Comcast 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

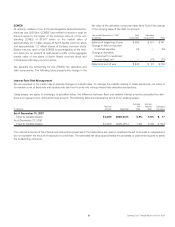

Fair Value Method

We hold unrestricted equity investments in publicly traded com-

panies that we account for as AFS or trading securities. As of

December 31, 2007, $2.049 billion of our fair value method secu-

rities support our obligations under our prepaid forward contracts

that terminate between 2011 and 2015. The net unrealized gains on

investments accounted for as AFS securities as of December 31,

2007 and 2006 were $42 million and $254 million, respectively. The

amounts were reported primarily as a component of accumulated

other comprehensive income (loss), net of related deferred income

taxes of $15 million in 2007 and $89 million in 2006.

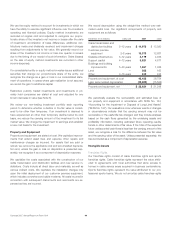

The cost, fair value and unrealized gains and losses related to our

AFS securities are presented in the table below. The decreases in

2007 from 2006 are primarily the result of the sale of all the re-

maining shares in Time Warner Inc. held by us during 2007.

Year ended December 31 (in millions) 2007 2006

Cost $ 685 $ 936

Unrealized gains 44 254

Unrealized losses (2) —

Fair value $ 727 $ 1,190

Proceeds from the sales of AFS securities for the years ended

December 31, 2007, 2006 and 2005 were $1.033 billion, $209 million

and $490 million, respectively. Gross realized gains on these sales for

the years ended December 31, 2007, 2006 and 2005 were $145 mil-

lion, $59 million and $18 million, respectively. Sales of AFS securities

for the years ended December 31, 2007, 2006 and 2005 consisted

primarily of sales of Time Warner Inc. common stock.

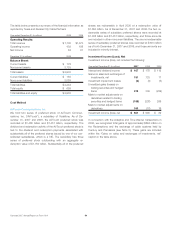

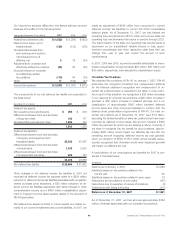

Equity Method

Our recorded investments as of December 31, 2007 and 2006

exceed our proportionate interests in the book value of the invest-

ees’ net assets by $354 million and $984 million, respectively. The

differences in value are primarily related to our investments in

Insight Midwest, L.P. (“Insight Midwest”) for 2007 and 2006 and

Texas and Kansas City Cable Partners in 2006. A portion of the

basis difference has been attributed to franchise-related customer

relationships of some of the investees. This difference was amor-

tized to equity in net (loss) income of affiliates over a period of four

years and was completed in 2006.

SpectrumCo, LLC

SpectrumCo, LLC (“SpectrumCo”), a consortium of investors includ-

ing us, was the successful bidder for 137 wireless spectrum licenses

for approximately $2.4 billion in the Federal Communications Com-

mission’s advanced wireless spectrum auction that concluded in

September 2006. Our portion of the total cost to purchase the

licenses was approximately $1.3 billion. Based on its currently

planned activities, we have determined that SpectrumCo is not a

VIE. We account for this joint venture as an equity method invest-

ment based on its governance structure, notwithstanding our 57%

majority interest.

Insight Midwest Partnership

In April 2007, we and Insight Communications (“Insight”) agreed to

divide the assets and liabilities of Insight Midwest, a 50%-50%

cable system partnership with Insight. On December 31, 2007, we

contributed approximately $1.3 billion to Insight Midwest for our

share of the partnership’s debt. On January 1, 2008, the dis-

tribution of assets of Insight Midwest without assumption of any of

Insight’s debt was completed and we received cable systems

serving approximately 696,000 video subscribers in Illinois and In-

diana (“Comcast Asset Pool”). Insight received cable systems

serving approximately 652,000 video subscribers, together with

approximately $1.24 billion of debt allocated to those cable sys-

tems (“Insight Asset Pool”). We accounted for our interest in

Insight Midwest as an equity method investment until the Comcast

Asset Pool was distributed to us on January 1, 2008. We expect

to record a gain on this transaction.

Texas and Kansas City Cable Partners

In July 2006, we initiated the dissolution of Texas and Kansas City

Cable Partners, our 50%-50% cable system partnership with TWC.

On January 1, 2007, the distribution of assets by Texas and Kansas

City Cable Partners was completed. We received the cable system

in the Houston Asset Pool, and TWC received the cable systems in

the Kansas City Asset Pool. Prior to the distribution, we accounted

for our investment in Texas and Kansas City Cable Partners under

the equity method.

53 Comcast 2007 Annual Report on Form 10-K