Capital One 1999 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

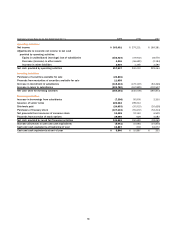

58

The amount of securities registered is limited to a $1,550,000

aggregate public offering price or its equivalent (based on the

applicable exchange rate at the time of sale) in one or more for-

eign currencies, currency units or composite currencies as shall

be designated by the Corporation. At December 31, 1999, the

Corporation had existing unsecured senior debt outstanding

under the shelf registrations of $550,000 including $125,000

maturing in 2003, $225,000 maturing in 2006, and $200,000

maturing in 2008.

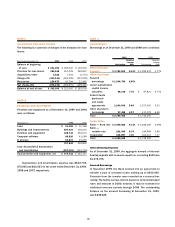

Interest-bearing deposits, other borrowings and senior

notes as of December 31, 1999, mature as follows:

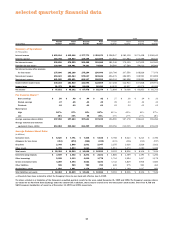

Interest-bearing Other

Deposits Borrowings Senior Notes Total

2000 $ 2,122,572 $ 2,317,706 $ 765,716 $ 5,205,994

2001 574,853 263,021 899,136 1,737,010

2002 283,163 56,151 565,000 904,314

2003 266,803 46,459 949,874 1,263,136

2004 473,345 295,000 768,345

Thereafter 63,073 97,129 705,822 866,024

Total $ 3,783,809 $ 2,780,466 $ 4,180,548 $ 10,744,823

note f

ASSOCIATE BENEFIT AND STOCK PLANS

The Company sponsors a contributory Associate Savings Plan

in which substantially all full-time and certain part-time associ-

ates are eligible to participate. The Company makes contribu-

tions to each eligible employee’s account, matches a portion of

associate contributions and makes discretionary contributions

based upon the Company meeting a certain earnings per share

target. The Company’s contributions to this plan were $27,157,

$16,357 and $10,264 for the years ended December 31, 1999,

1998 and 1997, respectively.

The Company has five stock-based compensation plans.

The Company applies Accounting Principles Board Opinion

No. 25, “Accounting for Stock Issued to Employees” (“APB 25”)

and related Interpretations in accounting for its stock-based

compensation plans. In accordance with APB 25, no compen-

sation cost has been recognized for the Company’s fixed stock

options, since the exercise price of all options equals or exceeds

the market price of the underlying stock on the date of grant,

nor for the Associate Stock Purchase Plan (the “Purchase

Plan”), which is considered to be noncompensatory. For the

performance-based option grants discussed below, compensa-

tion cost is measured as the difference between the exercise

price and the target stock price required for vesting and is rec-

ognized over the estimated vesting period. The Company

recognized $44,542, $70,038 and $24,772 of compensation

cost relating to its associate stock plans for the years ended

December 31, 1999, 1998 and 1997, respectively.

On April 29, 1999, the Company’s Board of Directors

approved a three-for-one stock split of the common stock of the

Corporation. The stock split was effected through a 200 percent

stock distribution on June 1, 1999, to the stockholders of record

on May 20, 1999. Consistent with the terms of the Company’s

stock-based compensation plans, the number of shares subject

to the plans and the respective exercise prices have been

adjusted accordingly and are reflected herein for all periods

presented.

SFAS No. 123, “Accounting for Stock-Based Compensation”

(“SFAS 123”) requires, for companies electing to continue to fol-

low the recognition provisions of APB 25, pro forma information

regarding net income and earnings per share, as if the recogni-

tion provisions of SFAS 123 were adopted for stock options

granted subsequent to December 31, 1994. For purposes of pro

forma disclosure, the fair value of the options was estimated at

the date of grant using a Black-Scholes option-pricing model

with the weighted average assumptions described below and is

amortized to expense over the options’ vesting period.

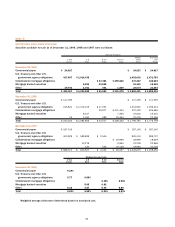

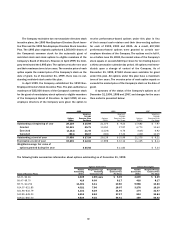

Year Ended December 31, 1999 1998 1997

Assumptions

Dividend yield .24% .32% .82%

Volatility factors of

expected market

price of stock 45% 40% 40%

Risk-free interest rate 5.29% 5.44% 6.27%

Expected option lives

(in years) 5.4 5.2 4.5

Pro Forma Information

Net income $ 325,701 $ 287,637 $ 186,003

Basic earnings per share $ 1.65 $ 1.46 $ 0.94

Diluted earnings per share $ 1.55 $ 1.38 $ 0.92

Under the 1994 Stock Incentive Plan, the Company has

reserved 43,112,640 common shares as of December 31, 1999,

for issuance in the form of incentive stock options, nonstatutory

stock options, stock appreciation rights, restricted stock and

incentive stock. The exercise price of each stock option issued to