Capital One 1999 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

note k

COMMITMENTS AND CONTINGENCIES

As of December 31, 1999, the Company had outstanding lines

of credit of approximately $55,500,000 committed to its cus-

tomers. Of that total commitment, approximately $35,300,000

was unused. While this amount represented the total available

lines of credit to customers, the Company has not experienced,

and does not anticipate, that all of its customers will exercise

their entire available line at any given point in time. The Com-

pany generally has the right to increase, reduce, cancel, alter or

amend the terms of these available lines of credit at any time.

Certain premises and equipment are leased under agree-

ments that expire at various dates through 2008, without taking

into consideration available renewal options. Many of these

leases provide for payment by the lessee of property taxes,

insurance premiums, cost of maintenance and other costs. In

some cases, rentals are subject to increase in relation to a cost

of living index. Total rental expense amounted to $37,685,

$18,242 and $13,644 for the years ended December 31, 1999,

1998 and 1997, respectively.

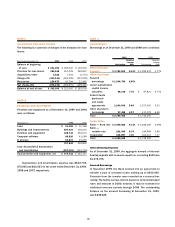

Future minimum rental commitments as of December 31,

1999, for all non-cancelable operating leases with initial or

remaining terms of one year or more are as follows:

2000 $ 39,379

2001 39,232

2002 36,564

2003 33,508

2004 23,787

Thereafter 112,321

Total $ 284,791

In 1998, the Company entered into a five-year lease of five

facilities in Tampa, Florida and Richmond, Virginia. Monthly rent

on the facilities is based on a fixed rate of 6.87% per annum

applied to the cost of the buildings included in the lease of

$86.8 million. The Company has two one-year renewal options

under the terms of the lease. If, at the end of the lease term, the

Company does not purchase all of the properties, the Company

would guarantee a residual value to the lessor of up to approx-

imately 84% of the cost of the buildings.

In 1999, the Company entered into two three-year agree-

ments for the lease of four facilities located in Tampa, Florida

and Federal Way, Washington. Monthly rent commences upon

completion of each of the buildings and is based on LIBOR rates

applied to the funded cost of the facilities. At December 31,

1999, one of the facilities had been completed and rent pay-

ments had commenced. The Company has a one-year renewal

option under the terms of the leases. If, at the end of each lease

term, the Company does not purchase all of the properties

under each of the leases, the Company would guarantee a

residual value to the lessor of up to approximately 85% of the

cost of the buildings in that lease agreement. The total funded

amount under both agreements was $55,201 at December 31,

1999, with an aggregate commitment of up to $120 million.

In connection with the transfer of substantially all of Signet

Bank’s credit card business to the Bank in November 1994, the

Company and the Bank agreed to indemnify Signet Bank (which

was acquired by First Union on November 30, 1997) for certain

liabilities incurred in litigation arising from that business, which

may include liabilities, if any, incurred in the purported class

action case described below.

During 1995, the Company and the Bank became involved

in a purported class action suit relating to certain collection

practices engaged in by Signet Bank and, subsequently, by the

Bank. The complaint in this case alleges that Signet Bank

and/or the Bank violated a variety of California state statutes

and constitutional and common law duties by filing collection

lawsuits, obtaining judgements and pursuing garnishment pro-

ceedings in the Virginia state courts against defaulted credit

card customers who were not residents of Virginia. This case

was filed in the Superior Court of California in the County of

Alameda, Southern Division, on behalf of a class of California

residents. The complaint in this case seeks unspecified statu-

tory damages, compensatory damages, punitive damages,

restitution, attorneys’ fees and costs, a permanent injunction

and other equitable relief.

In early 1997, the California court entered judgement in

favor of the Bank on all of the plaintiffs’ claims. The plaintiffs

appealed the ruling to the California Court of Appeals First Appel-

late District Division 4. In early 1999, the Court of Appeals

affirmed the trial court’s ruling in favor of the Bank on six counts,

but reversed the trial court’s ruling on two counts of the plain-

tiffs’ complaint. The California Supreme Court rejected the

Bank’s Petition for Review of the remaining two counts and

remitted them to the trial court for further proceedings. In August

1999, the trial court denied without prejudice plaintiffs’ motion

to certify a class on the one remaining common law claim. In

November 1999, the United States Supreme Court denied the