Capital One 1999 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

note h

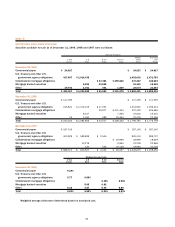

INCOME TAXES

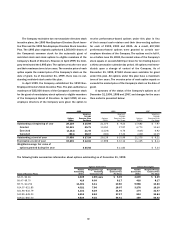

Deferred income taxes reflect the net tax effects of temporary

differences between the carrying amounts of assets and liabil-

ities for financial reporting purposes and the amounts used for

income tax purposes. Significant components of the Company’s

deferred tax assets and liabilities as of December 31, 1999 and

1998, were as follows:

December 31, 1999 1998

Deferred tax assets:

Allowance for loan losses $ 117,375 $ 75,738

Finance charge, fee and other

income receivables 111,599 57,913

Stock incentive plan 51,680 35,949

State taxes, net of federal benefit 15,131 7,310

Other 43,495 24,770

Subtotal 339,280 201,680

Valuation allowance (20,763) (14,168)

Total deferred tax assets 318,517 187,512

Deferred tax liabilities:

Securitizations 44,557 29,728

Deferred revenue 97,397 10,255

Other 17,110 7,814

Total deferred tax liabilities 159,064 47,797

Net deferred tax assets before

unrealized losses (gains) on

securities 159,453 139,715

Unrealized losses (gains) on

securities 13,369 (38,772)

Net deferred tax assets $ 172,822 $ 100,943

During 1999, the Company increased its valuation

allowance by $11,935 for certain state and international loss

carryforwards generated during the year. This increase in the

valuation allowance was partially offset by a decrease of $5,340

resulting from a change in tax regulations that will allow for

the recognition of the benefits of certain acquired net operat-

ing losses.

Significant components of the provision for income taxes

attributable to continuing operations were as follows:

Year Ended December 31, 1999 1998 1997

Federal taxes $ 232,910 $ 244,536 $ 138,877

State taxes 754 471 393

Deferred income taxes (19,738) (76,317) (23,198)

Income taxes $ 213,926 $ 168,690 $ 116,072

The reconciliation of income tax attributable to continuing

operations computed at the U.S. federal statutory tax rate to

income tax expense was:

Year Ended December 31, 1999 1998 1997

Income tax at statutory

federal tax rate 35.00% 35.00% 35.00%

Other 2.07 3.00 3.00

Income taxes 37.07% 38.00% 38.00%

note i

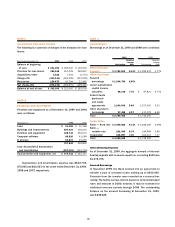

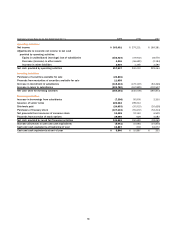

EARNINGS PER SHARE

The following table sets forth the computation of basic and

diluted earnings per share:

Year Ended December 31,

(Shares in Thousands) 1999 1998 1997

Numerator:

Net income $ 363,091 $ 275,231 $ 189,381

Denominator:

Denominator for basic

earnings per share —

Weighted-average shares 197,594 196,769 198,210

Effect of dilutive securities:

Stock options 13,089 11,990 4,734

Restricted stock 69

Dilutive potential

common shares 13,089 11,996 4,743

Denominator for diluted

earnings per share —

Adjusted weighted-

average shares 210,683 208,765 202,953

Basic earnings per share $ 1.84 $ 1.40 $ 0.96

Diluted earnings per share $ 1.72 $ 1.32 $ 0.93