Comcast 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• an increase in Cable segment capital expenditures of 41.2% to

approximately $6.0 billion, primarily as a result of (i) the installa-

tion of advanced set-top boxes, modems and other equipment

associated with the increase in subscribers to our digital video,

high-speed Internet and digital phone services; (ii) network

improvements to handle the growth in subscribers and to pro-

vide service improvements and enhancements; (iii) capital

expenditures related to commercial services to small and

medium-sized businesses; and (iv) integration of our newly

acquired cable systems

• acquisitions of (i) cable system serving Houston, Texas (approx-

imately 700,000 video subscribers), resulting from the dissolu-

tion of Texas and Kansas City Cable Partners (the “Houston

transaction”), in January 2007 and (ii) the cable system of Patriot

Media, serving approximately 81,000 video subscribers in central

New Jersey, in August 2007

• other acquisitions of (i) Fandango, an online entertainment site

and movie-ticket service, in April 2007 and (ii) Rainbow Media

Holdings LLC’s 60% interest in Bay Area SportsNet and its 50%

interest in Sports Channel New England, expanding our regional

sports networks, in June 2007

• repurchase of approximately 133 million shares of our Class A

common stock and Class A Special common stock under our

Board-authorized share repurchase program for approximately

$3.1 billion; in October 2007 our Board of Directors authorized a

$7 billion addition to the existing share repurchase program

Further details of our consolidated financial statements, including

discussion of our results of operations and our liquidity and capital

resources, are presented below.

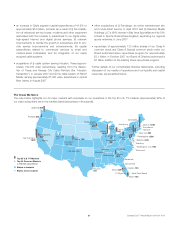

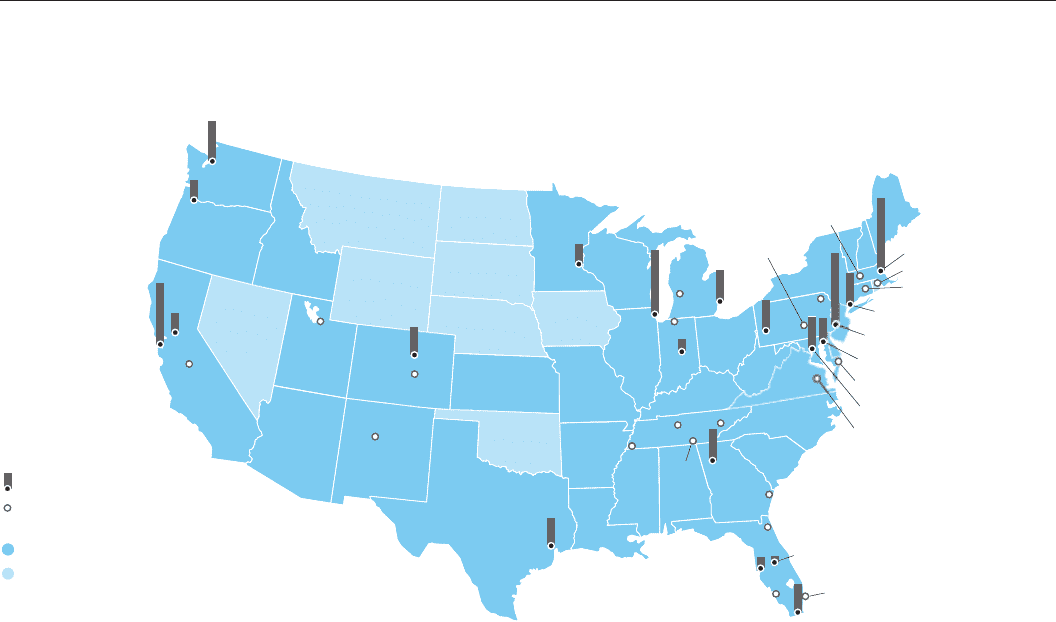

The Areas We Serve

The map below highlights our 40 major markets with emphasis on our operations in the top 25 U.S. TV markets. Approximately 92% of

our video subscribers are in the markets listed (subscribers in thousands).

Top 25 U.S. TV Markets

Top 40 Comcast Markets

(>125,000 subscribers)

States in footprint

States not in footprint

West Palm Beach

Nashville

Hartford

Grand

Rapids

Salt Lake

City

Houston

700

Atlanta

800

Baltimore 600

Washington, D.C. 900

Philadelphia 1,800

New York 800

Boston 1,600

Pittsburgh

700

Detroit

800

Miami 700

Orlando

Tampa

Indianapolis

Chicago

1,600

Minneapolis /

St. Paul

500

Denver 700

Seattle 1,000

Portland 500

Sacramento

500

San Francisco

1,500

Jacksonville

100

Ft. Myers

Richmond

Memphis

Fresno

Albuquerque

Salisbury

Knoxville

Chattanooga

Colorado

Springs

Harrisburg

South Bend

200

Savannah

Providence

Wilkes

Barre

Springfield

300

21 Comcast 2007 Annual Report on Form 10-K