Capital One 1997 Annual Report Download - page 47

Download and view the complete annual report

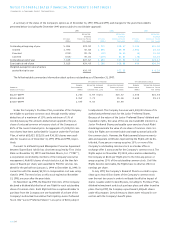

Please find page 47 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.losses on the securitization of consumer loan receivables based on

the estimated fair value of assets obtained and liabilities incurred in

the sale. Gains represent the present value of estimated cash flows

the Company has retained over the estimated outstanding period of

the receivables.This excess cash flow essentially represents an

“interest only”(“I/O”) strip, consisting of the excess of finance

charges and past-due fees over the sum of the return paid to certifi-

cateholders, estimated contractual servicing fees and credit losses.

Certain estimates inherent in the determination of the fair value

of the I/O strip are influenced by factors outside the Company’s

control, and as a result, such estimates could materially change in

the near term. Prior to 1997, no gains were recorded due to the

relatively short average life of the consumer loans securitized.

Excess servicing fee income was recorded over the life of each sale

transaction.

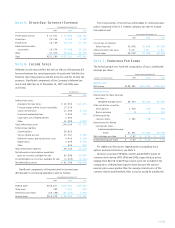

Premises and Equipment

Premises and equipment are stated at cost less accumulated depre-

ciation and amortization ($149,215 and $99,104 as of December 31,

1997 and 1996, respectively). Depreciation and amortization

expense are computed generally by the straight-line method over

the estimated useful lives of the assets.

Marketing

The Company expenses marketing costs as incurred.

Credit Card Fraud Losses

The Company experiences fraud losses from the unauthorized use

of credit cards.Transactions suspected of being fraudulent are

charged to non-interest expense after a sixty-day investigation

period.

Income Taxes

Deferred tax assets and liabilities are determined based on differ-

ences between the financial reporting and tax bases of assets and

liabilities, and are measured using the enacted tax rates and laws

that will be in effect when the differences are expected to reverse.

Earnings Per Share

In February 1997, the FASB issued SFAS No. 128, “Earnings per

Share” (“SFAS 128”). SFAS 128 replaced the calculation of pri-

mary and fully diluted earnings per share with basic and diluted

earnings per share. Unlike primary earnings per share, basic earn-

ings per share is based only on the weighted average number of

common shares outstanding, excluding any dilutive effects of

options and restricted stock. Diluted earnings per share is similar to

the previously reported fully diluted earnings per share and is based

on the weighted average number of common and common equiva-

lent shares, including dilutive stock options and restricted stock

outstanding during the year. Earnings per share amounts for all

periods have been restated to conform to SFAS 128 requirements.

Interest Rate Swap Agreements

The Company enters into interest rate swap agreements (“swaps”)

for purposes of managing its interest rate sensitivity. The Company

designates swaps to on-balance sheet instruments to alter the inter-

est rate characteristics of such instruments and to modify interest

rate sensitivity.The Company also designates swaps to off-balance

sheet items to reduce the interest rate sensitivity associated with

off-balance sheet cash flows (i.e., securitizations).

Swaps involve the periodic exchange of payments over the life of

the agreements. Amounts received or paid on swaps are recorded

on an accrual basis as an adjustment to the related income or

expense of the item to which the agreements are designated.The

related amount receivable from counterparties of $2,771 and

$41,548 as of December 31, 1997 and 1996, respectively, was

included in other assets. Changes in the fair value of swaps are not

reflected in the accompanying financial statements, where desig-

nated to existing or anticipated assets or liabilities and where swaps

effectively modify or reduce interest rate sensitivity.

Realized and unrealized gains or losses at the time of maturity,

termination, sale or repayment of a swap or designated item are

recorded in a manner consistent with the original designation of the

swap. Amounts are deferred and amortized as an adjustment to

interest expense over the original period of interest exposure, pro-

vided the designated asset or liability continues to exist or is proba-

ble of occurring. Realized and unrealized changes in fair value of

swaps, designated with items that no longer exist or are no longer

probable of occurring, are recorded as a component of the gain or

loss arising from the disposition of the designated item.

The Company’s credit exposure on swaps is limited to the value

of the swaps that have become favorable to the Company in the

event of nonperformance by the counterparties. Under the terms of

certain swaps, each party may be required to pledge collateral if

the market value of the swaps exceeds an amount set forth in the

agreement or in the event of a change in its credit rating.The Com-

pany actively monitors the credit ratings of counterparties and does

not anticipate nonperformance by the counterparties with which it

transacts its swaps.

PAGE 45