Capital One 1999 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

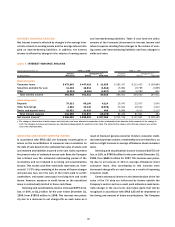

NET CHARGE-OFFS

Net charge-offs include the principal amount of losses (exclud-

ing accrued and unpaid finance charges, fees and fraud losses)

less current period recoveries. The Company charges off credit

card loans (net of any collateral) at 180 days past due.

For the year ended December 31, 1999, the managed net

charge-off rate decreased 148 basis points to 3.85%. For the

year ended December 31, 1999, the reported net charge-off

rate decreased 65 basis points to 3.59%. The decreases in man-

aged and reported net charge-off rates were the result of

improved general economic trends in consumer credit per-

formance as well as improved recovery efforts. The impact was

less apparent in the reported net charge-offs due to changes in

the composition of the reported portfolio compared to the off-

balance sheet portfolio. Table 7 shows the Company’s net

charge-offs for the years presented on a reported and man-

aged basis.

The Company’s objective is to optimize the profitability of

each account within acceptable risk characteristics. The Com-

pany takes measures as necessary, including requiring collateral

on certain accounts and other marketing and account man-

agement techniques, to maintain the Company’s credit quality

standards and to manage the risk of loss on existing accounts.

See “Risk Adjusted Revenue and Margin” for further discussion.

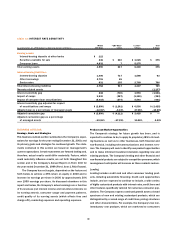

table 7: NET CHARGE-OFFS

Year Ended December 31 (Dollars in Thousands) 1999 1998 1997 1996 1995

Reported:

Average loans outstanding $ 7,667,355 $ 5,348,559 $ 4,103,036 $ 3,651,908 $ 2,940,208

Net charge-offs 275,470 226,531 198,192 132,590 59,618

Net charge-offs as a percentage of

average loans outstanding 3.59% 4.24% 4.83% 3.63% 2.03%

Managed:

Average loans outstanding $ 18,046,913 $ 15,209,537 $ 13,007,182 $ 11,268,461 $ 9,089,278

Net charge-offs 694,073 810,306 856,704 477,732 204,828

Net charge-offs as a percentage of

average loans outstanding 3.85% 5.33% 6.59% 4.24% 2.25%

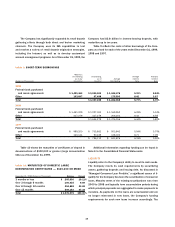

PROVISION AND ALLOWANCE FOR LOAN LOSSES

The allowance for loan losses is maintained at an amount esti-

mated to be sufficient to absorb probable future losses, net of

recoveries (including recovery of collateral), inherent in the exist-

ing reported loan portfolio. The provision for loan losses is the

periodic cost of maintaining an adequate allowance. Manage-

ment believes that the allowance for loan losses is adequate to

cover anticipated losses in the reported homogeneous con-

sumer loan portfolio under current conditions. There can be no

assurance as to future credit losses that may be incurred in con-

nection with the Company’s consumer loan portfolio, nor can

there be any assurance that the loan loss allowance that has

been established by the Company will be sufficient to absorb

such future credit losses. The allowance is a general allowance

applicable to the entire reported homogeneous consumer loan

portfolio, including the Company’s international portfolio which

to date has performed with relatively lower loss and delinquency

rates than the overall portfolio.

The amount of allowance necessary is determined prima-

rily based on a migration analysis of delinquent and current

accounts. In evaluating the sufficiency of the allowance for loan

losses, management also takes into consideration the following

factors: recent trends in delinquencies and charge-offs includ-

ing bankrupt, deceased and recovered amounts; historical

trends in loan volume; forecasting uncertainties and size of

credit risks; the degree of risk inherent in the composition of

the loan portfolio; economic conditions; credit evaluations and

underwriting policies. Additional information on the Company’s