Comcast 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Operating Results

The comparability of our results of operations and subscriber information is impacted by the effects of the Houston transaction in January

2007, the acquisition of Patriot Media in August 2007, the Adelphia and Time Warner transactions in July 2006, the acquisition of the cable

systems of Susquehanna Communications in April 2006, and other smaller acquisitions. We collectively refer to the cable systems

acquired in these transactions as the “newly acquired cable systems.” The newly acquired cable systems contributed 81,000 video sub-

scribers, 58,000 high-speed Internet subscribers and 16,000 phone subscribers in 2007. The newly acquired cable systems contributed

3.5 million video subscribers, 1.7 million high-speed Internet subscribers and 173,000 phone subscribers in 2006, including the Cable

system serving Houston, Texas for Cable segment purposes (see “Segment Operating Results” below). As a result of transferring our pre-

viously owned cable systems located in Los Angeles, Cleveland and Dallas (“Comcast Exchange Systems”) as part of the Adelphia and

Time Warner transactions, the operating results of the Comcast Exchange Systems are reported as discontinued operations for 2006 and

2005. The comparability of our results of operations is also impacted by the adoption of Statement of Financial Accounting Standards

(“SFAS”) No. 123R, “Share-Based Payment” (“SFAS No. 123R”) on January 1, 2006. See Item 8, Note 11 to our consolidated financial

statements for additional information regarding the adoption of SFAS No. 123R.

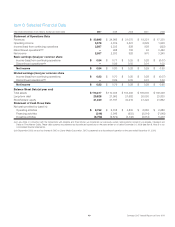

Year ended December 31 (in millions) 2007 2006 2005

% Change

2006 to 2007

% Change

2005 to 2006

Revenues $ 30,895 $ 24,966 $ 21,075 23.7% 18.5%

Costs and expenses

Operating, selling, general and administrative

(excluding depreciation and amortization) 19,109 15,524 13,003 23.1 19.4

Depreciation 5,107 3,828 3,413 33.4 12.2

Amortization 1,101 995 1,138 10.6 (12.5)

Operating income 5,578 4,619 3,521 20.8 31.2

Other income (expense) items, net (1,229) (1,025) (1,801) 20.0 (43.1)

Income from continuing operations before income taxes and

minority interest 4,349 3,594 1,720 21.0 109.0

Income tax expense (1,800) (1,347) (873) 33.6 54.3

Income from continuing operations before minority interest 2,549 2,247 847 13.4 165.5

Minority interest 38 (12) (19) n/m (36.8)

Income from continuing operations 2,587 2,235 828 15.8 169.9

Discontinued operations, net of tax —298 100 n/m 198.0

Net income $ 2,587 $ 2,533 $ 928 2.1% 173.0%

All percentages are calculated based on actual amounts. Minor differences may exist due to rounding.

Consolidated Revenues

Our Cable and Programming segments accounted for substantially

all of the increases in consolidated revenues for 2007 and 2006.

Cable segment and Programming segment revenues are dis-

cussed separately below in “Segment Operating Results.” The

remaining changes relate to our other business activities, primarily

Comcast Spectacor and growth in Comcast Interactive Media.

Consolidated Operating, Selling, General and

Administrative Expenses

Our Cable and Programming segments accounted for substantially

all of the increases in consolidated operating, selling, general and

administrative expenses for 2007 and 2006. Cable segment and

Programming segment operating, selling, general and administrative

expenses are discussed separately below in “Segment Operating

Results.” The remaining changes relate to our other business activ-

ities, including expanding our Comcast Interactive Media business,

the settlement of litigation in 2007 and player contract termination

costs at Comcast Spectacor in 2007.

Comcast 2007 Annual Report on Form 10-K 22