Capital One 1999 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

its subsidiaries may restrict the ability of the Company’s sub-

sidiaries to pay dividends to the Corporation or the ability of the

Corporation to pay dividends to its stockholders.

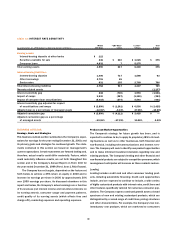

OFF-BALANCE SHEET RISK

The Company is subject to off-balance sheet risk in the normal

course of business including commitments to extend credit,

reduce the interest rate sensitivity of its securitization transac-

tions and its off-balance sheet financial instruments. The

Company enters into interest rate swap agreements in the man-

agement of its interest rate exposure. The Company also enters

into forward foreign currency exchange contracts and currency

swaps to reduce its sensitivity to changing foreign currency

exchange rates. These off-balance sheet financial instruments

involve elements of credit, interest rate or foreign currency

exchange rate risk in excess of the amount recognized on the

balance sheet. These instruments also present the Company

with certain credit, market, legal and operational risks. The

Company has established credit policies for off-balance sheet

instruments as it has for on-balance sheet instruments.

Additional information regarding off-balance sheet finan-

cial instruments can be found in Note N to the Consolidated

Financial Statements.

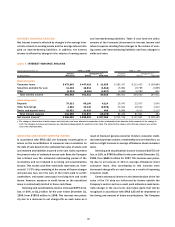

INTEREST RATE SENSITIVITY

Interest rate sensitivity refers to the change in earnings that

may result from changes in the level of interest rates. To the

extent that managed interest income and expense do not

respond equally to changes in interest rates, or that all rates

do not change uniformly, earnings could be affected. The

Company’s managed net interest income is affected by changes

in short-term interest rates, primarily the London InterBank

Offering Rate, as a result of its issuance of interest-bearing

deposits, variable rate loans and variable rate securitizations.

The Company manages and mitigates its interest rate sensitiv-

ity through several techniques which include, but are not limited

to, changing the maturity, repricing and distribution of assets

and liabilities and entering into interest rate swaps.

The Company measures exposure to its interest rate risk

through the use of a simulation model. The model generates a

distribution of possible twelve-month managed net interest

income outcomes based on (i) a set of plausible interest rate

scenarios, as determined by management based upon historical

trends and market expectations, (ii) all existing financial instru-

ments, including swaps, and (iii) an estimate of ongoing

business activity over the coming twelve months. The Company’s

asset/liability management policy requires that based on this

distribution there be at least a 95% probability that managed

net interest income achieved over the coming twelve months

will be no more than 3% below the mean managed net interest

income of the distribution. As of December 31, 1999, the

Company was in compliance with the policy; more than 99% of

the outcomes generated by the model produced a managed net

interest income of no more than 1.3% below the mean out-

come. The interest rate scenarios evaluated as of December 31,

1999 included scenarios in which short-term interest rates rose

in excess of 400 basis points or fell by as much as 175 basis

points over twelve months.

The analysis does not consider the effects of the changed

level of overall economic activity associated with various inter-

est rate scenarios. Further, in the event of a rate change of large

magnitude, management would likely take actions to further

mitigate its exposure to any adverse impact. For example, man-

agement may reprice interest rates on outstanding credit card

loans subject to the right of the consumers in certain states to

reject such repricing by giving timely written notice to the

Company and thereby relinquishing charging privileges. How-

ever, the repricing of credit card loans may be limited by

competitive factors as well as certain legal constraints.

Interest rate sensitivity at a point in time can also be ana-

lyzed by measuring the mismatch in balances of earning assets

and interest-bearing liabilities that are subject to repricing in

future periods.

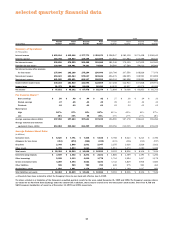

Table 12 reflects the interest rate repricing schedule

for earning assets and interest-bearing liabilities as of Decem-

ber 31, 1999.

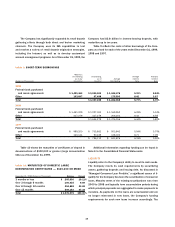

SUBSEQUENT EVENTS

On February 22, 2000, the Company’s Board of Directors

approved the repurchase of up to 10,000,000 shares of the

Company’s common stock over the next two years, in addition

to the 2,250,000 shares then remaining under the Company’s

repurchase programs approved in 1997 and 1998. As of Feb-

ruary 29, 2000, the Company had 10,846,400 shares available

for repurchase under these programs.