Capital One 1997 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

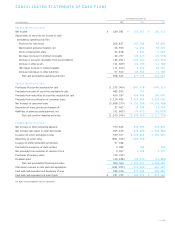

Consolidated Statements of Cash Flows

Year Ended December 31

(In Thousands) 1997 1996 1995

Operating Activities:

Net income $ 189,381 $ 155,267 $ 126,511

Adjustments to reconcile net income to cash

provided by operating activities:

Provision for loan losses 262,837 167,246 65,895

Depreciation and amortization, net 46,550 41,894 33,424

Stock compensation plans 24,878 7,921 4,020

Decrease (increase) in interest receivable 26,707 (23,017) (40,958)

Increase in accounts receivable from securitizations (86,261) (143,141) (122,364)

Increase in other assets (41,469) (24,795) (11,786)

(Decrease) increase in interest payable (11,914) 6,431 64,667

Increase (decrease) in other liabilities 97,914 89,964 (4,780)

Net cash provided by operating activities 508,623 277,770 114,629

Investing Activities:

Purchases of securities available for sale (1,275,900) (947,478) (400,117)

Proceeds from sales of securities available for sale 483,592 773

Proceeds from maturities of securities available for sale 450,787 490,040 100,000

Proceeds from securitization of consumer loans 2,114,695 2,695,000 3,525,000

Net increase in consumer loans (2,858,279) (4,251,269) (4,293,988)

Recoveries of loans previously charged off 27,462 13,300 13,353

Additions of premises and equipment, net (51,602) (74,871) (61,623)

Net cash used for investing activities (1,109,245) (2,074,505) (1,117,375)

Financing Activities:

Net increase in interest-bearing deposits 370,632 246,985 243,836

Net increase (decrease) in other borrowings 265,129 (278,820) (1,230,885)

Issuances of senior and deposit notes 529,977 2,105,864 2,469,869

Maturities of senior notes (891,436) (603,500)

Issuance of preferred beneficial interests 97,428

Proceeds from exercise of stock options 4,082 186 132

Net proceeds from issuances of common stock 4,957 3,109 1,257

Purchases of treasury stock (50,762)

Dividends paid (20,638) (20,573) (15,883)

Net cash provided by financing activities 309,369 1,453,251 1,468,326

(Decrease) increase in cash and cash equivalents (291,253) (343,484) 465,580

Cash and cash equivalents at beginning of year 528,976 872,460 406,880

Cash and cash equivalents at end of year $ 237,723 $ 528,976 $ 872,460

See Notes to Consolidated Financial Statements.

PAGE 43