Comcast 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

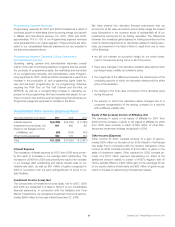

Income Tax Expense

Our effective income tax rate for 2007, 2006 and 2005 was 41.4%,

37.5% and 50.7%, respectively. Income tax expense reflects an

effective income tax rate that differs from the federal statutory rate

primarily due to state income taxes and interest on uncertain tax

positions. Our tax rate in 2006 was impacted by adjustments to

uncertain tax positions, primarily related to the favorable resolution of

issues and revised estimates of the outcome of unresolved issues

with various taxing authorities. Our tax rate in 2005 was impacted by

taxes associated with other investments. We expect our 2008

annual effective tax rate to be in the range of 40% to 45%.

Discontinued Operations

The operating results of our previously owned cable systems

located in Los Angeles, Dallas and Cleveland, which were reported

as discontinued operations for 2006 and 2005, included seven

months of operations in 2006 because the closing date of the

transaction was July 31, 2006. For 2005, results include 12

months of operations. As a result of the exchange of these sys-

tems in the Adelphia and Time Warner transactions, we recog-

nized a gain of $195 million, net of tax of $541 million (see Note 5)

in 2006. The effective tax rate on the gain is higher than the federal

statutory rate primarily as a result of the nondeductible amounts

attributed to goodwill.

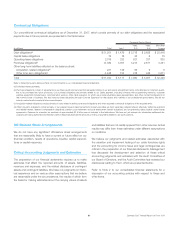

Liquidity and Capital Resources

Our businesses generate significant cash flow from operating activ-

ities. The proceeds from monetizing our nonstrategic investments

have also provided us with a significant source of cash flow. We

believe that we will be able to meet our current and long-term li-

quidity and capital requirements, including fixed charges, through

our cash flow from operating activities, existing cash, cash equiv-

alents and investments; through available borrowings under our

existing credit facilities; and through our ability to obtain future

external financing. We anticipate continuing to use a substantial

portion of our cash flow to fund our capital expenditures, invest in

business opportunities and return capital to investors, through

stock repurchases and dividends. The credit markets have been

and continue to be volatile due primarily to difficulties in the resi-

dential mortgage markets as well as the slowing economy. We do

not hold any cash equivalents or short-term investments whose

liquidity or value has been affected by these negative trends in the

financial markets.

Operating Activities

Details of cash provided by operating activities are presented in

the table below:

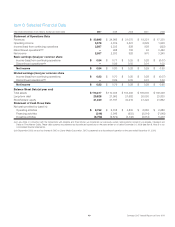

Year ended December 31 (in millions) 2007 2006 2005

Operating income $ 5,578 $ 4,619 $ 3,521

Depreciation and

amortization 6,208 4,823 4,551

Operating income before

depreciation and

amortization 11,786 9,442 8,072

Operating income before

depreciation and

amortization from

discontinued operations —264 421

Noncash share-based

compensation and

contribution expense 223 223 66

Changes in operating assets

and liabilities (200) (280) (733)

Cash basis operating

income 11,809 9,649 7,826

Proceeds from sales of

trading securities 603 ——

Payments of interest (2,134) (1,880) (1,809)

Payments of income taxes (1,638) (1,284) (1,137)

Proceeds from interest,

dividends and other

non-operating items 185 233 175

Payments related to

settlement of litigation of

an acquired company —(67) (220)

Excess tax benefit under

SFAS No. 123R presented

in financing activities (33) (33) —

Net cash provided by

operating activities $ 8,792 $ 6,618 $ 4,835

Comcast 2007 Annual Report on Form 10-K 28