Capital One 1999 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

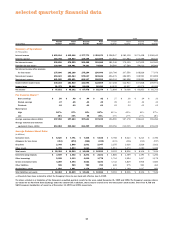

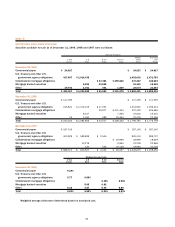

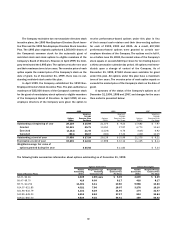

note e

BORROWINGS

Borrowings as of December 31, 1999 and 1998 were as follows:

1999 1998

Weighted Weighted

Average Average

Outstanding Rate Outstanding Rate

Interest-bearing

Deposits $ 3,783,809 5.34% $ 1,999,979 4.77%

Other borrowings

Secured

borrowings $ 1,344,790 6.65%

Junior subordinated

capital income

securities 98,178 7.76 $ 97,921 6.77%

Federal funds

purchased

and resale

agreements 1,240,000 5.84 1,227,000 5.53

Other short-term

borrowings 97,498 3.97 417,279 6.58

Total $ 2,780,466 $ 1,742,200

Senior Notes

Bank — fixed rate $ 3,409,652 6.71% $ 3,268,182 6.29%

Bank —

variable rate 221,999 6.74 146,998 5.89

Corporation 548,897 7.20 324,213 7.17

Total $ 4,180,548 $ 3,739,393

Interest-bearing Deposits

As of December 31, 1999, the aggregate amount of interest-

bearing deposits with accounts equal to or exceeding $100 was

$1,076,076.

Secured Borrowings

In November 1999, the Bank entered into an agreement to

transfer a pool of consumer loans totaling up to $500,000.

Proceeds from the transfer were recorded as a secured bor-

rowing. The facility accrues interest based on commercial paper

rates and matures in 2000; however, it may be extended for

additional one-year periods through 2008. The outstanding

balance on the secured borrowing at December 31, 1999,

was $245,625.

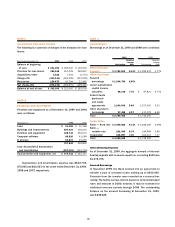

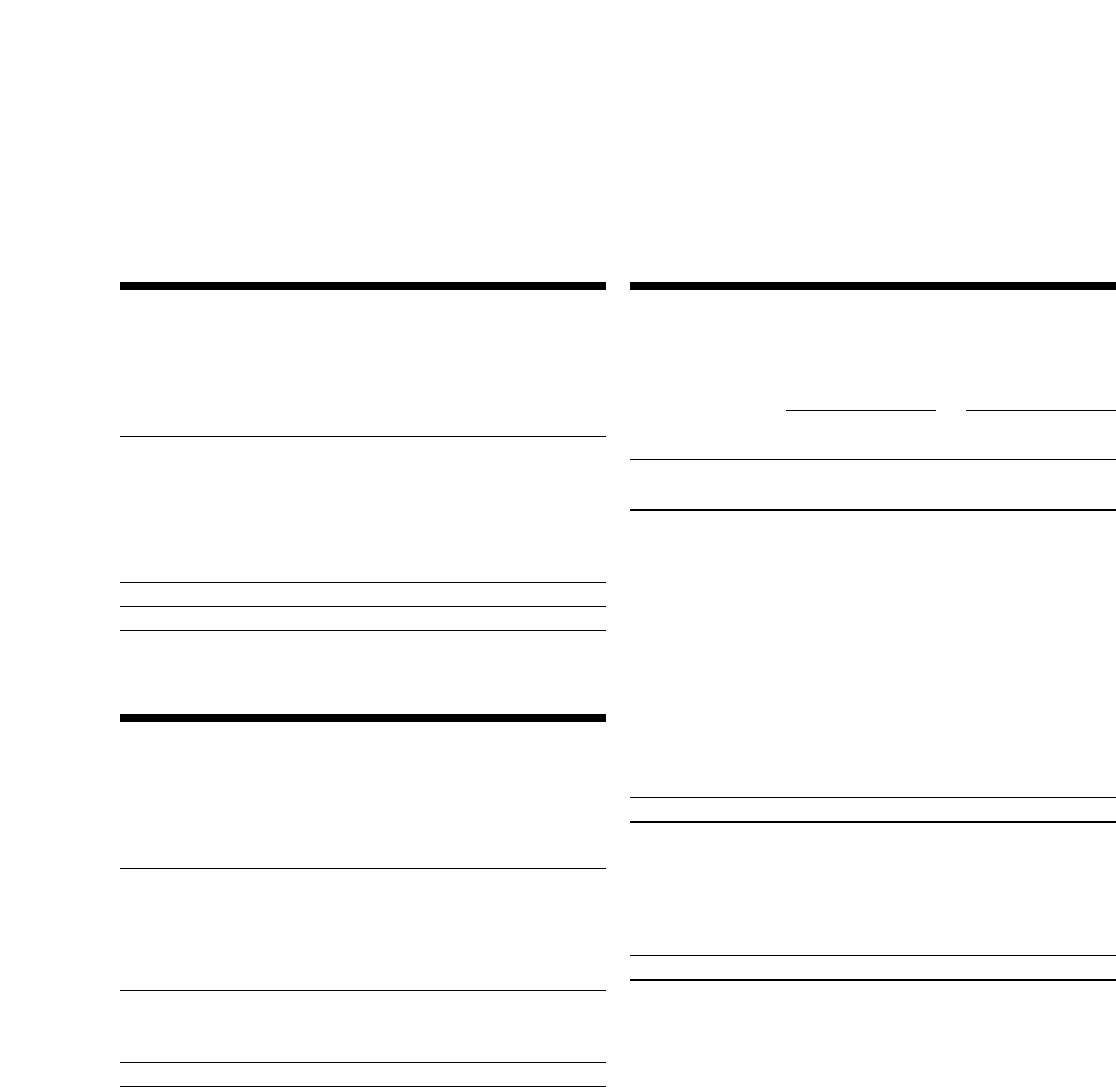

note c

ALLOWANCE FOR LOAN LOSSES

The following is a summary of changes in the allowance for loan

losses:

Year Ended December 31, 1999 1998 1997

Balance at beginning

of year $ 231,000 $ 183,000 $ 118,500

Provision for loan losses 382,948 267,028 262,837

Acquisitions/other 3,522 7,503 (2,770)

Charge-offs (400,143) (294,295) (223,029)

Recoveries 124,673 67,764 27,462

Net charge-offs (275,470) (226,531) (195,567)

Balance at end of year $ 342,000 $ 231,000 $ 183,000

note d

PREMISES AND EQUIPMENT

Premises and equipment as of December 31, 1999 and 1998

were as follows:

December 31, 1999 1998

Land $ 10,168 $ 10,168

Buildings and improvements 197,434 126,205

Furniture and equipment 448,742 254,070

Computer software 86,626 41,084

In process 54,874 23,325

797,844 454,852

Less: Accumulated depreciation

and amortization (327,112) (212,705)

Total premises and equipment, net $ 470,732 $ 242,147

Depreciation and amortization expense was $122,778,

$75,005 and $63,537, for the years ended December 31, 1999,

1998 and 1997, respectively.