Capital One 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One Financial Corporation 1999 Annual Report

99

“that’s what

i want.”

capital one 1999 annual report

Table of contents

-

Page 1

99 Capital One Financial Corporation 1999 Annual Report "that's what i want." capital one 1999 annual report -

Page 2

...10 years old? For a whole day, the entire universe seemed to revolve around you. If we could translate that feeling into a mission statement, we would because our world revolves around you. Where other companies aim to "meet or exceed" the expectations of their associates, customers and shareholders... -

Page 3

..., and that's what they expect us to be. So we've made Capital One a terrific place to work. We give associates big opportunities. We invest in their growth and reward great performance. Compensation and benefits are highly innovative. We're proud that 15,500 smart, energetic, committed individuals... -

Page 4

ower -

Page 5

... fall through. "It was devastating to come home empty-handed," Joe says. "The Company's employee benefit plan paid part of the cost, but the rest of the money we'd spent to get that far had tapped out our savings." A few weeks later, the Fergusons were presented with an opportunity to adopt a baby... -

Page 6

...encouraged to go out and add value. Through stock ownership and options programs, there's an opportunity to create substantial value for yourself as well." Like many senior managers, Bill has traded half his bonus for options and recently traded his options for the next two years in exchange for the... -

Page 7

..., MANAGER, SITE OPERATIONS. RICHMOND, VIRGINIA Go-For-It Culture. An Eagle Scout and former U.S. Army major, Bill came to Capital One in 1997 as a site operations manager. After two promotions he now manages a team of technicians who provide computer support to all of Capital One's U.S. buildings... -

Page 8

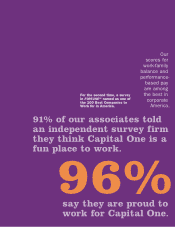

... SM named us one of the 100 Best Companies to Work for in America. Our scores for work-family balance and performancebased pay are among the best in corporate America. 91% of our associates told an independent survey firm they think Capital One is a fun place to work. 96% say they are proud to... -

Page 9

to -

Page 10

... customers Each of our customers takes a unique journey through Capital One. Every account is customfitted to the individual's circumstances. We market to our customers' practical needs, their personal passions, their stages of life. We build strong, lasting relationships through high-value products... -

Page 11

... is a leader in online credit cards. Setting up a Capital One account on the Internet takes less than 60 seconds, and new customers can immediately shop online. Our Web site also expands service options. "The online payment system was one of the main reasons I signed up with Capital One," says Adam... -

Page 12

... through North Carolina last September, they also blew a hole through the family budget of Quentin and Denise Memmelaar. Bad roads and washed-out bridges kept Quentin from work for three weeks. "I called Capital One to explain that we had no money coming in," Denise says. "We just needed a little... -

Page 13

... village that draws 60,000 visitors a year. Her husband, John Gilliat, is Rugby's property director. "Capital One is a partner we know we can count on. It is the only credit card company we've dealt with in a long time that hasn't thrown us any curves, like rate increases or unexpected fees." -

Page 14

Consumer Reports® rates our MilesOne Platinum Visa, the #1 travel reward credit card. No wonder. Miles are redeemable on any airline. No blackout periods. Low fixed rate. SM Capital One profitably serves customers across the credit spectrum. Capital One has 24 million customers - more than AOL® ... -

Page 15

rewa With our InformationBased Strategy, we have reinvented the credit card industry and created explosive growth for Capital One. Our financial performance has set records across the board in our five years as a public company. Our radically new approach and its superior results have led our ... -

Page 16

rded -

Page 17

..., PORTFOLIO MANAGER, NEUBERGER BERMAN. NEW YORK, NEW YORK of associates own our stock or options 81% Intellectual Capital. Kent is in the business of picking winners. The mutual fund he manages, Neuberger Berman's Focus Fund, owns 2,767,500 shares of Capital One stock, and Kent personally owns 112... -

Page 18

a brilliant future SID AND MARCY PASKOWITZ, INDIVIDUAL INVESTORS. M C LEAN, VIRGINIA compound annual revenue growth for 5 years: 44% Education and Retirement Savings. Sid decided to invest in Capital One soon after the Company's first annual meeting. "Marcy and I were there because she was already... -

Page 19

... BROWN, SECOND CURVE CAPITAL. NEW YORK, NEW YORK growth in customers since 1995 369% Growth, Year After Year. For a security analyst, there is no higher professional honor than a spot on one of Institutional Investor® magazine's annual all-star lists. In the financial services category, Tom Brown... -

Page 20

...equity have topped 20% for five years in a row. Between our IPO in 1994 and year-end 1999, our revenues increased 512%. In 1999, we won four Alexander Hamilton Awards, given by Treasury & Risk Management magazine for excellence in financial management. Our treasury department took first prize. ® -

Page 21

Richard D. Fairbank Chairman and Chief Executive Officer Nigel W. Morris President and Chief Operating Officer -

Page 22

...consecutive years, a record matched by only 10 of the country's 10,000 public companies. Other highlights: • We started as a U.S. credit card company. We now have a growing international business. We also market auto loans, installment loans, deposit accounts, other consumer financial products and... -

Page 23

... credit cards available for the first time to millions of people. IBS allows us to reach hard-to-find customers in thousands of "microsegments" and offer them innovative, high-value products tailored to their needs. We have built a thriving business in the superprime market - the country's most blue... -

Page 24

... Year-end reported loans Year-end off-balance sheet loans Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate (30+ days) Net charge-off rate YEAR-END REPORTED DATA: Assets Earning assets Average assets Average earning assets Common equity Associates... -

Page 25

... it excels at data mining, testing, customizing and innovating. Financial services are ideal for direct marketing, and customer interactions produce an endless stream of information for research and development. On the Internet, IBS works at unprecedented speeds. Testing and customizing happen in... -

Page 26

To describe our trajectory over the last five years, we had to invent a word: hyper- growth. Revenues grew from $628 million to $3.8 billion. Up 512%. Customer base grew from 5 million to 24 million. Up 369%. Our ranks grew from 2,500 associates to 15,500. Up 532%. -

Page 27

1999 ï¬nancial presentation 27 28 45 46 47 48 52 Selected Financial and Operating Data Management's Discussion and Analysis of Financial Condition and Results of Operations Selected Quarterly Financial Data Management's Report on Consolidated Financial Statements and Internal Controls Over ... -

Page 28

... Stockholders' equity Managed Consumer Loan Data: Average reported loans Average off-balance sheet loans Average total managed loans Interest income Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate Net charge-off rate Operating Ratios: Return... -

Page 29

... (including salaries and associate benefits), marketing expenses and income taxes. Signiï¬cant marketing expenses (e.g., advertising, printing, credit bureau costs and postage) to implement the Company's new product strategies are incurred and expensed prior to the acquisition of new accounts while... -

Page 30

... salaries and beneï¬ts expense of $187.1 million, or 65% reï¬,ect the increase in marketing investment in existing and new product opportunities and the cost of operations to manage the growth in the Company's accounts and products offered. Average managed consumer loans grew 17% for the year ended... -

Page 31

...period drops below the sum of the certiï¬cate table 2: OPERATING DATA AND RATIOS Year Ended December 31 (Dollars in Thousands) rate payable to investors, loan servicing fees and net credit losses during the period. Prior to the commencement of the amortization or accumulation period, all principal... -

Page 32

...other cards targeted $1.2 $1.9 $3.1 to certain markets that are underserved by the Company's competitors. These products do not have a signiï¬cant, immediate impact on managed loan balances; rather they typically consist of lower credit limit 97 98 99 accounts and balances that build over time. The... -

Page 33

... amount and frequency of past-due fees as compared to the prior year, continued growth in the Company's portfolio of higher yielding products and repricings of low introductory rate loans during late 1998 and early 1999. The managed net interest margin for the year ended December 31, 1999, increased... -

Page 34

...RATES Year Ended December 31 (Dollars in Thousands) Average Balance 1999 Income/ Expense Yield/ Rate Average Balance 1998 Income/ Expense Yield/ Rate Average Balance 1997 Income/ Expense Yield/ Rate Assets: Earning assets Consumer loans (1) Securities available... Other borrowings Senior and deposit ... -

Page 35

... economic trends in consumer credit, increased purchase volume, membership and overlimit fees, as well as a slight increase in average off-balance sheet consumer loans. Servicing and securitizations income increased $107.5 million, or 16%, to $789.8 million for the year ended December 31, 1998... -

Page 36

... as the increase in salaries and associate beneï¬ts, was primarily a result of a 42% increase in the average number of accounts for the year ended December 31, 1999 and the Company's continued exploration and testing of new products and markets. Non-interest expense for the year ended December 31... -

Page 37

...months old. Accordingly, it is likely that the Company's managed loan portfolio could experience increased levels of delinquency and credit losses as the average age of the Company's accounts increases. Changes in the rates of delinquency and credit losses can also result from a shift in the product... -

Page 38

... (excluding accrued and unpaid ï¬nance charges, fees and fraud losses) less current period recoveries. The Company charges off credit card loans (net of any collateral) at 180 days past due. For the year ended December 31, 1999, the managed net charge-off rate decreased 148 basis points to 3.85... -

Page 39

... has accessed the international securitization market for a number of years with both US$ and foreign denominated transactions. Both of the Company's committed revolving credit facilities offer foreign currency funding options. The Bank has established a $1.0 billion Euro Medium Term Note program... -

Page 40

... deposit gathering efforts through both direct and broker marketing channels. The Company uses its IBS capabilities to test and market a variety of retail deposit origination strategies, including the Internet, as well as to develop customized account management programs. As of December 31, 1999... -

Page 41

... funds in the financial markets in adequate amounts and at favorable rates. As of December 31, 1999, the Company, the Bank and the Savings Bank collectively had over $1.6 billion in unused commitments, under its credit facilities, available for liquidity needs. CAPITAL ADEQUACY As of December... -

Page 42

... to any adverse impact. For example, management may reprice interest rates on outstanding credit card loans subject to the right of the consumers in certain states to reject such repricing by giving timely written notice to the Company and thereby relinquishing charging privileges. However, the... -

Page 43

... automobile ï¬nancing. Credit card opportunities include, and are expected to continue to include, a wide variety of highly customized products with interest rates, credit lines and other features speciï¬cally tailored for numerous consumer populations. The Company expects continued growth... -

Page 44

... in the credit card market has resulted in a decrease in credit card response rates and has reduced the productivity of marketing dollars invested in that line of business. In addition, the cost to acquire new accounts varies across product lines and is expected to rise as the Company moves beyond... -

Page 45

... its credit cards and consumer loans and to otherwise access the capital markets at attractive rates and terms to fund its operations and future growth; difï¬culties or delays in the development, production, testing and marketing of new products or services; losses associated with new products or... -

Page 46

... is a tabulation of the Company's unaudited quarterly results for the years ended December 31, 1999 and 1998. The Company's common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 9,738 and... -

Page 47

... and performing selected tests of transactions and records as they deem appropriate. These auditing procedures are designed to provide reasonable assurance that the financial statements are free of material misstatement. Management depends on its accounting systems and internal controls in meeting... -

Page 48

... examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and signiï¬cant estimates made by management, as well as evaluating the overall ï¬nancial statement presentation. We believe... -

Page 49

... 31 (Dollars in Thousands, Except Per Share Data) 1999 1998 Assets: Cash and due from banks Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans Less: Allowance for loan losses Net loans Premises... -

Page 50

...offers credit card products, and Capital One, F.S.B. (the "Savings Bank"), which offers consumer lending products (including credit cards) and deposit products. The Corporation and its subsidiaries are collectively referred to as the "Company." The accompanying Consolidated Financial Statements have... -

Page 51

...servicing fees and credit losses. The I/O strip is carried at fair value in accounts receivable from securitizations, with changes in the fair value reported... the disposition of the designated item. Interest rate and foreign currency exchange rate risk management contracts are generally expressed in... -

Page 52

...line method over the estimated useful lives of the assets. Useful lives for premises and equipment are as follows: buildings and improvements - 5-39 years; furniture and equipment - 3-10 years; computers and software - 3 years. Marketing The Company expenses marketing costs as incurred. Credit Card... -

Page 53

note b SECURITIES AVAILABLE FOR SALE Securities available for sale as of December 31, 1999, 1998 and 1997 were as follows: Maturity Schedule 1 Year or Less 1-5 Years 5-10 Years Over 10 Years Market Value Totals Amortized Cost Totals December 31, 1999 Commercial paper U.S. Treasury and other U.S. ... -

Page 54

... 1997, respectively. In November 1999, the Bank entered into an agreement to transfer a pool of consumer loans totaling up to $500,000. Proceeds from the transfer were recorded as a secured borrowing. The facility accrues interest based on commercial paper rates and matures in 2000; however, it may... -

Page 55

... and 1998, the Company had no outstandings under the Credit Facility or its predecessor facility. Under the Company's bank note program, the Bank from time to time may issue senior bank notes at ï¬xed or variable rates tied to LIBOR with maturities from 30 days to 30 years. The aggregate principal... -

Page 56

... or its equivalent (based on the applicable exchange rate at the time of sale) in one or more foreign currencies, currency units or composite currencies as shall be designated by the Corporation. At December 31, 1999, the Corporation had existing unsecured senior debt outstanding under the shelf... -

Page 57

...107 options to certain key managers (including 1,884,435 options to the Company's Chief Executive Officer ["CEO"] and Chief Operating Officer ["COO"]) with an exercise price equal to the fair market value on the date of grant. The CEO and COO gave up their salaries for the year 2001 and their annual... -

Page 58

...for ten trading days in a thirty consecutive calendar day period. All options vest immediately upon a change of control of the Company. As of December 31, 1999, 27,510 shares were available for grant under this plan. All options under this plan have a maximum term of ten years. The exercise price of... -

Page 59

... shares, respectively, under this program. Certain treasury shares have been reissued in connection with the Company's beneï¬t plans. note g OTHER NON-INTEREST EXPENSE Year Ended December 31, 1999 1998 1997 Professional services Collections Bankcard association assessments Fraud losses Other... -

Page 60

... December 31, 1999 1998 Deferred tax assets: Allowance for loan losses Finance charge, fee and other income receivables Stock incentive plan State taxes, net of federal beneï¬t Other Subtotal Valuation allowance Total deferred tax assets Deferred tax liabilities: The reconciliation of income... -

Page 61

... interest rate risk exposure, risk diversification, management expertise, asset quality, liquidity and internal controls. The most recent notiï¬cations received from the regulators categorized the Bank and the Savings Bank as "well-capitalized." To be categorized as "well-capitalized," the Bank and... -

Page 62

...% of the cost of the buildings. In 1999, the Company entered into two three-year agreements for the lease of four facilities located in Tampa, Florida and Federal Way, Washington. Monthly rent commences upon completion of each of the buildings and is based on LIBOR rates applied to the funded cost... -

Page 63

... is demanded in the complaint of the California case and the trial court entered judgement in favor of the Bank before the parties completed any signiï¬cant discovery, an informed assessment of the ultimate outcome of this case cannot be made at this time. Management believes, however, that there... -

Page 64

... value of securities available for sale was determined using current market prices. See Note B for fair values by type of security. Consumer Loans December 31, Geographic Region: South $ West Northeast Midwest International The net carrying amount of consumer loans, including the Company's seller... -

Page 65

... of the open market. Statements of Income for the Year Ended December 31, 1999 1998 1997 Interest from temporary investments Interest expense Dividends, principally from bank subsidiaries Non-interest income Non-interest expense Income before income taxes and equity in undistributed earnings... -

Page 66

... 200,012 38,576 (2,183) 3,290 229,064 Purchases of securities available for sale Proceeds from maturities of securities available for sale Increase in investment in subsidiaries Increase in loans to subsidiaries Net cash used for investing activities Financing Activities: (26,836) 11,658 (115,233... -

Page 67

... President and Chief Operating Ofï¬cer Capital One Financial Corporation W. Ronald Dietz* Sr. Vice President, Credit Card Operations Managing Partner Customer Contact Solutions, LLC James A. Flick, Jr.* Matthew J. Cooper Sr. Vice President, Marketing and Analysis John G. Finneran, Jr. President... -

Page 68

consolidated statements of income Year Ended December 31 (In Thousands, Except Per Share Data) 1999 1998 1997 Interest Income: Consumer loans, including fees Securities available for sale Other Total interest income Interest Expense: Deposits Other borrowings Senior and deposit notes Total ... -

Page 69

... (Dollars in Thousands, Except Per Share Data) Common Stock Shares Amount Paid-In Capital, Net Treasury Stock Total Stockholders' Equity Balance, December 31, 1996 198,975,783 Comprehensive income: Net income Other comprehensive income, net of income tax: Unrealized gains on securities, net... -

Page 70

consolidated statements of cash ï¬,ows Year Ended December 31 (In Thousands) 1999 1998 1997 Operating Activities: Net income Adjustments to reconcile net income to cash provided by operating activities: Provision for loan losses Depreciation and amortization, net Stock compensation plans (... -

Page 71

...on New York Stock Exchange Stock Symbol COF Member of S&P 500 Corporate Registrar/Transfer Agent Thursday, April 27, 2000, 10:00 a.m. Eastern Time Fairview Park Marriott Hotel 3111 Fairview Park Drive Falls Church, VA 22042 Principal Financial Contact Paul Paquin Vice President, Investor Relations... -

Page 72

... modem better financing personal shopper full tank grill magazines sandwich frequent flyer miles cd player trip to the circus day in the sun baby clothes pool table mother's day present movie tickets thank-you notes watercolor set business cards calculator surround sound dozen roses yearly check-up...