Comcast 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ownership interest and (iv) the valuation of retained noncontrolling

equity investments when a subsidiary is deconsolidated. SFAS

No. 160 is effective for us beginning January 1, 2009. We are

currently assessing the potential impact that the adoption of SFAS

No. 160 will have on our consolidated financial statements.

EITF Issue No. 06-10

In March 2007, the EITF reached a consensus on EITF Issue

No. 06-10, “Accounting for Deferred Compensation and Post-

retirement Benefit Aspects of Collateral Assignment Split-Dollar

Life Insurance Arrangements” (“EITF 06-10”). EITF 06-10 provides

that an employer should recognize a liability for the postretirement

benefit related to collateral assignment split-dollar life insurance

arrangements in accordance with either SFAS No. 106, “Employ-

ers’ Accounting for Postretirement Benefits Other Than

Pensions,” or APB No. 12, “Omnibus Opinion.” We expect to

record a liability of approximately $130 million related to the adop-

tion of EITF 06-10 as of January 1, 2008, by an adjustment to

retained earnings.

Note 4: Earnings Per Share

Basic earnings per common share (“Basic EPS”) is computed by

dividing net income from continuing operations by the weighted-

average number of common shares outstanding during the period.

Our potentially dilutive securities include potential common shares

related to our stock options and RSUs. Diluted earnings per

common share (“Diluted EPS”) considers the impact of potentially

dilutive securities except in periods in which there is a loss be-

cause the inclusion of the potential common shares would have an

antidilutive effect. Diluted EPS excludes the impact of potential

common shares related to our stock options in periods in which

the option exercise price is greater than the average market price

of our Class A common stock and our Class A Special common

stock (see Note 11).

Diluted EPS for 2007, 2006 and 2005 excludes approximately

61 million, 116 million and 126 million, respectively, of potential

common shares related to our share-based compensation plans,

because the inclusion of the potential common shares would have

an antidilutive effect.

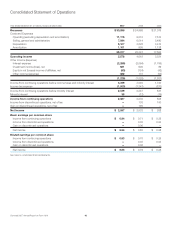

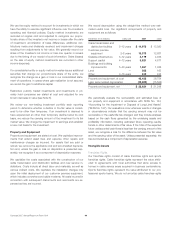

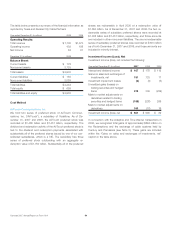

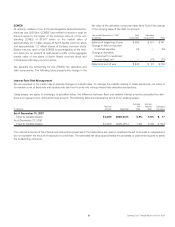

The following table reconciles the numerator and denominator of the computations of Diluted EPS from continuing operations for the

years presented:

2007 2006 2005

Year ended December 31 (in millions, except per share data) Income Shares

Per

Share

Amount Income Shares

Per

Share

Amount Income Shares

Per

Share

Amount

Basic EPS $ 2,587 3,098 $ 0.84 $ 2,235 3,160 $ 0.71 $ 828 3,295 $ 0.25

Effect of dilutive securities:

Assumed exercise or issuance of shares

relating to stock plans 31 20 17

Diluted EPS $ 2,587 3,129 $ 0.83 $ 2,235 3,180 $ 0.70 $ 828 3,312 $ 0.25

49 Comcast 2007 Annual Report on Form 10-K