Capital One 1997 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.technology, we have created a massive data warehouse (12 trillion

bytes and growing) with consumer financial, demographic and

lifestyle information to help us customize products. In 1997 we

conducted a record number of tests (more than 14,000!) and

invested a record $225 million in marketing. And as our strong

earnings growth shows, the strategy has been highly effective.

Over the last three years, in keeping with our strategy of mass

customization, we have launched a long list of products for con-

sumers across the credit spectrum. We now offer, for example, co-

branded cards, affinity cards, lifestyle cards, college student cards,

fixed- and variable-rate cards, joint-account and secured cards for

consumers with limited or tarnished credit histories, and the low

introductory-rate balance-transfer products we pioneered seven

years ago. In October, we introduced a Mercedes-Benz Capital One

Visa card, which gives us an alliance with one of the world’s most

prestigious brands and increases our access to a highly desirable

group of customers, the 1.2 million Americans who own or lease

Mercedes-Benz automobiles. Capital One’s recent innovations also

include credit cards for consumers in Canada and the United

Kingdom, non-card lending products and cellular phone service.

Launched in 1996, Capital One’s international ventures exceed-

ed expectations for 1997. In December, we committed $50 million

to a new European operations center in Nottingham, England,

which will service our U.K. customers and give Capital One a

springboard to the Continent. We believe our strengths in scientific

testing and mass customization will serve us well in designing

products to meet the distinctive customer needs of each country

we enter.

Capital One prides itself on constant innovation throughout the

Company, and in 1997 our business strategy, technology and opera-

tions received top awards from

Beyond Computing

magazine and

from Visa. We also ranked number one on

ComputerWorld

’s list of

best places to work in the U.S. financial services industry. And

we were pleased that

Forbes

magazine recognized our momentum

by selecting us for one of the

Forbes

500 short lists: the 25

“Champs” of strong growth.

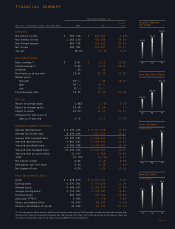

Vast Opportunity for Growth

Having conquered the challenges of 1997, Capital One begins 1998

with excitement and confidence, particularly now that the con-

sumer credit picture is starting to brighten. We have set our sights

on a fourth consecutive year of earnings growth in excess of 20%.

We see vast opportunity for growth. In the United States, cred-

it cards are increasingly the preferred form of consumer payment,

and they are steadily winning market share from other types of

consumer borrowing. Capital One now serves nearly one in ten

U.S. households, and our customers are using their cards for more

and more transactions.

Internationally, we see great potential for Capital One. Many

card markets outside the United States resemble the U.S. market

of a decade ago, when the banking industry offered every cus-

tomer the same product regardless of risk or need. We believe the

strategy of mass customization we have used to build our U.S.

business can be exported with great success, lowering credit costs

for the world’s consumers and creating long-term value for Capital

One stockholders.

The target for 1998: a fourth

consecutive year of earnings growth

and return on equity exceeding 20%.

PAGE 4