Capital One 1999 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Securitizations

The Company records gains or losses on the securitization of con-

sumer loan receivables on the date of sale based on the

estimated fair value of assets sold and retained and liabilities

incurred in the sale. Gains represent the present value of esti-

mated cash flows the Company has retained over the estimated

outstanding period of the receivables. This excess cash flow

essentially represents an “interest only”(“I/O”) strip, consisting of

the excess of finance charges and past-due fees over the sum of

the return paid to certificateholders, estimated contractual serv-

icing fees and credit losses. The I/O strip is carried at fair value

in accounts receivable from securitizations, with changes in the

fair value reported as a component of cumulative other compre-

hensive income. Certain estimates inherent in the determination

of the fair value of the I/O strip are influenced by factors outside

the Company’s control, and as a result, such estimates could

materially change in the near term. The gains on securitizations

are included in servicing and securitizations income.

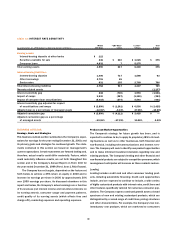

Off-Balance Sheet Financial Instruments

The nature and composition of the Company’s assets and lia-

bilities and off-balance sheet items expose the Company to

interest rate risk. The Company’s foreign currency denominated

assets and liabilities expose it to foreign currency exchange rate

risk. To mitigate these risks, the Company uses certain types of

derivative financial instruments. The Company enters into inter-

est rate swap agreements (“interest rate swaps”) in the

management of its interest rate exposure. All of the Company’s

interest rate swaps are designated and effective as hedges of

specific existing or anticipated assets or liabilities. The Company

enters into forward foreign currency exchange contracts

(“f/x contracts”) and currency swaps to reduce its sensitivity

to changing foreign currency exchange rates. All of the Com-

pany’s f/x contracts and currency swaps are designated and

effective as hedges of specific assets or liabilities. The Company

does not hold or issue derivative financial instruments for trad-

ing purposes.

Swap agreements involve the periodic exchange of pay-

ments over the life of the agreements. Amounts paid or received

on interest rate and currency swaps are recorded on an accrual

basis as an adjustment to the related income or expense of the

item to which the agreements are designated. As of December

31, 1999 and 1998, the related amounts payable to counter-

parties were $4,748 and $2,463, respectively. Changes in the

fair value of interest rate swaps are not reflected in the accom-

panying financial statements, where designated to existing or

anticipated assets or liabilities and where swaps effectively mod-

ify or reduce interest rate sensitivity.

F/x contracts represent an agreement to exchange a spec-

ified notional amount of two different currencies at a specified

exchange rate on a specified future date. Changes in the fair

value of f/x contracts and currency swaps are recorded in the

period in which they occur as foreign currency gains or losses in

other non-interest income, effectively offsetting the related

gains or losses on the items to which they are designated.

Realized and unrealized gains or losses at the time of

termination, sale or repayment of a derivative contract are

recorded in a manner consistent with its original designation.

Amounts are deferred and amortized as an adjustment to the

related income or expense over the original period of exposure,

provided the designated asset or liability continues to exist, or

in the case of anticipated transactions, is probable of occurring.

Realized and unrealized changes in the fair value of swaps

or f/x contracts, designated with items that no longer exist or

are no longer probable of occurring, are recorded as a compo-

nent of the gain or loss arising from the disposition of the

designated item.

Interest rate and foreign currency exchange rate risk man-

agement contracts are generally expressed in notional principal

or contract amounts that are much larger than the amounts

potentially at risk for nonperformance by counterparties. In the

event of nonperformance by the counterparties, the Company’s

credit exposure on derivative financial instruments is equal to

the gross unrealized gains on the outstanding contracts.

At December 31, 1999, the gross unrealized gains in the port-

folio were $83,314. The Company actively monitors the credit

ratings of its counterparties. Under the terms of certain swaps,

each party may be required to pledge collateral if the mar-

ket value of the swaps exceeds an amount set forth in the

agreement or in the event of a change in its credit rating. At

December 31, 1999, $58,717 of such collateral has been

pledged to the Company.