Capital One 1999 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

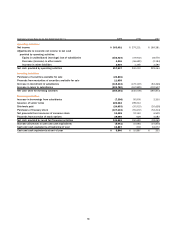

50

Cumulative

Other Total

Common Stock Paid-In Retained Comprehensive Treasury Stockholders’

(Dollars in Thousands, Except Per Share Data) Shares Amount Capital, Net Earnings Income Stock Equity

Balance, December 31, 1996 198,975,783 $ 1,990 $ 480,056 $ 256,397 $ 1,948 $ 740,391

Comprehensive income:

Net income 189,381 189,381

Other comprehensive income,

net of income tax:

Unrealized gains on securities,

net of income taxes of $481 532 532

Foreign currency

translation adjustments 59 59

Other comprehensive income 591 591

Comprehensive income 189,972

Cash dividends — $.11 per share (20,638) (20,638)

Purchases of treasury stock $ (52,314) (52,314)

Issuances of common stock 305,400 3 2,753 2,201 4,957

Exercise of stock options 390,870 4 2,612 1,466 4,082

Common stock issuable

under incentive plan 24,772 24,772

Other items, net (363) 2,037 2,037

Balance, December 31, 1997 199,671,690 1,997 512,230 425,140 2,539 (48,647) 893,259

Comprehensive income:

Net income 275,231 275,231

Other comprehensive income,

net of income tax:

Unrealized gains on securities,

net of income taxes of $37,170 60,648 60,648

Foreign currency translation

adjustments (2,532) (2,532)

Other comprehensive income 58,116 58,116

Comprehensive income 333,347

Cash dividends — $.11 per share (20,533) (20,533)

Purchases of treasury stock (91,672) (91,672)

Issuances of common stock 35,381 26,745 62,126

Exercise of stock options 4,500 (23,683) 43,323 19,640

Common stock issuable

under incentive plan 70,038 70,038

Other items, net (5,814) 4,201 4,201

Balance, December 31, 1998 199,670,376 1,997 598,167 679,838 60,655 (70,251) 1,270,406

Comprehensive income:

Net income 363,091 363,091

Other comprehensive income,

net of income tax:

Unrealized losses on securities,

net of income tax benefit

of $58,759 (95,868) (95,868)

Foreign currency

translation adjustments 3,951 3,951

Other comprehensive income (91,917) (91,917)

Comprehensive income 271,174

Cash dividends — $.11 per share (20,653) (20,653)

Purchases of treasury stock (107,104) (107,104)

Issuances of common stock (1,628) 9,833 8,205

Exercise of stock options (38,422) 76,508 38,086

Common stock issuable

under incentive plan 49,236 49,236

Other items, net 45 6,237 20 6,257

Balance, December 31, 1999 199,670,421 $ 1,997 $ 613,590 $ 1,022,296 $ (31,262) $ (91,014) $ 1,515,607

See Notes to Consolidated Financial Statements.

consolidated statements of changes

in stockholders’ equity