Comcast 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7: Management’s Discussion and

Analysis of Financial Condition and Results

of Operations

Introduction and Overview

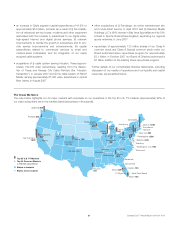

We are the largest cable operator in the United States and offer a

variety of entertainment and communications products and serv-

ices. As of December 31, 2007, our cable systems served

approximately 24.1 million video subscribers, 13.2 million high-

speed Internet subscribers and 4.6 million phone subscribers and

passed approximately 48.5 million homes in 39 states and the

District of Columbia.

We classify our operations in two reportable segments: Cable and

Programming. Our Cable segment, which generates approximately

95% of our consolidated revenues, manages and operates our

cable systems. Our Programming segment consists primarily of

our national programming networks. During 2007, our operations

generated consolidated revenues of approximately $30.9 billion.

Our Cable segment earns revenues primarily through subscriptions

to our video, high-speed Internet and phone services (“cable

services”). We market our cable services individually and as bundled

services primarily to residential customers. We are beginning to offer

bundled cable services to small and medium-sized businesses. Our

video services range from a limited basic service and a digital starter

service to our full digital cable service. Our full digital cable service

provides access to over 250 channels, including premium and

pay-per-view channels; video on demand (which allows access to a

library of movies, sports and news and the ability to start a selection

at any time and to pause, rewind and fast-forward selections); music

channels; and an interactive, on-screen program guide (which allows

the subscriber to navigate the channel lineup and the video on

demand library). Digital cable subscribers may also subscribe to

additional digital cable services, including digital video recorder

(“DVR”) (which allows digital recording of programs and pausing and

rewinding of “live” television) and high-definition television (“HDTV”)

(which provides multiple channels in high definition). As of

December 31, 2007, approximately 50% of the homes in the areas

we serve subscribed to our video service and approximately 63% of

those video subscribers subscribed to at least one of our digital

cable services. Our high-speed Internet service provides Internet

access at downstream speeds of up to 16 Mbps depending on the

level of service selected. As of December 31, 2007, approximately

28% of the homes in the areas we serve subscribed to our high-

speed Internet service. Our digital phone service provides unlimited

local and domestic long-distance calling and other features and is

our most recent cable service offering. As of December 31, 2007,

approximately 10% of the homes in the areas we serve subscribed

to our digital phone service. In addition to cable services, other

Cable segment revenue sources include advertising and the oper-

ations of our regional sports and news networks.

Our Programming segment consists primarily of our consoli-

dated national programming networks, including E!, The Golf

Channel, VERSUS, G4 and Style. Revenue from our Programming

segment is earned primarily from the sale of advertising and from

monthly per subscriber license fees paid by multichannel video pro-

gramming distributors (“MVPDs”).

Our other business interests include Comcast Spectacor and Com-

cast Interactive Media. Comcast Spectacor owns the Philadelphia

Flyers, the Philadelphia 76ers and two large, multipurpose arenas in

Philadelphia, and manages other facilities for sporting events, concerts

and other events. Comcast Interactive Media develops and operates

Comcast’s Internet businesses focused on entertainment, information

and communication, including Comcast.net, Fancast, thePlatform and

Fandango. Comcast Spectacor, Comcast Interactive Media and all

other consolidated businesses not included in our Cable or Program-

ming segments are included in “Corporate and Other” activities.

We operate our businesses in an intensely competitive environ-

ment. We compete with a number of different companies that offer

a broad range of services through increasingly diverse means.

Competition for the cable services we offer consists primarily of

DBS operators and telephone companies. In 2007, many of these

competitors have expanded their service areas, added features

and adopted aggressive pricing and packaging for services and

features that are comparable to the services and features we offer.

A substantial portion of our revenues comes from residential sub-

scribers whose spending patterns may be affected by prevailing

economic conditions. Intensifying competition and a weakening

economy affected our net subscriber additions during the second

half of 2007 and may, if these conditions continue, adversely

impact our results of operations in the future.

2007 Developments

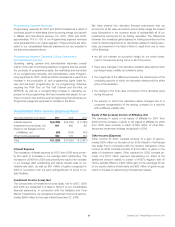

• consolidated revenue increased 23.7% to approximately $30.9

billion and consolidated operating income increased 20.8% to

approximately $5.6 billion, both driven by results in our Cable

segment

• Cable segment revenue increased 21.9% to approximately

$29.3 billion and operating income before depreciation and amor-

tization increased 23.3% to approximately $11.9 billion, both

driven by acquisitions, as well as growth in our digital cable, high-

speed Internet and digital phone services; during 2007, excluding

subscribers obtained through acquisitions, we added approx-

imately 2.5 million digital cable subscribers, approximately

1.7 million high-speed Internet subscribers and approximately

2.5 million digital phone subscribers while the number of basic

video subscribers decreased 180,000

Comcast 2007 Annual Report on Form 10-K 20