Capital One 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

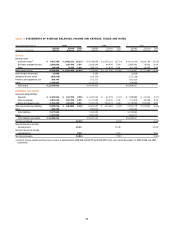

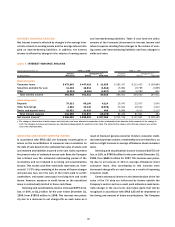

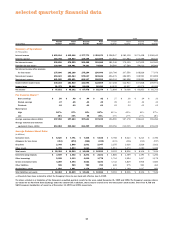

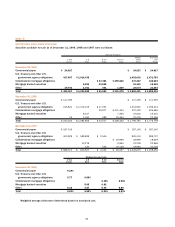

table 12: INTEREST RATE SENSITIVITY

Within >180 Days– >1 Year– Over

As of December 31, 1999 Subject to Repricing (Dollars in Millions) 180 Days 1 Year 5 Years 5 Years

Earning assets:

Interest-bearing deposits at other banks $ 112

Securities available for sale 246 $ 210 $ 1,025 $ 375

Consumer loans 4,632 7 5,275

Total earning assets 4,990 217 6,300 375

Interest-bearing liabilities:

Interest-bearing deposits 1,406 717 1,598 63

Other borrowings 2,715 65

Senior notes 631 135 2,709 706

Total interest-bearing liabilities 4,752 917 4,307 769

Non-rate related assets (1,137)

Interest sensitivity gap 238 (700) 1,993 (1,531)

Impact of swaps 1,930 (287) (1,350) (293)

Impact of consumer loan securitizations (5,018) (274) 5,893 (601)

Interest sensitivity gap adjusted for impact

of securitizations and swaps $ (2,850) $ (1,261) $ 6,536 $ (2,425)

Adjusted gap as a percentage of managed assets –12.06% –5.33% 27.65% –10.26%

Adjusted cumulative gap $ (2,850) $ (4,111) $ 2,425 $ —

Adjusted cumulative gap as a percentage

of managed assets –12.06% –17.39% 10.26% 0.00%

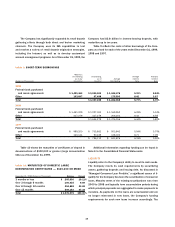

BUSINESS OUTLOOK

Earnings, Goals and Strategies

This business outlook section summarizes the Company’s expec-

tations for earnings for the year ending December 31, 2000, and

its primary goals and strategies for continued growth. The state-

ments contained in this section are based on management’s

current expectations. Certain statements are forward looking and,

therefore, actual results could differ materially. Factors, which

could materially influence results, are set forth throughout this

section and in the Company’s Annual Report on Form 10-K for

the year ended December 31, 1999 (Part I, Item 1, Risk Factors).

The Company has set targets, dependent on the factors set

forth below, to achieve a 25% return on equity in 2000 and to

increase its earnings per share in 2000 by approximately 30%

over 1999 earnings per share. As discussed elsewhere in this

report and below, the Company’s actual earnings are a function

of its revenues (net interest income and non-interest income on

its earning assets), consumer usage and payment patterns,

credit quality of its earning assets (which affects fees and

charge-offs), marketing expenses and operating expenses.

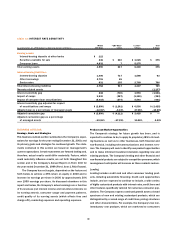

Product and Market Opportunities

The Company’s strategy for future growth has been, and is

expected to continue to be, to apply its proprietary IBS to its lend-

ing business as well as to other businesses, both financial and

non-financial, including telecommunications and Internet serv-

ices. The Company will seek to identify new product opportunities

and to make informed investment decisions regarding new and

existing products. The Company’s lending and other financial and

non-financial products are subject to competitive pressures, which

management anticipates will increase as these markets mature.

Lending

Lending includes credit card and other consumer lending prod-

ucts, including automobile financing. Credit card opportunities

include, and are expected to continue to include, a wide variety

of highly customized products with interest rates, credit lines and

other features specifically tailored for numerous consumer pop-

ulations. The Company expects continued growth across a broad

spectrum of new and existing customized products, which are

distinguished by a varied range of credit lines, pricing structures

and other characteristics. For example, the Company’s low non-

introductory rate products, which are marketed to consumers