Comcast 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

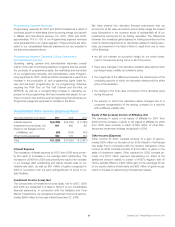

Capital Expenditures

Our most significant recurring investing activity has been capital

expenditures in our Cable segment and we expect that this will

continue in the future. A significant portion of our capital expendi-

tures is based on the level of growth and the technology being

deployed. The following table summarizes the capital expenditures

we incurred in our Cable segment from 2005 through 2007:

Year ended December 31 (in millions) 2007 2006 2005

Customer premise

equipment(a) $ 3,164 $ 2,321 $ 1,769

Scalable infrastructure(b) 1,014 906 824

Line extensions(c) 352 275 287

Support capital(d) 792 435 279

Upgrades(e) 520 307 250

Commercial(f) 151 ——

Total $ 5,993 $ 4,244 $ 3,409

(a) Customer premise equipment includes costs incurred to connect our services at

the subscriber’s home. The equipment deployed typically includes standard digital

converters, HD converters, digital video recorders, remote controls, high-speed

Internet modems and digital phone modems. Customer premise equipment also

includes the cost of installing such equipment for new subscribers as well as the

material and labor cost incurred to install the cable that connects a subscriber’s

dwelling to the network.

(b) Scalable infrastructure includes costs incurred to secure growth in subscribers,

revenue units or to provide service enhancements, other than those related to

customer premise equipment. Such equipment includes equipment that controls

signal reception, processing and transmission throughout our distribution network

as well as equipment that controls and communicates with the customer premise

equipment residing within a subscriber’s home. Also included in scalable infra-

structure is certain equipment necessary for content aggregation and distribution

(video on demand equipment) and equipment necessary to provide certain video,

high-speed Internet and digital phone service features (voice mail, e-mail, etc.).

(c) Line extensions include the costs of extending our distribution network into new

service areas. These costs typically include network design, purchase and installa-

tion of fiber-optic and coaxial cable, and certain electronic equipment.

(d) Support capital includes costs associated with the replacement or enhancement of

non-network assets due to technical or physical obsolescence and wear-out.

These costs typically include vehicles, computer and office equipment, furniture

and fixtures, tools and test equipment.

(e) Upgrades include costs to enhance or replace existing fiber/coaxial cable net-

works, including recurring betterments.

(f) Commercial includes costs incurred related to the rollout of our services to small

and medium-sized businesses. Such equipment typically includes high-speed

Internet modems and phone modems and the costs of installing such equip-

ment for new customers as well as materials and labor incurred to install the

cable that connects a customer’s business to the closest point of the main dis-

tribution network.

Cable capital expenditures increased 41.2% from 2006 to 2007

and 24.5% from 2005 to 2006 primarily as a result of the rollout of

our digital phone service and an increase in demand for advanced

set-top boxes (including DVR and HDTV) and high-speed Internet

modems. These increases were accelerated by the introduction of

our triple play bundle in late 2005 and as a result of regulatory

changes in 2007. We also incurred additional capital expenditures

in our newly acquired cable systems. In anticipation of this growth,

we have continued to improve the capacity and reliability of our

network in order to handle the additional volume and advanced

services.Wehavealsoexpandedourserviceareathroughline

extensions and now pass more than 48 million homes.

The amounts of capital expenditures in our Programming segment

and our other business activities have not been significant. Con-

solidated 2007 capital expenditures include approximately $110

million related to the consolidation of offices in Pennsylvania and

relocation of our corporate headquarters. The amounts of our

capital expenditures for 2008 and for subsequent years will

depend on numerous factors, including acquisitions, competition,

changes in technology, regulatory changes and the timing and rate

of deployment of new services.

Acquisitions

In 2007, acquisitions were primarily related to our acquisitions

of Patriot Media, Sports Channel New England, Bay Area Sports-

Net and Fandango. In 2006, acquisitions were primarily related to

the Adelphia and Time Warner transactions, the acquisition of the

cable systems of Susquehanna Communications and the acquis-

ition of our additional interest in E! Entertainment Television.

Proceeds from Sale of Investments

In 2007 and 2006, proceeds from the sales and restructurings of

investments were primarily related to the disposition of our owner-

ship interests in Time Warner Inc.

Purchases of Investments

In 2007, purchases of investments consisted primarily of our addi-

tional investment in Insight Midwest, L.P. and our purchase of

available for sale securities. In 2006, purchases of investments

were primarily related to the purchase of our interest in Spec-

trumCo and to our additional investment in Texas and Kansas City

Cable Partners.

Comcast 2007 Annual Report on Form 10-K 30