Comcast 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2007, we sold $603 million of trading securities. Proceeds from

sales of trading securities are presented within cash provided by

operating activities in accordance with generally accepted account-

ing principles. These amounts are not related to operations but re-

sult from the sales of investments.

The increase in interest payments from 2005 to 2007 was primarily

the result of an increase in our average debt outstanding.

The increase in tax payments from 2005 to 2007 was primarily the

result of the effects of increases in income, sales of investments

and the settlement of federal and state tax audits.

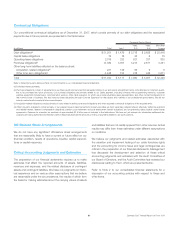

Financing Activities

Net cash provided by (used in) financing activities consists primar-

ily of our proceeds from borrowings offset by our debt repayments

and our repurchases of our Class A and Class A Special common

stock. We have made, and may from time to time in the future

make, optional repayments on our debt obligations, which may

include repurchases of our outstanding public notes and deben-

tures, depending on various factors, such as market conditions.

See Note 8 to our consolidated financial statements for further

discussion of our financing activities, including details of our debt

repayments and borrowings.

Long-Term Debt Borrowings, Repayments and Redemptions

Proceeds from borrowings fluctuates from year to year based on

the levels of acquisitions and scheduled debt repayments.

The higher level of borrowings in 2006 was primarily a result of

the Houston transaction, the Adelphia and Time Warner trans-

actions, the acquisition of the remaining portion of E! Entertainment

Television that we did not already own and our investment in

SpectrumCo, LLC (“SpectrumCo”).

Available Borrowings Under Credit Facilities

We traditionally maintain significant availability under lines of credit

and our commercial paper program to meet our short-term liquid-

ity requirements. As of December 31, 2007, amounts available

under these facilities totaled approximately $4.370 billion. In Jan-

uary 2008, we entered into an amended and restated revolving

bank credit facility which may be used for general corporate pur-

poses. This amendment increased the size of the credit facility

from $5.0 billion to $7.0 billion and extended the maturity of the

loan commitment from October 2010 to January 2013.

Debt Covenants

We and our cable subsidiaries that have provided guarantees (see

Note 17) are subject to the covenants and restrictions set forth in

the indentures governing our public debt securities and in the

credit agreements governing our bank credit facilities. We and the

guarantors are in compliance with the covenants, and we believe

that neither the covenants nor the restrictions in our indentures or

loan documents will limit our ability to operate our business or raise

additional capital. Our credit facilities’ covenants are tested on an

ongoing basis. The only financial covenant in our $5.0 billion

revolving credit facility and our amended and restated $7.0 billion

revolving credit facility relates to leverage (ratio of debt to operating

income before depreciation and amortization). As of December 31,

2007, we met our financial covenant in our $5 billion revolving

credit facility by a significant margin. Our ability to comply with this

financial covenant in the future does not depend on further debt

reduction or on improved operating results.

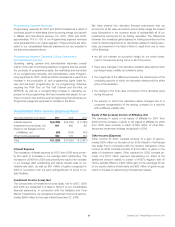

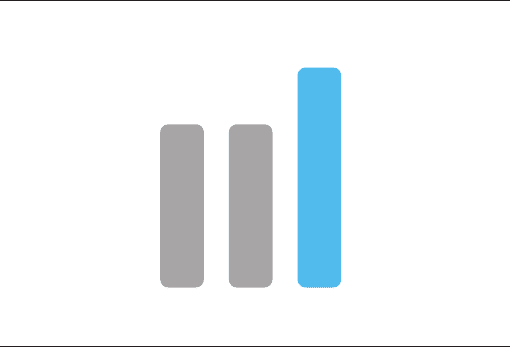

Share Repurchase Program and Dividends

In October 2007, our Board of Directors authorized a $7 billion addi-

tion to our existing share repurchase program. As of December 31,

2007, we had approximately $6.9 billion of availability remaining

under the share repurchase authorization, which we intend to fully

utilize by the end of 2009, subject to market conditions. On February

13, 2008 our Board of Directors approved a quarterly dividend of

$0.0625 per share, which will be payable in April 2008. This repre-

sents the first payment of a planned annual dividend of $0.25 per

share.

Share Repurchases

(in billions)

$2.3 $2.3

$3.1

2007

2006

2005

Investing Activities

Net cash used in investing activities consisted primarily of cash paid

for capital expenditures, acquisitions and investments, partially offset

by proceeds from sales and restructurings of investments.

29 Comcast 2007 Annual Report on Form 10-K