Capital One 1999 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

will continuously assess the performance of new and existing

securitization transactions as estimates of future cash flows

change.

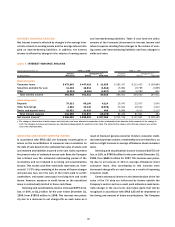

OTHER NON-INTEREST INCOME

Interchange income increased $57.8 million, or 67%, to

$144.3 million for the year ended December 31, 1999, from

$86.5 million in 1998. Service charges and other fees increased

to $1.0 billion, or 70%, for the year ended December 31, 1999

compared to $612.0 million for the year ended December 31,

1998. These increases were primarily due to a 42% increase in

the average number of accounts for the year ended December 31,

1999, from 1998, an increase in purchase volume, an increase

in interchange rates received by the Company and a shift to

more fee-intensive products.

Interchange income increased $37.5 million, or 76%, to

$86.5 million for the year ended December 31, 1998, from

$49.0 million in 1997. Service charges and other fees increased

to $612.0 million, or 81%, for the year ended December 31,

1998 compared to $337.8 million for the year ended December

31, 1997. These increases were due to a 39% increase in the

average number of accounts for the year ended December 31,

1998, from 1997, an increase in charge volume, a shift to more

fee-intensive products and changes in the terms of overlimit

fees charged.

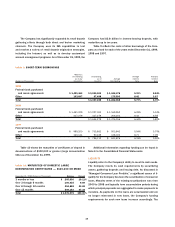

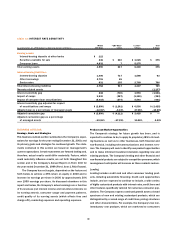

NON-INTEREST EXPENSE

Non-interest expense for the year ended December 31, 1999,

increased $1.0 billion, or 68%, to $2.5 billion from $1.5 billion

for the year ended December 31, 1998. Contributing to the

increase in non-interest expense were marketing expenses

which increased $285.6 million, or

64%, to $731.9 million in 1999, from

$446.3 million in 1998. The increase

in marketing expenses during 1999

reflects the Company’s continued

identification of and investments in

opportunities for growth. Salaries

and associate benefits increased

$303.8 million, or 64%, to $780.2

million in 1999, from $476.4 million

in 1998, as the Company added approximately 5,000 associates

to our staffing levels to manage the growth in the Company’s

accounts. All other non-interest expenses increased $411.0 mil-

lion, or 76%, to $952.9 million for the year ended December 31,

1999, from $541.9 million in 1998. The increase in other non-

interest expense, as well as the increase in salaries and

associate benefits, was primarily a result of a 42% increase in

the average number of accounts for the year ended December 31,

1999 and the Company’s continued exploration and testing of

new products and markets.

Non-interest expense for the year ended December 31,

1998 increased $587.6 million, or 67%, to $1.5 billion from

$877.0 million for the year ended December 31, 1997. Con-

tributing to the increase in non-interest expense were marketing

expenses which increased $221.4 million, or 98%, to

$446.3 million in 1998, from $224.8 million in 1997. The

increase in marketing expenses during 1998 reflects the Com-

pany’s continued identification of and investments in

opportunities for growth. Salaries and associate benefits

increased $187.1 million, or 65%, to $476.4 million in 1998

from $289.3 million in 1997, as the Company added approx-

imately 4,500 associates to manage the growth in the

Company’s accounts. This increase also reflects an additional

$45.3 million in compensation expense associated with the

Company’s associate stock plans compared to the prior year. All

other non-interest expenses increased $179.1 million, or 49%, to

$541.9 million for the year ended December 31, 1998 from

$362.8 million in 1997. The increase in other non-interest

expenses was primarily the result of a 39% increase in the aver-

age number of accounts for the year ended December 31, 1998.

INCOME TAXES

The Company’s income tax rate was 37%, 38% and 38%, for the

years ended December 31, 1999, 1998 and 1997, respectively.

The effective rate includes both state and federal income tax

components.

ASSET QUALITY

The asset quality of a portfolio is generally a function of the ini-

tial underwriting criteria used, levels of competition, account

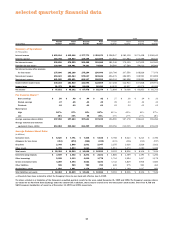

(in millions)

$225 $446 $732

97 98 99

marketing

investment