Capital One 1997 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

apital One had a remarkable year. In fact, we set records

for every major measure of financial and operating perfor-

mance: total revenue, net interest income and margin, risk

adjusted revenue and margin, non-interest income, net income,

earnings per share, return on assets, return on equity, accounts,

managed loans and marketing investment.

We added 3.2 million customers, ending the year with 11.7 mil-

lion accounts. For the third straight year, earnings grew by more

than 20% and return on equity exceeded 20%. The price of our

stock rose 50% to $54 3/16 at year-end. Since our initial public

offering in November 1994, the stock price has more than tripled.

Even more gratifying than the results themselves was the fact

that they were achieved in one of the most turbulent years in the

history of the credit card industry. In the first half of 1997, as

charge-offs and consumer bankruptcies continued an ascent that

began a few years ago, several of our competitors either exited

the credit card business or retrenched. Capital One’s record per-

formance in this challenging climate demonstrates the power

of our information-based strategy, our innovation and our finan-

cial conservatism.

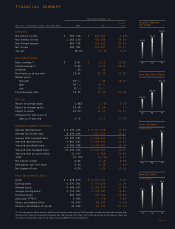

During 1997 net income rose 22% to $189.4 million, or $2.80

per share (diluted), from $155.3 million, or $2.32 per share

(diluted), the previous year. Actually, our financial performance

was even stronger. In the fourth quarter, we made several account-

ing adjustments that take a more conservative approach to

charge-offs and the recognition of revenue. Although these adjust-

ments had the effect of reducing earnings, they will serve to

strengthen Capital One’s financial foundation, which we regard as

To Our Stockholders:

vital to the Company’s long-term success. Our accounting policies

remain among the most conservative in the credit card sector.

Total revenue (managed net interest income plus non-interest

income) grew 41% to $2.1 billion in 1997 from $1.5 billion in

1996. Managed net interest income increased 28% to $1.3 billion,

elevating our net interest margin by 95 basis points to a record

9.24% in the fourth quarter of 1997 compared with the same

period in 1996. Managed non-interest income for 1997 grew by

68% to $776 million.

The large increase in Capital One’s revenues was fueled by

another record-setting year of new account growth. We increased

our customer base by 37%. For the second year in a row, our

growth rate in accounts was the largest reported by any major

card issuer. Because of our continuing concerns about the quality

of consumer credit, we deliberately held loan growth to a slower

pace, largely through tight controls on underwriting and credit

limits. At the end of 1997, Capital One’s managed loans totaled

$14.2 billion, up 11% from $12.8 billion a year earlier.

Although the economy was booming in 1997, with unemploy-

ment at a 24-year low, inflation at an 11-year low and consumer

confidence at its highest point in 28 years, the consumer credit

sector continued to experience increased charge-offs for the third

consecutive year before finally stabilizing in the third quarter

of 1997.

Capital One met this challenge with strict underwriting stan-

dards on new loans, selective credit-based repricing and targeted

initiatives to increase revenues—strategies that significantly

increased the profitability of our credit card portfolio. In 1997, our

In one of the credit card

industry’s most turbulent years,

Capital One turned in a record

performance.

C

PAGE 2