Comcast 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

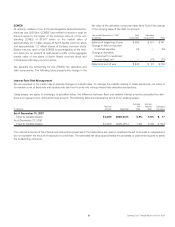

As a result of the Exchanges, we recognized a gain on the sale of

discontinued operations of $195 million, net of tax of $541 million

and a gain on the sale of the Century and Parnassos cable sys-

tems of approximately $111 million that is included within invest-

ment income (loss), net.

The cable systems that TWC transferred to us in the Exchanges

included cable systems that TWC acquired from Adelphia in its asset

purchase from Adelphia and TWC’s Philadelphia cable system.

Purchase Price Allocation

The cable systems acquired in the Houston transaction and in the

Adelphia and Time Warner transactions were accounted for in

accordance with SFAS No. 141. The results of operations for the

cable systems acquired in these transactions are reported in our

Cable segment, effective August 1, 2006 for the Houston trans-

action and effective July 31, 2006 for the Adelphia and Time Warner

transactions. The results of operations for the cable systems ac-

quired have been included in our consolidated financial statements

since January 1, 2007 for the Houston transaction (the date of the

distribution of assets) and since July 31, 2006 for the Adelphia and

Time Warner transactions (the acquisition date). For both the Hous-

ton transaction and the Adelphia and Time Warner transactions, the

weighted-average amortization period of the franchise-related cus-

tomer relationship intangible assets acquired was seven years. As a

result of the Houston transaction, we reversed deferred tax liabilities

of approximately $200 million, primarily related to the excess of tax

basis of the assets acquired over the tax basis of the assets

exchanged, and reduced the amount of goodwill that would have

otherwise been recorded in the acquisition. As a result of the

redemption of our investment in TWC and the exchange of the cable

systems held by Century and Parnassos in 2006, we reversed

deferred tax liabilities of approximately $760 million, primarily related

to the excess of tax basis of the assets acquired over the tax basis

of the assets exchanged, and reduced the amount of goodwill and

other noncurrent assets that would have otherwise been recorded in

the acquisition. Substantially all of the goodwill recorded is expected

to be amortizable for tax purposes.

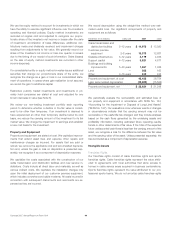

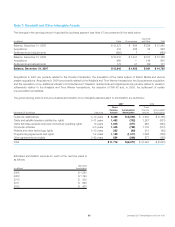

The table below presents the purchase price allocation to assets

acquired and liabilities assumed as a result of the Houston trans-

action and the Adelphia and Time Warner transactions, exclusive

of the cable systems held by Century and Parnassos and trans-

ferred to TWC:

(in millions) Houston

Adelphia and

Time Warner

Property and equipment $ 870 $ 2,640

Franchise-related customer relationships 266 1,627

Cable franchise rights 1,954 6,730

Goodwill 426 420

Other assets 267 111

Total liabilities (73) (351)

Net assets acquired $ 3,710 $ 11,177

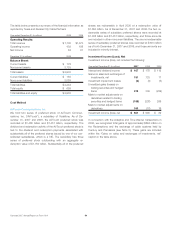

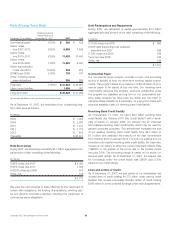

Discontinued Operations

As discussed above, the operating results of the Comcast Ex-

change Systems transferred to TWC are reported as discontinued

operations for all periods and are presented in accordance with

SFAS No. 144. The table below presents the operating results of

the Comcast Exchange Systems through the closing date of the

Exchanges (July 31, 2006):

Year ended December 31 (in millions) 2006 2005

Revenues $ 734 $ 1,180

Income before income taxes $ 121 $ 159

Income tax expense $ (18) $ (59)

Net income $ 103 $ 100

Unaudited Pro Forma Information

The following unaudited pro forma information has been presented

as if the Houston transaction occurred on January 1, 2006 and the

Adelphia and Time Warner transactions occurred on January 1,

2005. This information is based on historical results of operations,

adjusted for purchase price allocations, and is not necessarily

indicative of what the results would have been had we operated

the entities since the dates indicated.

Year ended December 31

(in millions, except per share data) 2006 2005

Revenues $ 27,526 $ 23,672

Income from continuing operations $ 2,225 $ 770

Income from discontinued operations,

net of tax $ 103 $ 100

Gain on discontinued operations,

net of tax $ 195 $ —

Net Income $ 2,523 $ 870

Basic earnings per common share $ 0.80 $ 0.26

Diluted earnings per common share $ 0.79 $ 0.26

51 Comcast 2007 Annual Report on Form 10-K