Comcast 2007 Annual Report Download - page 49

Download and view the complete annual report

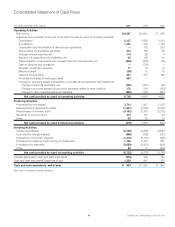

Please find page 49 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SFAS No. 123R also required us to change the classification, in

our consolidated statement of cash flows, of any income tax bene-

fits realized upon the exercise of stock options or issuance of

restricted share unit (“RSU”) awards in excess of that which is

associated with the expense recognized for financial reporting

purposes. These amounts are presented as a financing activity

rather than as an operating activity in our consolidated statement

of cash flows.

Before January 1, 2006, we accounted for our share-based com-

pensation plans in accordance with the provisions of Accounting

Principles Board (“APB”) Opinion No. 25, “Accounting for Stock

Issued to Employees” (“APB No. 25”), as permitted by SFAS

No. 123, and accordingly did not recognize compensation expense

for stock options with an exercise price equal to or greater than the

market price of the underlying stock at the date of grant. See Note

11 for further details regarding share-based compensation.

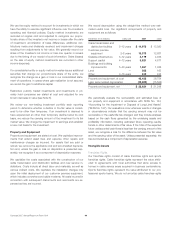

Postretirement and Postemployment Benefits

We charge to operations the estimated costs of retiree benefits

and benefits for former or inactive employees, after employment

but before retirement, during the years the employees provide

services (see Note 9).

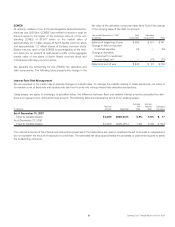

Income Taxes

We recognize deferred tax assets and liabilities for temporary differ-

ences between the financial reporting basis and the tax basis of

our assets and liabilities and the expected benefits of using net

operating loss carryforwards. The impact of changes in tax rates

and laws on deferred taxes, if any, applied during the years in

which temporary differences are expected to be settled, is re-

flected in the consolidated financial statements in the period of

enactment (see Note 12).

We adopted the provisions of FIN 48, “Accounting for Uncertainty

in Income Taxes — an Interpretation of FASB Statement No. 109”

on January 1, 2007. FIN 48 prescribes the recognition threshold

and measurement attribute for the financial statement recognition

and measurement of uncertain tax positions taken or expected to

be taken in a tax return. See Note 12 for the impact of the adop-

tion of FIN 48.

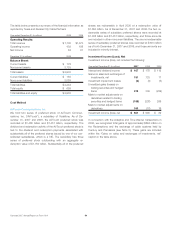

We account for income tax uncertainties that arise in connection

with business combinations and those that are associated with enti-

ties acquired in business combinations in accordance with Emerging

Issues Task Force (“EITF”) Issue No. 93-7, “Uncertainties Related to

Income Taxes in a Purchase Business Combination” (“EITF 93-7”).

Deferred tax assets and liabilities are recorded as of the date of a

business combination and are based on our estimate of the ultimate

tax basis that will be accepted by the various taxing authorities.

Liabilities for contingencies associated with prior tax returns filed by

the acquired entity are recorded based on our estimate of the ultimate

settlement that will be accepted by the various taxing authorities.

Estimated interest expense on these liabilities after the acquisition is

reflected in our consolidated income tax provision. We adjust these

deferred tax accounts and liabilities periodically to reflect revised esti-

mated tax bases and any estimated settlements with the various

taxing authorities. The effect of these adjustments is generally applied

to goodwill except for post-acquisition interest expense, which is

recognized as an adjustment of income tax expense. Upon adoption

of SFAS No. 141R, “Business Combinations — a replacement of

FASB Statement No. 141” (“SFAS No. 141R”) (see Note 3), all tax

benefits recognized that otherwise would have impacted goodwill

will be recognized in the income statement.

We classify interest and penalties, if any, associated with our un-

certain tax positions as a component of income tax expense.

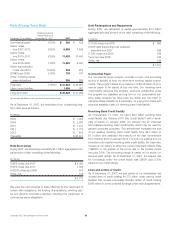

Derivative Financial Instruments

We use derivative financial instruments for a number of purposes.

We manage our exposure to fluctuations in interest rates by using

derivative financial instruments, which may include interest rate

exchange agreements (“swaps”) and interest rate lock agreements

(“rate locks”). We manage our exposure to fluctuations in the value

of some of our investments by entering into equity collar agree-

ments (“equity collars”) and equity put option agreements (“equity

put options”). We are also a party to equity warrant agreements

(“equity warrants”). We have issued indexed debt instruments

(“ZONES”) and have entered into prepaid forward sale agreements

(“prepaid forward sales”) whose values, in part, are derived from

the market value of certain publicly traded common stock. We

have also sold call options on some of our investments in equity

securities. We use equity hedges to manage exposure to changes

in equity prices associated with stock appreciation rights of

acquired companies. These equity hedges are recorded at fair

value based on market quotes.

For derivative instruments designated and effective as fair value

hedges, such as fixed to variable swaps, changes in the fair value of

the derivative instrument are substantially offset in the consolidated

statement of operations by changes in the fair value of the hedged

item. For derivative instruments designated as cash flow hedges,

such as variable to fixed swaps and rate locks, the effective portion

of any hedge is reported in other comprehensive income (loss) until

it is recognized in earnings during the same period in which the

hedged item affects earnings. The ineffective portion of all hedges is

recognized each period in current earnings. Changes in the fair value

of derivative instruments that are not designated as a hedge are

recorded each period in current earnings.

47 Comcast 2007 Annual Report on Form 10-K