Capital One 1999 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

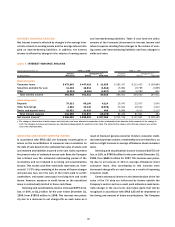

DELINQUENCIES

Table 6 shows the Company’s consumer loan delinquency trends

for the years presented on a reported and managed basis. The

entire balance of an account is con-

tractually delinquent if the minimum

payment is not received by the pay-

ment due date. Delinquencies not only

have the potential to impact earn-

ings if the account charges off, they

also are costly in terms of the per-

sonnel and other resources dedi-

cated to resolving the delinquencies.

The 30-plus day delinquency

rate for the reported consumer

loan portfolio increased to 5.92%

as of December 31, 1999, from

4.70% as of December 31, 1998.

The 30-plus day delinquency rate for

the managed consumer loan port-

folio was 5.23% as of December 31,

1999, up from 4.70% as of Decem-

ber 31, 1998.

management activities and demographic concentration, as well

as general economic conditions. The seasoning of the accounts

is also an important factor as accounts tend to exhibit a rising

trend of delinquency and credit losses as they season. As of

December 31, 1999 and 1998, 60% and 59% of managed

accounts, respectively, representing 51% of the total managed

loan balance, were less than eighteen months old. Accordingly,

it is likely that the Company’s managed loan portfolio could

experience increased levels of delinquency and credit losses as

the average age of the Company’s accounts increases.

Changes in the rates of delinquency and credit losses can

also result from a shift in the product mix. As discussed in “Risk

Adjusted Revenue and Margin,” certain other customized card

products have, in some cases, higher delinquency and higher

charge-off rates. In the case of secured card loans, collateral, in

the form of cash deposits, reduces any ultimate charge-offs. The

costs associated with higher delinquency and charge-off rates

are considered in the pricing of individual products.

During 1999, general economic conditions for consumer

credit remained stable as industry levels of charge-offs (includ-

ing bankruptcies) and delinquencies both decreased. These

trends have positively impacted the Company’s 1999 results.

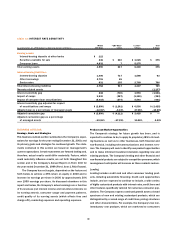

table 6: DELINQUENCIES

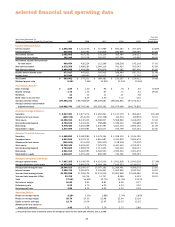

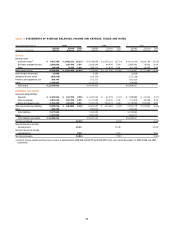

December 31 1999 1998 1997 1996 1995

% of % of % of % of % of

Total Total Total Total Total

(Dollars in Thousands) Loans Loans Loans Loans Loans Loans Loans Loans Loans Loans

Reported:

Loans outstanding $ 9,913,549 100.00% $ 6,157,111 100.00% $ 4,861,687 100.00% $ 4,343,902 100.00% $ 2,921,679 100.00%

Loans delinquent:

30–59 days 236,868 2.39 123,162 2.00 104,216 2.14 96,819 2.23 65,711 2.25

60–89 days 129,251 1.30 67,504 1.10 64,217 1.32 55,679 1.28 38,311 1.31

90 or more days 220,513 2.23 98,798 1.60 99,667 2.05 111,791 2.57 79,694 2.73

Total $ 586,632 5.92% $ 289,464 4.70% $ 268,100 5.51% $ 264,289 6.08% $ 183,716 6.29%

Managed:

Loans outstanding $ 20,236,588 100.00% $ 17,395,126 100.00% $ 14,231,015 100.00% $ 12,803,969 100.00% $ 10,445,480 100.00%

Loans delinquent:

30–59 days 416,829 2.06 329,239 1.89 327,407 2.30 279,787 2.19 165,306 1.58

60–89 days 238,476 1.18 182,982 1.05 213,726 1.50 162,668 1.27 92,665 .89

90 or more days 403,464 1.99 305,589 1.76 340,887 2.40 356,700 2.78 181,243 1.73

Total $ 1,058,769 5.23% $ 817,810 4.70% $ 882,020 6.20% $ 799,155 6.24% $ 439,214 4.20%

(in percentages)

6.20 4.70 5.23

97 98 99

managed 30+ day

delinquency rate

(in percentages)

6.59 5.33 3.85

97 98 99

managed net

charge-off rate