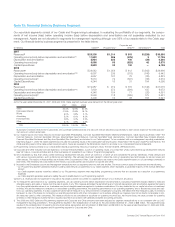

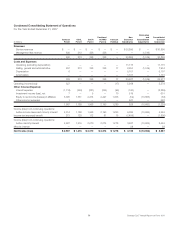

Comcast 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

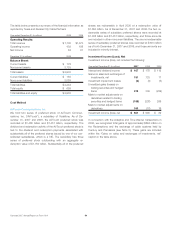

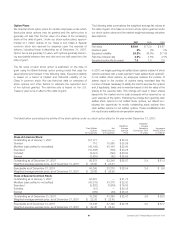

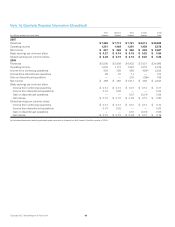

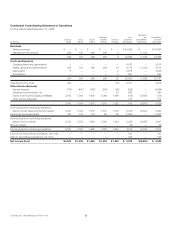

Our income tax expense differs from the federal statutory amount

because of the effect of the following items:

Year ended December 31 (in millions) 2007 2006 2005

Federal tax at statutory rate $ (1,522) $ (1,258) $ (602)

State income taxes, net of

federal benefit (153) (132) (105)

Nondeductible losses from

joint ventures and equity in

net (losses) income of

affiliates, net 318 (24)

Adjustments to uncertain and

effectively settled tax positions (35) 93 (35)

Accrued interest on uncertain

and effectively settled

tax positions (110) 64 (70)

Other 17 (132) (37)

Income tax expense $ (1,800) $ (1,347) $ (873)

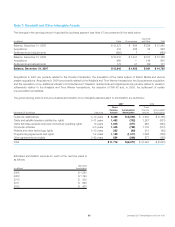

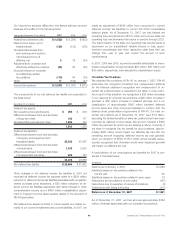

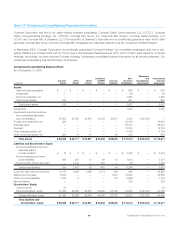

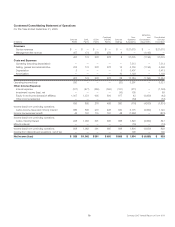

The components of our net deferred tax liability are presented in

the table below:

December 31 (in millions) 2007 2006

Deferred tax assets:

Net operating loss carryforwards $ 252 $ 309

Differences between book and tax basis

of long-term debt 163 177

Nondeductible accruals and other 1,225 742

1,640 1,228

Deferred tax liabilities:

Differences between book and tax basis

of property and equipment and

intangible assets 25,935 25,527

Differences between book and tax basis

of investments 1,542 2,633

Differences between book and tax basis

of indexed debt securities 829 720

28,306 28,880

Net deferred tax liability $ 26,666 $ 27,652

Other changes in net deferred income tax liabilities in 2007 not

recorded as deferred income tax expense relate to a $224 million

reduction in deferred income tax liabilities associated with acquisition

related purchase price allocations, a $53 million reduction of de-

ferred income tax liabilities associated with items included in other

comprehensive income and a $960 million reclassification adjust-

ment to long-term income taxes payable related to the adoption of

FIN 48 (see below).

Net deferred tax assets included in current assets are related pri-

marily to our current investments and current liabilities. In 2007, we

made an adjustment of $249 million from noncurrent to current

deferred income tax liabilities to correct the 2006 consolidated

balance sheet. As of December 31, 2007, we had federal net

operating loss carryforwards of $170 million and various state net

operating loss carryforwards that expire in periods through 2027.

The determination of the state net operating loss carryforwards is

dependent on our subsidiaries’ taxable income or loss, appor-

tionment percentages and other respective state laws that can

change from year to year and impact the amount of such

carryforwards.

In 2007, 2006 and 2005, income tax benefits attributable to share-

based compensation of approximately $49 million, $60 million and

$35 million, respectively, were allocated to stockholders’ equity.

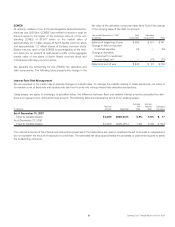

Uncertain Tax Positions

We adopted the provisions of FIN 48 on January 1, 2007. FIN 48

prescribes the recognition threshold and measurement attribute

for the financial statement recognition and measurement of un-

certain tax positions taken or expected to be taken in a tax return.

As a result of this adoption, we recognized a $35 million decrease

in our reserves for uncertain tax positions, a $25 million increase in

goodwill, a $60 million increase in retained earnings and a re-

classification of approximately $960 million between deferred

income taxes and other noncurrent liabilities to conform with the

balance sheet presentation requirements of FIN 48. Our total un-

certain tax positions as of December 31, 2007 were $1.9 billion,

excluding the federal benefits on state tax positions that have been

recorded as deferred income taxes; this amount includes a $469

million tax payment for which we are seeking a refund. Currently, if

we were to recognize the tax benefit for such positions, approx-

imately $580 million would impact our effective tax rate with the

remaining amount impacting deferred income tax and goodwill.

Upon our adoption of SFAS 141R in 2009, all tax benefits subse-

quently recognized that otherwise would have impacted goodwill

will impact our effective tax rate.

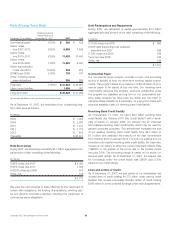

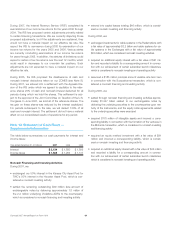

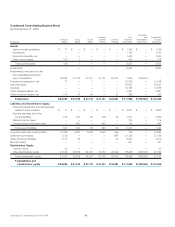

A reconciliation of our unrecognized tax benefits for 2007 is pre-

sented in the table below:

(in millions)

Balance as of January 1, 2007 $ 2,099

Additions based on tax positions related to the

current year 65

Additions based on tax positions related to prior years 18

Reductions for tax positions of prior years (157)

Reductions due to expiration of statute of limitations (3)

Settlements with taxing authorities (101)

Balance as of December 31, 2007 $ 1,921

As of December 31, 2007, we had accrued approximately $766

million of interest associated with our uncertain tax positions.

63 Comcast 2007 Annual Report on Form 10-K