Comcast 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Phone. We offer our interconnected VoIP digital phone service that

provides unlimited local and domestic long-distance calling and

includes such features as voice mail, caller ID and call waiting. Our

digital phone service was available to approximately 42 million or

87% of the homes in the areas we serve, as of December 31,

2007. We expect that by the end of 2008 approximately 91% of

our homes passed will have access to our digital phone service. In

some areas, we provide circuit-switched local phone service.

Revenues increased in 2007 and 2006 as a result of increases in

the number of digital phone subscribers. These increases were

partially offset by the loss of approximately 470,000 and 330,000

circuit-switched phone subscribers in 2007 and 2006, respec-

tively. In 2007, approximately $100 million of the increases in our

phone revenue were attributable to our newly acquired cable sys-

tems. In 2006, the amount was $40 million. Our circuit-switched

phone service subscribers will continue to decrease as we phase

out this service in 2008.

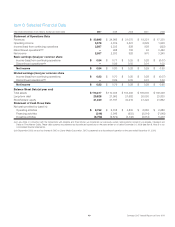

Comcast Digital Voice Subscribers

(in millions)

4Q073Q07

2Q07

1Q07

4Q06

1.9

2.4

3.1

3.8

4.4

Advertising. As part of our programming license agreements with

programming networks, we receive an allocation of scheduled ad-

vertising time that we may sell to local, regional and national adver-

tisers. We also coordinate the advertising sales efforts of other

cable operators in some markets, and in other markets we have

formed and operate advertising interconnects, which establish a

physical, direct link between multiple cable systems and provide

for the sale of regional and national advertising across larger geo-

graphic areas than could be provided by a single cable operator.

Advertising revenues increased in 2007 as a result of our newly

acquired cable systems. Absent the growth from the newly ac-

quired cable systems, advertising revenue decreased slightly in

2007, reflecting continued weakness across the television advertis-

ing market, a decline in political advertising and one less week in the

broadcast calendar during 2007. Advertising revenue increased in

2006 as a result of strong political advertising and the addition of our

newly acquired cable systems.

Other. We also generate revenues from our regional sports and

news networks, installation services, commissions from third-party

electronic retailing and fees for other services, such as providing

businesses with data connectivity and networked applications.

Our regional sports and news networks include Comcast Sports-

Net (Philadelphia), Comcast SportsNet Mid-Atlantic (Baltimore/

Washington), Cable Sports Southeast, CN8 — The Comcast Net-

work, Comcast SportsNet Chicago, Comcast SportsNet West

(Sacramento), Comcast SportsNet NorthWest, Comcast Sports-

Net New England (Boston), Bay Area SportsNet (San Francisco)

and Comcast MountainWest Sports Network. These networks

earn revenue through the sale of advertising time and receive pro-

gramming license fees paid by MVPDs.

Other revenues increased in 2007 as a result of our regional sports

network acquisitions and our newly acquired cable systems. Other

revenues increased in 2006 as a result of the addition of our newly

acquired cable systems.

Franchise Fees. Our franchise fee revenues represent the pass-

through to our subscribers of the fees required to be paid to state

and local franchising authorities. Under the terms of our franchise

agreements, we are generally required to pay an amount based on

our gross video revenues to the local franchising authority. The

increases in franchise fees collected from our cable subscribers

are primarily a result of the increases in our revenues on which the

fees apply.

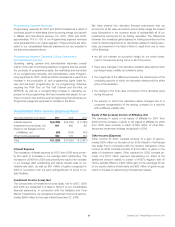

Total Cable Segment Revenue. As a result of the growth in rev-

enues from our products and services, we have been able to

increase our total average monthly revenue per video subscriber

(including all Cable segment revenue sources) from approximately

$82 in 2005 to approximately $95 in 2006 and to approximately

$102 in 2007.

A

verage Monthly Total Revenue

per Video Subscriber

$82

$95

$102

2007

2006

2005

Cable Segment Expenses

We continue to focus on controlling the growth of expenses.

Our operating margins (operating income before depreciation and

25 Comcast 2007 Annual Report on Form 10-K