates for 2007 from

2006 and the increase in equity in net losses of affiliates for 2006

from 2005 were primarily a result of $59 million of other-than-

temporary impairment charges recognized in 2006.

Other Income (Expense)

Other income for 2007 consists primarily of a gain of approx-

imately $500 million on the sale of our 50% interest in the Kansas

City Asset Pool in connection with the Houston transaction. Other

income for 2006 consists primarily of $170 million of gains on the

sales of investment assets. Other expense for 2005 consists pri-

marily of a $170 million payment representing our share of the

settlement amount related to certain of AT&T’s litigation with At

Home, partially offset by a $24 million gain on the exchange of one

of our equity method investments and $62 million of gains recog-

nized on the sale or restructuring of investment assets.

27 Comcast 2007 Annual Report on Form 10-K