Comcast 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

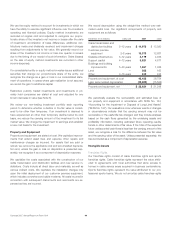

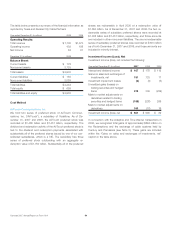

Note 5: Acquisitions and Other Significant Events

The Houston Transaction

In July 2006, we initiated the dissolution of Texas and Kansas City

Cable Partners (“Houston transaction”), our 50%-50% cable sys-

tem partnership with Time Warner Cable. On January 1, 2007, the

distribution of assets by Texas and Kansas City Cable Partners

was completed and we received the cable system serving Hous-

ton, Texas (“Houston Asset Pool”) and Time Warner Cable re-

ceived the cable systems serving Kansas City, south and west

Texas, and New Mexico (“Kansas City Asset Pool”). We accounted

for the distribution of assets by Texas and Kansas City Cable

Partners as a sale of our 50% interest in the Kansas City Asset

Pool in exchange for acquiring an additional 50% interest in the

Houston Asset Pool. This transaction resulted in an increase of

approximately 700,000 video subscribers. The estimated fair value

of the 50% interest of the Houston Asset Pool we received was

approximately $1.1 billion and resulted in a pretax gain of approx-

imately $500 million, which is included in other income (expense).

We recorded our 50% interest in the Houston Asset Pool as a

step acquisition in accordance with SFAS No. 141, “Business

Combinations” (“SFAS No. 141”). The exchange of our 50% inter-

est in the Kansas City Asset Pool for Time Warner Cable’s 50%

interest in the Houston Asset Pool is considered a noncash in-

vesting activity.

The Adelphia and Time Warner Transactions

In April 2005, we entered into an agreement with Adelphia

Communications (“Adelphia”) in which we agreed to acquire cer-

tain assets and assume certain liabilities of Adelphia (the “Adelphia

acquisition”). At the same time,weandTimeWarnerCableInc.

and certain of its affiliates (“TWC”) entered into several agreements

in which we agreed to (i) have our interest in Time Warner Enter-

tainment Company, L.P. (“TWE”) redeemed, (ii) have our interest

in TWC redeemed (together with the TWE redemption, the “Re-

demptions”) and (iii) exchange certain cable systems acquired from

Adelphia and certain Comcast cable systems with TWC (the

“Exchanges”). On July 31, 2006, these transactions were com-

pleted. We collectively refer to the Adelphia acquisition, the Re-

demptions and the Exchanges as the “Adelphia and Time Warner

transactions.” Also in April 2005, Adelphia and TWC entered into

an agreement for the acquisition of substantially all of the remain-

ing cable system assets and the assumption of certain of the

liabilities of Adelphia.

TheAdelphiaandTimeWarnertransactions, which are described

in more detail below, resulted in a net increase of 1.7 million video

subscribers, a net cash payment by us of approximately $1.5 bil-

lion and the disposition of our ownership interests in TWE and

TWC and the assets of two cable system partnerships.

The Adelphia and Time Warner transactions added cable systems

in 16 states (California, Colorado, Connecticut, Florida, Georgia,

Louisiana, Maryland, Massachusetts, Minnesota, Mississippi, Ore-

gon, Pennsylvania, Tennessee, Vermont, Virginia and West Virginia).

We expect that the larger systems will result in economies of scale.

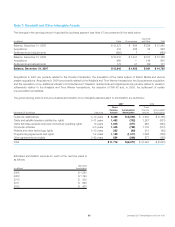

TheAdelphiaAcquisition

We paid approximately $3.6 billion in cash for the acquisition of Adel-

phia’s interest in two cable system partnerships and certain Adelphia

cable systems and to satisfy certain related liabilities. Approximately

$2.3 billion of the amount paid was related to the acquisition of

Adelphia’s interest in Century-TCI California Communications, L.P.

(“Century”) and Parnassos Communications, L.P. (“Parnassos” and

together with Century, the “Partnerships”). We held a 25% interest in

Century and a 33.33% interest in Parnassos. Our prior interests in the

Partnerships were accounted for as cost method investments. After

acquiring Adelphia’s interests in the Partnerships, we transferred the

cable systems held by the Partnerships to TWC in the Exchanges, as

discussed further below.

In addition to acquiring Adelphia’s interest in Century and Parnas-

sos, we acquired cable systems from Adelphia for approximately

$600 million in cash that we continue to own and operate.

The Redemptions

Our 4.7% interest in TWE was redeemed in exchange for 100% of

the equity interests in a subsidiary of TWE holding cable systems

with a fair value of approximately $600 million and approximately

$147 million in cash. Our 17.9% interest in TWC was redeemed in

exchange for 100% of the capital stock of a subsidiary of TWC

holding cable systems with a fair value of approximately $2.7 billion

and approximately $1.9 billion in cash. Our ownership interests in

TWE and TWC were accounted for as cost method investments.

We recognized a gain of approximately $535 million, in the aggre-

gate, on the Redemptions, which is included in investment income

(loss), net.

The Exchanges

The estimated fair value of the cable systems we transferred to

and received from TWC was approximately $8.6 billion and $8.5

billion, respectively. TWC made net cash payments aggregating

approximately $67 million to us for certain preliminary adjustments

related to the Exchanges.

The cable systems we transferred to TWC included our previously

owned cable systems located in Los Angeles, Cleveland and Dal-

las (“Comcast Exchange Systems”) and the cable systems held by

Century and Parnassos. The operating results of the Comcast

Exchange Systems are reported as discontinued operations for all

periods and are presented in accordance with SFAS No. 144 (see

“Discontinued Operations” below).

Comcast 2007 Annual Report on Form 10-K 50