Capital One 1999 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

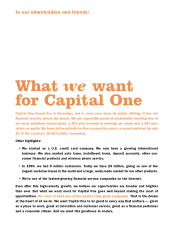

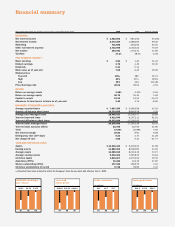

To ensure that it will, we often forgo short-run gains to achieve long-term success. Our

marketing investment, which funds testing and product rollouts, is huge: the $732 million

we invested in 1999 was 127% of our pretax earnings. Our capital base significantly exceeds

the regulatory requirements for a “well-capitalized” financial institution.

As in the past, our growth will be driven by our information-based strategy (IBS), which we

created 12 years ago. IBS links our database (one of the world’s largest) to prize-winning

information technology and highly sophisticated analytics. With IBS we scientifically test

ideas before taking them to market, and we tailor the product to the individual customer.

Before IBS, issuers priced all cards at 19.8% and denied credit to applicants whose risk pro-

files did not fit narrow parameters. The testing and customizing made possible with IBS have

transformed the credit card industry by dramatically reducing credit costs for most con-

sumers and by making credit cards available for the first time to millions of people.

IBS allows us to reach hard-to-find customers in thousands of “microsegments” and offer

them innovative, high-value products tailored to their needs. We have built a thriving

business in the superprime market — the country’s most blue-chip customers. We also

successfully market to the needs and passions of sports fans, music lovers, newlyweds, new

parents, and hundreds of other lifestyle and lifestage groups. And we market profitably to the

underserved — customers traditionally overlooked by our competitors.

With IBS we can innovate constantly. And rapid, substantive innovation is essential to great-

ness. The winners in an increasingly competitive world will be the companies that offer the

best buys, offer them first and move on when competitors move in. Capital One’s innovation

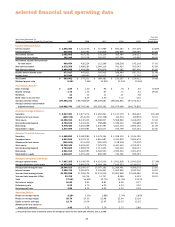

machine is running smoothly at very high speed: in 1999, we tested 36,114 new ideas, 25%

more than in 1998.

IBS has generated consistently high returns for Capital One and has helped us maintain excel-

lent credit quality. Our profitability in 1999 was one of the highest among major issuers, and

our charge-off rate was the very lowest.

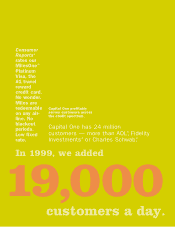

While we are enjoying explosive growth in the U.S. credit card business, we have also been

successful in exporting IBS to other markets. We now operate in Canada and the United

Kingdom and are actively testing in other countries. In addition, we continue to diversify

beyond credit cards. Our 1998 acquisition of Summit Acceptance Corporation has given us

a beachhead in auto finance, a market almost twice the size of the credit card business. Our

installment loan business grew by 45% in 1999.