Comcast 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

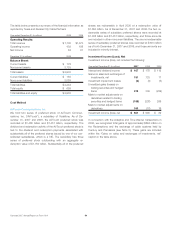

Note 7: Goodwill and Other Intangible Assets

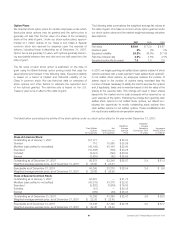

The changes in the carrying amount of goodwill by business segment (see Note 15) are presented in the table below:

(in millions) Cable Programming

Corporate

and Other Total

Balance, December 31, 2005 $ 12,273 $ 966 $ 259 $ 13,498

Acquisitions 432 468 58 958

Settlements and adjustments (695) 7 — (688)

Balance, December 31, 2006 $ 12,010 $ 1,441 $ 317 $ 13,768

Acquisitions 660 — 146 806

Settlements and adjustments 172 41 (82) 131

Balance, December 31, 2007 $ 12,842 $ 1,482 $ 381 $ 14,705

Acquisitions in 2007 are primarily related to the Houston transaction, the acquisition of the cable system of Patriot Media and various

smaller acquisitions. Acquisitions in 2006 are primarily related to the Adelphia and Time Warner transactions, the Susquehanna acquisition

and the acquisition of our additional interest in E! Entertainment Television. Settlements and adjustments are primarily related to valuation

refinements related to the Adelphia and Time Warner transactions, the adoption of FIN 48 and, in 2006, the settlement of certain

pre-acquisition tax liabilities.

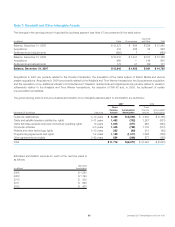

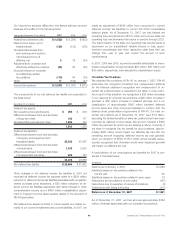

The gross carrying amount and accumulated amortization of our intangible assets subject to amortization are as follows:

2007 2006

December 31 (in millions) Useful Life

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Customer relationships 4–12 years $ 5,466 $ (3,694) $ 4,954 $ (3,188)

Cable and satellite television distribution rights 5–11 years 1,482 (702) 1,267 (533)

Cable franchise renewal costs and contractual operating rights 10 years 1,045 (377) 982 (283)

Computer software 3–5 years 1,445 (798) 1,104 (515)

Patents and other technology rights 3–12 years 225 (90) 214 (62)

Programming agreements and rights 1–4 years 1,199 (1,017) 1,026 (782)

Other agreements and rights 2–22 years 854 (299) 877 (180)

Total $ 11,716 $ (6,977) $ 10,424 $ (5,543)

Estimated amortization expense for each of the next five years is

as follows:

(in millions)

Estimated

Amortization

2008 $ 1,292

2009 $ 1,190

2010 $ 932

2011 $ 628

2012 $ 503

55 Comcast 2007 Annual Report on Form 10-K