Capital One 1999 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

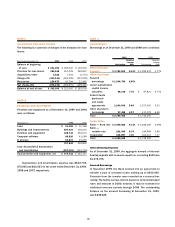

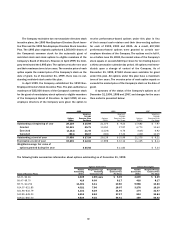

59

date equals or exceeds the market price of the Company’s stock

on the date of grant. Each option’s maximum term is ten years.

The number of shares available for future grants was 2,191,884,

2,178,669 and 293,442 as of December 31, 1999, 1998 and

1997, respectively. Other than the performance-based options

discussed below, options generally vest annually over three to

five years and expire beginning November 2004.

In April 1999, the Company established the 1999 Stock

Incentive Plan. Under the plan, the Company has reserved

600,000 common shares for issuance in the form of nonstatu-

tory stock options. The exercise price of each stock option

equals or exceeds the market price of the Company’s stock on

the date of grant. The maximum term of each option is ten

years. The number of shares available for future grant was

283,800 as of December 31, 1999. All options granted under

the plan to date were granted on April 29, 1999 and expire on

April 29, 2009. These options vested immediately upon the

optionee’s execution of an intellectual property protection agree-

ment with the Company.

In April 1999, the Company’s Board of Directors approved

a stock option grant to senior management (“EntrepreneurGrant

IV”). This grant was composed of 7,636,107 options to certain

key managers (including 1,884,435 options to the Company’s

Chief Executive Officer [“CEO”] and Chief Operating Officer

[“COO”]) with an exercise price equal to the fair market value

on the date of grant. The CEO and COO gave up their salaries for

the year 2001 and their annual cash incentives, annual option

grants and Senior Executive Retirement Plan contributions for

the years 2000 and 2001 in exchange for their Entrepreneur-

Grant IV options. Other members of senior management gave

up all potential annual stock option grants for 1999 and 2000

in exchange for this one-time grant. All options under this grant

will vest on April 29, 2008, or earlier if the common stock’s fair

market value is at or above $100 per share for at least ten

trading days in any thirty consecutive calendar day period on or

before June 15, 2002, or upon a change of control of the Com-

pany. These options will expire on April 29, 2009.

In April 1998, upon stockholder approval, a 1997 stock

option grant to senior management (“EntrepreneurGrant II”)

became effective at the December 18, 1997 market price of

$16.25 per share. This grant included 3,429,663 performance-

based options granted to certain key managers (including

2,057,265 options to the Company’s CEO and COO), which

vested in April 1998 when the market price of the Company’s

stock remained at or above $28.00 for at least ten trading days

in a thirty consecutive calendar day period. The grant also

included 671,700 options which vest in full, regardless of the

stock price, on December 18, 2000, or immediately upon a

change in control of the Company.

In April 1999 and 1998, the Company granted 1,045,362

and 1,335,252 options, respectively, to all associates not

granted options in the EntrepreneurGrant II or Entrepreneur-

Grant IV. Certain associates were granted options in exchange

for giving up future compensation. Other associates were

granted a set number of options. These options were granted

at the then market price of $56.46 and $31.71 per share,

respectively, and vest, in full, on April 29, 2002 and April 30,

2001, respectively, or immediately upon a change in control of

the Company.

In June 1998, the Company’s Board of Directors approved

a grant to executive officers (“EntrepreneurGrant III”). This grant

consisted of 2,611,896 performance-based options granted to

certain key managers (including 2,000,040 options to the Com-

pany’s CEO and COO), which were approved by the stockholders

in April 1999, at the then market price of $33.77 per share. The

Company’s CEO and COO gave up 300,000 and 200,010 vested

options (valued at $8,760 in total), respectively, in exchange for

their EntrepreneurGrant III options. Other executive officers gave

up future cash compensation for each of the next three years in

exchange for the options. All options made under this grant will

vest if the Company’s stock reaches $58.33 per share for at

least ten trading days in a thirty consecutive calendar day period

by June 11, 2001, or immediately upon a change in control of

the Company.

In April 1996, upon stockholder approval, a 1995 stock

option grant to the Company’s CEO and COO became effective.

This grant was for performance-based options to purchase

7,500,000 common shares at the September 15, 1995, mar-

ket price of $9.73 per share. Vesting of the options was depend-

ent on the fair market value of the common stock remaining at

or above specified levels for at least ten trading days in any

thirty consecutive calendar day period. Fifty percent of the

options vested in January 1997 when the Company’s stock

reached $12.50 per share; 25% vested in October 1997 when

the stock reached $14.58 per share; and the remaining 25%

vested in January 1998 when the stock reached $16.67

per share.