Capital One 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

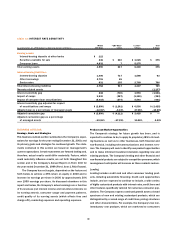

Internationally, the Company has funding programs

designed for foreign investors or to raise funds in foreign cur-

rencies. The Company has accessed the international

securitization market for a number of years with both US$ and

foreign denominated transactions. Both of the Company’s com-

mitted revolving credit facilities offer foreign currency funding

options. The Bank has established a $1.0 billion Euro Medium

Term Note program that is targeted to non-U.S. investors. The

Company funds its foreign assets by directly or synthetically bor-

rowing or securitizing in the local currency to mitigate the

financial statement effect of currency translation.

38

allowance for loan loss policy can be found in Note A to the

Consolidated Financial Statements.

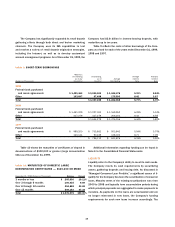

Table 8 sets forth the activity in the allowance for loan

losses for the periods indicated. See “Asset Quality,” “Delin-

For the year ended December 31, 1999, the provision for

loan losses increased to $382.9 million, or 43%, from the 1998

provision for loan losses of $267.0 million as average reported

loans increased by 43%. The Company increased the allowance

for loan losses by $111.0 million during 1999 due to the

increase in the delinquency rate, the growth in reported loans

and the increase in the dollar amount of net charge-offs.

For the year ended December 31, 1998, the provision for

loan losses increased to $267.0 million, or 2%, from the 1997

provision for loan losses of $262.8 million as average reported

loans increased by 30%, offset by general improvements in con-

sumer credit performance. The Company increased the

allowance for loan losses by $48.0 million during 1998 prima-

rily due to the growth in reported loans.

FUNDING

The Company has established access to a wide range of domes-

tic funding alternatives, in addition to securitization of its con-

sumer loans. The Company primarily issues senior unsecured

debt of the Bank through its $8 billion bank note program, of

which $3.6 billion was outstanding as of December 31, 1999,

with original terms of one to ten years. During 1999, the Bank

continued to expand its fixed income investor base by launching

$925 million of benchmark underwritten senior note transac-

tions. The Corporation continued to access the capital markets

with a $225 million seven-year senior note.

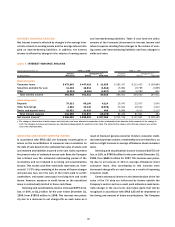

funding (in millions)

total funding: $10,745 total funding: $7,481

December 31, 1999 December 31, 1998

$3,784 $2,780

$2,230

$1,951

$2,000 $1,742

$2,478

$1,261

interest-bearing deposits

other borrowings

senior notes <3 years

senior notes >3 years

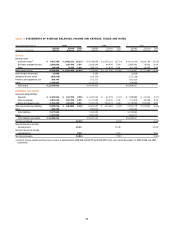

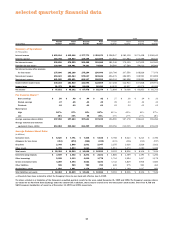

table 8: SUMMARY OF ALLOWANCE FOR LOAN LOSSES

Year Ended December 31 (Dollars in Thousands) 1999 1998 1997 1996 1995

Balance at beginning of year $ 231,000 $ 183,000 $ 118,500 $ 72,000 $ 68,516

Provision for loan losses 382,948 267,028 262,837 167,246 65,895

Acquisitions/other 3,522 7,503 (2,770) (18,887) (11,504)

Charge-offs (400,143) (294,295) (223,029) (115,159) (64,260)

Recoveries 124,673 67,764 27,462 13,300 13,353

Net charge-offs (275,470) (226,531) (195,567) (101,859) (50,907)

Balance at end of year $ 342,000 $ 231,000 $ 183,000 $ 118,500 $ 72,000

Allowance for loan losses to loans

at end of year 3.45% 3.75% 3.76% 2.73% 2.86%

quencies” and “Net Charge-Offs” for a more complete analysis

of asset quality.