Comcast 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

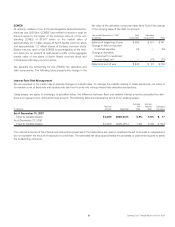

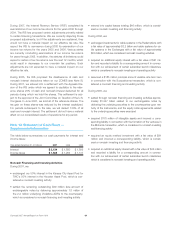

We sometimes enter into rate locks to hedge the risk that the cash

flows related to the interest payments on an anticipated issuance

or assumption of fixed-rate debt may be adversely affected by

interest-rate fluctuations. Upon the issuance or assumption of

fixed-rate debt, the value of the rate locks is recognized as an

adjustment to interest expense, similar to a deferred financing

cost, over the same period in which the related interest costs on

the debt are recognized in earnings (currently approximately 10

years remaining, unless the debt is retired earlier).

In 2007 and 2006, the effect of our interest rate derivative financial

instruments was an increase to our interest expense of approx-

imately $43 million and $39 million, respectively. In 2005, the

effect was a decrease to our interest expense of approximately

$16 million.

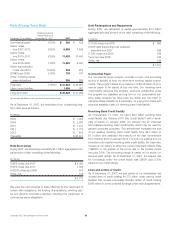

Estimated Fair Value

As of December 31, 2007 and 2006, our debt had estimated fair

values of $32.565 billion and $28.923 billion, respectively. The

estimated fair value of our publicly traded debt is based on quoted

market values for the debt. Interest rates that are currently avail-

able to us for issuance of debt with similar terms and remaining

maturities are used to estimate fair value for debt issues for which

quoted market prices are not available.

Debt Covenants

Some of our loan agreements require that we maintain financial

ratios based on debt and operating income before depreciation

and amortization, as defined in the agreements. We were in com-

pliance with all financial covenants for all periods presented.

Guarantee Structures

See Note 17 for a discussion of our subsidiary guarantee structures.

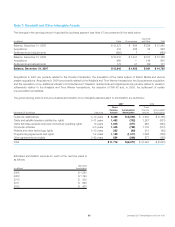

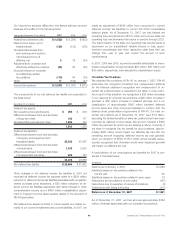

Note 9: Pension, Postretirement and Other

Employee Benefit Plans

Pension Benefits

We sponsor two pension plans that together provide benefits to

substantially all former employees of a previously acquired company.

Future benefits for both plans have been frozen. Total pension

expense recognized for the years ended December 31, 2007, 2006

and 2005 was $4 million, $8 million and $8 million, respectively.

Postretirement Benefits

Our postretirement medical benefits cover substantially all of our

employees who meet certain age and service requirements. The

majority of eligible employees participate in the Comcast Post-

retirement Healthcare Stipend Program (the “Stipend Plan”), and a

small number of eligible employees participate in legacy plans of

acquired companies. The Stipend Plan provides an annual stipend

for reimbursement of healthcare costs to each eligible employee

based on years of service. Based on the benefit design of the

Stipend Plan, we are not exposed to the cost of increasing health-

care, since the amounts under the Stipend Plan are fixed at a pre-

determined amount. Postretirement expense recognized for the

years ended December 31, 2007, 2006 and 2005 was $34 million,

$29 million and $25 million, respectively.

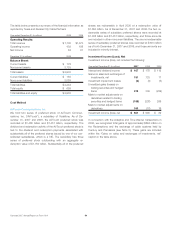

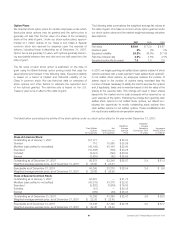

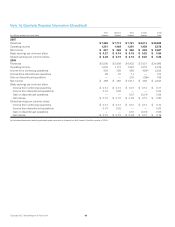

The following table provides condensed information relating to our pension benefits and postretirement benefits for the periods presented:

2007 2006

Year ended December 31 (in millions)

Pension

Benefits

Postretirement

Benefits

Pension

Benefits

Postretirement

Benefits

Benefit obligation $ 179 $ 280 $ 184 $ 280

Fair value of plan assets $ 157 $ — $ 122 $ —

Plan funded status and recorded benefit obligation $ (22) $ (280) $ (62) $ (280)

Portion of benefit obligation not yet recognized as a component of net periodic

benefit cost $ 1 $ (39) $12 $ (4)

Discount rate 6.25% 6.65% 5.75% 6.00%

Expected return on plan assets 8.00% N/A 7.00% N/A

Comcast 2007 Annual Report on Form 10-K 58