Comcast 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

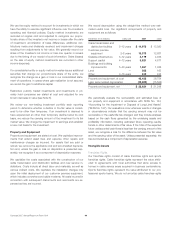

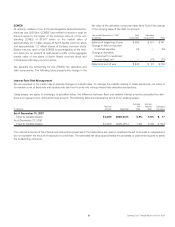

The table below presents a summary of the financial information as

reported by Texas and Kansas City Cable Partners:

Year ended December 31 (in millions) 2006 2005

Operating Results:

Total revenue $ 1,705 $1,470

Operating income 402 198

Net Income 84 81

December 31 (in millions) 2006

Balance Sheet:

Current assets $ 178

Noncurrent assets 2,725

Total assets $ 2,903

Current liabilities $ 155

Noncurrent liabilities 2,089

Total liabilities $ 2,244

Total equity $ 659

Total liabilities and equity $ 2,903

Cost Method

AirTouch Communications, Inc.

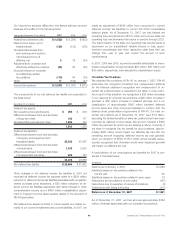

We hold two series of preferred stock of AirTouch Commun-

ications, Inc. (“AirTouch”), a subsidiary of Vodafone. As of De-

cember 31, 2007 and 2006, the AirTouch preferred stock was

recorded at $1.465 billion and $1.451 billion, respectively. The

dividend and redemption activity of the AirTouch preferred stock is

tied to the dividend and redemption payments associated with

substantially all of the preferred shares issued by one of our con-

solidated subsidiaries, which is a VIE. The subsidiary has three

series of preferred stock outstanding with an aggregate re-

demption value of $1.750 billion. Substantially all of the preferred

shares are redeemable in April 2020 at a redemption value of

$1.650 billion. As of December 31, 2007 and 2006, the two re-

deemable series of subsidiary preferred shares were recorded at

$1.465 billion and $1.451 billion, respectively, and those amounts

are included in other noncurrent liabilities. The one nonredeemable

series of subsidiary preferred shares was recorded at $100 million

as of both December 31, 2007 and 2006, and those amounts are

included in minority interest.

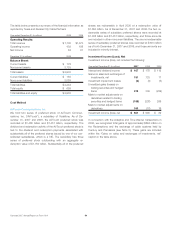

Investment Income (Loss), Net

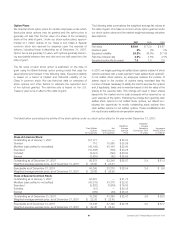

Investment income (loss), net includes the following:

Year ended December 31 (in millions) 2007 2006 2005

Interest and dividend income $ 167 $ 178 $ 112

Gains on sales and exchanges of

investments, net 151 733 17

Investment impairment losses (4) (4) (3)

Unrealized gains (losses) on

trading securities and hedged

items 315 339 (259)

Mark to market adjustments on

derivatives related to trading

securities and hedged items (188) (238) 206

Mark to market adjustments on

derivatives 160 (18) 16

Investment income (loss), net $ 601 $ 990 $ 89

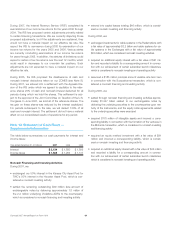

In connection with the Adelphia and Time Warner transactions in

2006, we recognized total gains of approximately $646 million on

the Redemptions and the exchange of cable systems held by

Century and Parnassos (see Note 5). These gains are included

within the “Gains on sales and exchanges of investments, net”

caption in the table above.

Comcast 2007 Annual Report on Form 10-K 54