Capital One 1999 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

In October 1999, the Bank entered into a £750,000 revolv-

ing credit facility collateralized by a security interest in certain

consumer loans of the Company. Interest on the facility is based

on commercial paper rates or London InterBank Offering Rates

(“LIBOR”). The facility matures in 2000. At December 31, 1999,

£500,000 ($809,100 equivalent) was outstanding under the

facility.

In May 1999, Summit Acceptance Corporation, a subsidiary

of the Company, entered into an agreement to transfer a pool of

consumer loans totaling $350,000. Proceeds from the transfer

were recorded as a secured borrowing. Principal payments on

the borrowing are based on principal collections net of losses

on the transferred consumer loans. The borrowing accrues

interest based on commercial paper rates and matures on June

15, 2006 or earlier depending upon the repayment of the under-

lying consumer loans. At December 31, 1999, $290,065 of the

secured borrowing was outstanding.

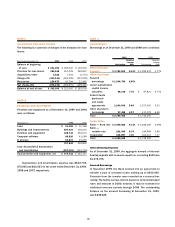

Junior Subordinated Capital Income Securities

In January 1997, Capital One Capital I, a subsidiary of the Bank

created as a Delaware statutory business trust, issued

$100,000 aggregate amount of Floating Rate Junior Subordi-

nated Capital Income Securities that mature on February 1,

2027. The securities represent a preferred beneficial interest in

the assets of the trust.

Other Short-Term Borrowings

In May 1999, the Company entered into a four-year, $1,200,000

unsecured revolving credit arrangement (the “Credit Facility”).

The Credit Facility is comprised of two tranches: a $810,000

Tranche A facility available to the Bank and the Savings Bank,

including an option for up to $250,000 in multicurrency avail-

ability, and a $390,000 Tranche B facility available to the

Corporation, the Bank and the Savings Bank, including an option

for up to $150,000 in multicurrency availability. Each tranche

under the facility is structured as a four-year commitment and

is available for general corporate purposes. All borrowings under

the Credit Facility are based on varying terms of LIBOR. The

Bank has irrevocably undertaken to honor any demand by the

lenders to repay any borrowings which are due and payable by

the Savings Bank but have not been paid. Any borrowings under

the Credit Facility will mature on May 24, 2003; however,

the final maturity of each tranche may be extended for three

additional one-year periods with the lenders’ consent. As of

December 31, 1999 and 1998, the Company had no outstand-

ings under the Credit Facility or its predecessor facility.

In August 1997, the Company entered into a three-year,

$350,000 equivalent unsecured revolving credit arrangement

(the “UK/Canada Facility”), which is being used to finance the

Company’s expansion in the United Kingdom and Canada. The

UK/Canada Facility is comprised of two tranches: a Tranche A

facility in the amount of £156,458 ($249,800 equivalent based

on the exchange rate at closing) and a Tranche B facility in the

amount of C$139,609 ($100,200 equivalent based on the

exchange rate at closing). An amount of £34,574 or C$76,910

($55,200 equivalent based on the exchange rates at closing)

may be transferred between the Tranche A facility and the

Tranche B facility, respectively, upon the request of the Company.

In the second quarter of 1998, the Company requested the

transfer of the £34,574 from the Tranche A facility to the

Tranche B facility. Each tranche under the facility is structured

as a three-year commitment. All borrowings under the UK/

Canada Facility are based on varying terms of LIBOR. The Cor-

poration serves as the guarantor of all borrowings under the

UK/Canada Facility. There were no outstandings under the UK/

Canada Facility as of December 31, 1999. As of December 31,

1998, the Company had a total of $166,345 outstanding under

the UK/Canada Facility ($66,400 under Tranche A and $99,945

under Tranche B).

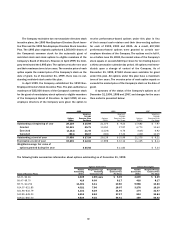

Bank Notes

Under the Company’s bank note program, the Bank from time

to time may issue senior bank notes at fixed or variable rates

tied to LIBOR with maturities from 30 days to 30 years. The

aggregate principal amount available for issuance under the

program is $8,000,000 (of which, up to $200,000 may be sub-

ordinated bank notes). There were no subordinated bank notes

issued or outstanding as of December 31, 1999 and 1998.

The Bank has established a program for the issuance of

debt instruments to be offered outside of the United States.

Under this program, the Bank from time to time may issue

instruments in the aggregate principal amount of $1,000,000

equivalent outstanding at any one time ($5,000 outstanding as

of December 31, 1999 and 1998). Instruments under this pro-

gram may be denominated in any currency or currencies.

The Corporation has three shelf registration statements

under which the Corporation from time to time may offer and

sell (i) senior or subordinated debt securities, consisting of

debentures, notes and/or other unsecured evidences, (ii) pre-

ferred stock, which may be issued in the form of depository

shares evidenced by depository receipts and (iii) common stock.