Capital One 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

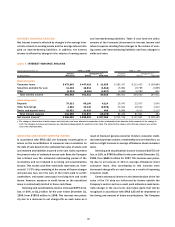

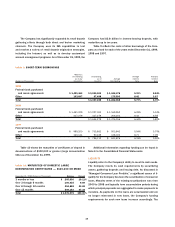

NET INTEREST INCOME

Net interest income is interest and past-due fees earned from

the Company’s consumer loans and securities less interest

expense on borrowings, which include interest-bearing deposits,

other borrowings and borrowings from senior and deposit notes.

Reported net interest income for the year ended

December 31, 1999, was $1.1 billion compared to $687.3 mil-

lion for 1998, representing an increase of $365.4 million, or

53%. Net interest income increased as a result of both growth

in earning assets and an increase in the net interest margin.

Average earning assets increased 34% for the year ended

December 31, 1999, to $9.7 billion from $7.2 billion for the year

ended December 31, 1998. The reported net interest margin

increased to 10.86% in 1999, from 9.51% in 1998 primarily

attributable to a 58 basis point increase in the yield on con-

sumer loans to 19.33% for the year ended December 31, 1999,

from 18.75% for the year ended December 31, 1998. The yield

on consumer loans increased primarily due to an increase in the

amount and frequency of past-due fees as compared to the

prior year, continued growth in the Company’s portfolio of higher

yielding products and repricings of low introductory rate loans

during late 1998 and early 1999.

The managed net interest margin for the year ended

December 31, 1999, increased to 10.83% from 9.91% for the

year ended December 31, 1998. This increase was primarily the

result of a 60 basis point increase in consumer loan yield for

the year ended December 31, 1999, as well as a decrease of 26

basis points in borrowing costs to 5.79% in 1999, from 6.05%

in 1998. The increase in consumer loan yield to 17.59% for the

year ended December 31, 1999, from 16.99% in 1998 princi-

pally reflected increases in the amount and frequency of

past-due fees and growth in higher yielding loans.

Reported net interest income for the year ended

December 31, 1998 was $687.3 million, compared to

$376.1 million for 1997, representing an increase of

$311.1 million, or 83%. Net interest income increased as a

result of growth in earning assets and an increase in the net

interest margin. Average earning assets increased 26% for the

year ended December 31, 1998, to $7.2 billion from $5.8 billion

for 1997. The reported net interest margin increased to 9.51%

in 1998, from 6.54% in 1997 and was primarily attributable to

a 364 basis point increase in the yield on consumer loans to

18.75% for the year ended December 31, 1998, from 15.11%

for the year ended December 31, 1997. The yield on consumer

loans increased primarily due to an increase in the amount and

frequency of past-due fees as compared to the prior year. In

addition, the Company’s continued shift to higher yielding prod-

ucts, offset by growth in low non-introductory rate products,

contributed to the increase in yield on consumer loans during

the same periods.

The managed net interest margin for the year ended

December 31, 1998, increased to 9.91% from 8.81% for the

year ended December 31, 1997. This increase was primarily the

result of a 126 basis point increase in consumer loan yield for

the year ended December 31, 1998, offset by an increase of

nine basis points in borrowing costs for the same period, as

compared to 1997. The increase in consumer loan yield to

16.99% for the year ended December 31, 1998, from 15.73%

in 1997 principally reflected increases in the amount and fre-

quency of past-due fees and growth in higher yielding loans. The

average rate paid on borrowed funds increased slightly reflect-

ing the Company’s shift to more fixed rate funding to match the

increase in fixed rate consumer loan products.

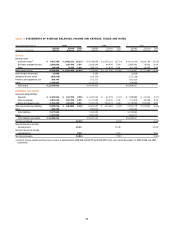

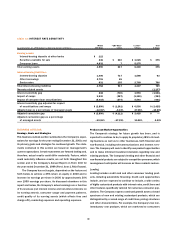

Table 4 provides average balance sheet data, an analysis of

net interest income, net interest spread (the difference between

the yield on earning assets and the cost of interest-bearing lia-

bilities) and net interest margin for each of the years ended

December 31, 1999, 1998 and 1997.