Comcast 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Retirement Obligations

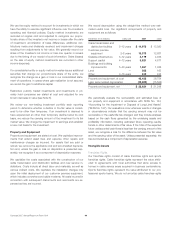

SFAS No. 143, “Accounting for Asset Retirement Obligations,” as

interpreted by Financial Accounting Standards Board (“FASB”)

Interpretation (“FIN”) No. 47, “Accounting for Conditional Asset

Retirement Obligations — an Interpretation of FASB Statement

No. 143,” requires that a liability be recognized for an asset retire-

ment obligation in the period in which it is incurred if a reasonable

estimate of fair value can be made.

Certain of our franchise and lease agreements contain provisions

requiring us to restore facilities or remove property in the event that

the franchise or lease agreement is not renewed. We expect to

continually renew our franchise agreements and therefore cannot

estimate any liabilities associated with such agreements. A remote

possibility exists that franchise agreements could terminate un-

expectedly, which could result in us incurring significant expense in

complying with the restoration or removal provisions. The disposal

obligations related to our properties are not material to our con-

solidated financial statements. No such liabilities have been

recorded in our consolidated financial statements.

Revenue Recognition

Cable revenues are primarily derived from subscriber fees received

for our video, high-speed Internet and phone services (“cable

services”) and from advertising. We recognize revenues from cable

services as the service is provided. We manage credit risk by

screening applicants through the use of credit bureau data. If a

subscriber’s account is delinquent, various measures are used to

collect outstanding amounts, including termination of the sub-

scriber’s cable service. Installation revenues obtained from the

connection of subscribers to our cable systems are less than

related direct selling costs. Therefore, such revenues are recog-

nized as connections are completed. We recognize advertising

revenue at estimated realizable values when the advertising is

aired. Revenues earned from other sources are recognized when

services are provided or events occur. Under the terms of our

franchise agreements, we are generally required to pay an amount

based on our gross video revenues to the local franchising au-

thority. We normally pass these fees through to our cable sub-

scribers and classify the fees as a component of revenues with the

corresponding costs included in operating expenses. We present

other taxes imposed on a revenue producing transaction as rev-

enue if we are acting as a principal or as expense if we are acting

as an agent.

Our Programming businesses recognize revenue from distributors

as programming is provided, generally under multiyear distribution

agreements. From time to time these agreements expire while pro-

gramming continues to be provided to the operator based

on interim arrangements while the parties negotiate new contract

terms. Revenue recognition is generally limited to current payments

being made by the operator, typically under the prior contract terms,

until a new contract is negotiated, sometimes with effective dates

that affect prior periods. Differences between actual amounts

determined upon resolution of negotiations and amounts recorded

during these interim arrangements are recorded in the period of

resolution.

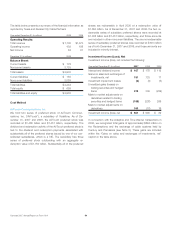

Advertising revenue for our Programming businesses is recognized

in the period in which commercials or programs are aired. In some

instances, our Programming businesses guarantee viewer ratings

either for the programming or for the commercials. Revenue is

deferred to the extent of an estimated shortfall in the ratings. Such

shortfalls are primarily settled by providing additional advertising

time, at which point the revenue is recognized.

Cable Programming Expenses

Cable programming expenses are the fees we pay to program-

ming networks to license the programming we package, offer and

distribute to our cable subscribers. Programming is acquired for

distribution to our cable subscribers, generally under multiyear

distribution agreements, with rates typically based on the number

of subscribers that receive the programming, channel positioning

and penetration factors. From time to time these contracts expire

and programming continues to be provided based on interim

arrangements while the parties negotiate new contractual terms,

sometimes with effective dates that affect prior periods. While

payments are typically made under the prior contract terms, the

amount of our programming expenses recorded during these in-

terim arrangements is based on our estimates of the ultimate

contractual terms expected to be negotiated.

Our cable subsidiaries have received or may receive incentives

from programming networks for the licensing of their program-

ming. We classify the deferred portion of these fees within liabilities

and recognize the fees as a reduction of programming expenses

(included in operating expenses) over the term of the contract.

Share-Based Compensation

Effective January 1, 2006, we adopted SFAS No. 123R, “Share-

Based Payment” (“SFAS No. 123R”), using the Modified Prospective

Approach. Under the Modified Prospective Approach, the amount of

compensation cost recognized includes: (i) compensation cost for all

share-based payments granted before but not yet vested as of

January 1, 2006, based on the grant date fair value estimated in

accordance with the provisions of SFAS No. 123, “Accounting for

Stock-Based Compensation” (“SFAS No. 123”) and (ii) compensa-

tion cost for all share-based payments granted or modified sub-

sequent to January 1, 2006, based on the estimated fair value at the

date of grant or subsequent modification date in accordance with

the provisions of SFAS No. 123R.

Comcast 2007 Annual Report on Form 10-K 46