Capital One 1999 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

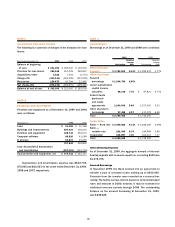

Options to purchase approximately 5,200,000, 6,436,000

and 2,848,000 shares of common stock during 1999, 1998 and

1997, respectively, were not included in the computation of

diluted earnings per share because the options’ exercise prices

were greater than the average market price of the common

shares and, therefore, their inclusion would be antidilutive.

note j

REGULATORY MATTERS

The Bank and the Savings Bank are subject to capital adequacy

guidelines adopted by the Federal Reserve Board (the “Federal

Reserve”) and the Office of Thrift Supervision (the “OTS”) (col-

lectively, the “regulators”), respectively. The capital adequacy

guidelines and the regulatory framework for prompt corrective

action require the Bank and the Savings Bank to maintain spe-

cific capital levels based upon quantitative measures of their

assets, liabilities and off-balance sheet items. The inability to

meet and maintain minimum capital adequacy levels could

result in the regulators taking actions that could have a mate-

rial effect on the Company’s consolidated financial statements.

Additionally, the regulators have broad discretion in applying

higher capital requirements. Regulators consider a range of fac-

tors in determining capital adequacy, such as an institution’s

size, quality and stability of earnings, interest rate risk exposure,

risk diversification, management expertise, asset quality, li-

quidity and internal controls.

The most recent notifications received from the regulators

categorized the Bank and the Savings Bank as “well-capitalized.”

To be categorized as “well-capitalized,” the Bank and the Sav-

ings Bank must maintain minimum capital ratios as set forth

in the following table. As of December 31, 1999, there were no

conditions or events since the notifications discussed above that

management believes would have changed either the Bank or

the Savings Bank’s capital category.

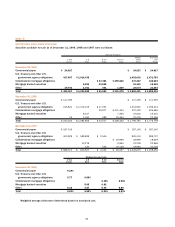

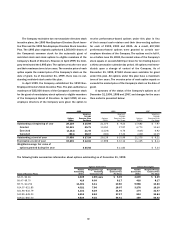

To Be “Well-

Capitalized”

Minimum For Under Prompt

Capital Corrective

Adequacy Action

Ratios Purposes Provisions

December 31, 1999

Capital One Bank

Tier 1 Capital 10.64% 4.00% 6.00%

Total Capital 13.11 8.00 10.00

Tier 1 Leverage 11.13 4.00 5.00

Capital One, F.S.B.

Tier 1 Capital 9.06% 4.00% 6.00%

Total Capital 10.69 8.00 10.00

Tier 1 Leverage 8.08 4.00 5.00

December 31, 1998

Capital One Bank

Tier 1 Capital 11.38% 4.00% 6.00%

Total Capital 13.88 8.00 10.00

Tier 1 Leverage 10.24 4.00 5.00

Capital One, F.S.B.

Tier 1 Capital 11.28% 4.00% 6.00%

Total Capital 13.87 12.00 10.00

Tier 1 Leverage 9.46 8.00 5.00

During 1996, the Bank received regulatory approval and

established a branch office in the United Kingdom. In connec-

tion with such approval, the Company committed to the Federal

Reserve that, for so long as the Bank maintains a branch in the

United Kingdom, the Company will maintain a minimum Tier 1

Leverage ratio of 3.0%. As of December 31, 1999 and 1998,

the Company’s Tier 1 Leverage ratio was 12.79% and 13.49%,

respectively.

Additionally, certain regulatory restrictions exist that limit

the ability of the Bank and the Savings Bank to transfer funds

to the Corporation. As of December 31, 1999, retained earnings

of the Bank and the Savings Bank of $281,500 and $61,900,

respectively, were available for payment of dividends to the Cor-

poration without prior approval by the regulators. The Savings

Bank, however, is required to give the OTS at least thirty days

advance notice of any proposed dividend and the OTS, in its dis-

cretion, may object to such dividend.