Capital One 1997 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 32

Table 11 shows the Bank and Savings Bank’s regulatory capital

ratios as of and for the years ended December 31, 1997 and 1996.

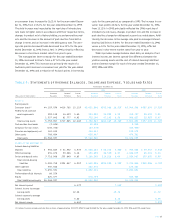

Table 11: Regulatory Capital Ratios

To Be “Well-

Capitalized”

Minimum for Under Prompt

Capital Corrective

Adequacy Action

Ratios Purposes Provisions

December 31, 1997

Capital One Bank

Tier 1 Capital 10.49% 4.00% 6.00%

Total Capital 13.26 8.00 10.00

Tier 1 Leverage 10.75 4.00 5.00

Capital One, F.S.B. (1)

Tangible Capital 11.26% 1.50% 6.00%

Total Capital 17.91 12.00 10.00

Core Capital 11.26 8.00 5.00

December 31, 1996

Capital One Bank

Tier 1 Capital 11.61% 4.00% 6.00%

Total Capital 12.87 8.00 10.00

Tier 1 Leverage 9.04 4.00 5.00

Capital One, F.S.B. (1)

Tangible Capital 9.18% 1.50% 6.00%

Total Capital 16.29 12.00 10.00

Core Capital 9.18 8.00 5.00

(1) Until June 30, 1999, the Savings Bank is subject to capital requirements that

exceed minimum capital adequacy requirements, including the requirement to

maintain a minimum Core Capital ratio of 8% and a Total Capital ratio of 12%.

During 1996, the Bank received regulatory approval and estab-

lished a branch office in the United Kingdom. In connection with

such approval, the Company committed to the Federal Reserve that,

for so long as the Bank maintains such branch in the United King-

dom, the Company will maintain a minimum Tier 1 Leverage ratio

of 3.0%. As of December 31, 1997 and 1996, the Company’s Tier 1

Leverage ratio was 13.83% and 11.13%, respectively.

Additionally, certain regulatory restrictions exist which limit the

ability of the Bank and the Savings Bank to transfer funds to the

Corporation. As of December 31, 1997, retained earnings of the

Bank and the Savings Bank of $99.6 million and $24.8 million,

respectively, were available for payment of dividends to the Corpo-

ration without prior approval by the regulators.The Savings Bank,

however, is required to give the OTS at least thirty days’ advance

notice of any proposed dividend and the OTS, in its discretion, may

object to such dividend.

Off-Balance Sheet Risk

The Company is subject to off-balance sheet risk in the normal

course of business including commitments to extend credit, excess

servicing income from securitization transactions and swaps. In

order to reduce the interest rate sensitivity and to match asset and

liability repricings, the Company has entered into swaps which

involve elements of credit or interest rate risk in excess of the

amount recognized on the balance sheet. Swaps present the Com-

pany with certain credit, market, legal and operational risks.The

Company has established credit policies for off-balance sheet

instruments as it does for on-balance sheet instruments.

Interest Rate Sensitivity

Interest rate sensitivity refers to the change in earnings that may

result from changes in the level of interest rates.To the extent that

managed interest income and managed interest expense do not

respond equally to changes in interest rates, or that all rates do not

change uniformly, earnings could be affected.The Company’s man-

aged net interest income is affected by changes in short-term

interest rates, primarily LIBOR, as a result of its issuance of

interest-bearing deposits, variable rate loans and variable rate secu-

ritizations. However, due to the Company’s use of swaps, the effects

of these interest rate changes are mitigated.The Company manages

its interest rate sensitivity through several techniques which

include, but are not limited to, changing the maturity and distribu-

tion of assets and liabilities, entering into swaps and repricing of

consumer loans.

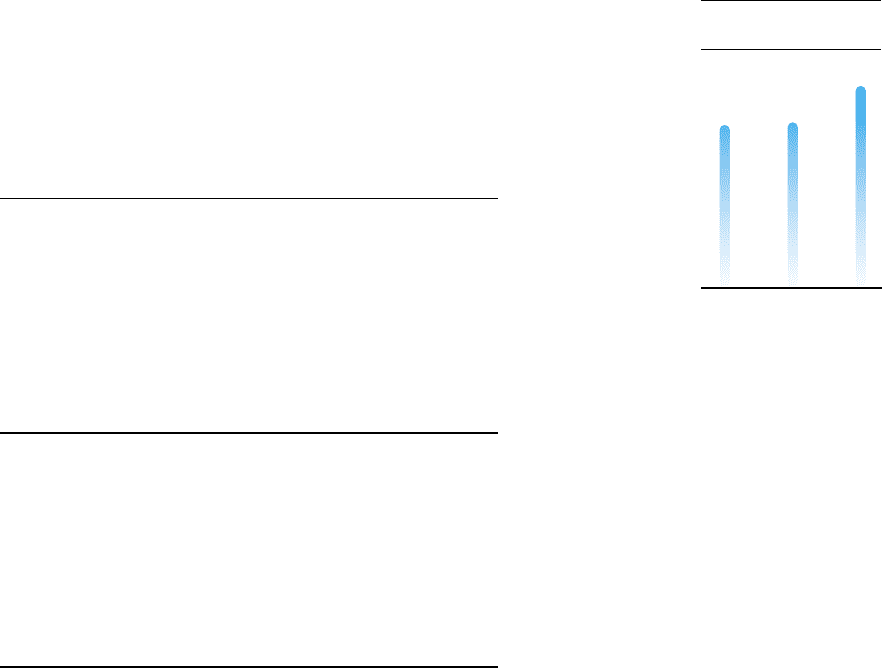

4.88%

Capital to Managed

Assets as of Year-end(1)

(in billions)

4.96%

6.03%

95 96 97

(1) Includes preferred

beneficial interests.