Capital One 1997 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

percentage of on-balance sheet consumer loans increased to 3.76%

as of December 31, 1997 from 2.73% as of December 31, 1996 pri-

marily due to increases in the net charge-off rate to 4.83% for 1997

from 3.63% in 1996, resulting from continued loan seasoning, gen-

eral economic trends in consumer credit performance and the modi-

fication in charge-off policy described earlier.The provision increase

also reflected the increase in on-balance sheet consumer loans to

$4.9 billion as of December 31, 1997, an increase of 12% from

December 31, 1996 and the continued growth of second generation

products. In consideration of these factors, the Company increased

the allowance for loan losses by $64.5 million during 1997.

For the year ended December 31, 1996, the provision for loan

losses increased to $167.2 million, or 154%, from the 1995 provi-

sion for loan losses of $65.9 million.The increase in the provision

for loan losses resulted from increases in average reported con-

sumer loans of 24%, continued loan seasoning, a shift in the compo-

sition of reported consumer loans and general economic trends in

consumer credit performance. Net charge-offs as a percentage of

average reported consumer loans increased to 3.63% for the year

ended December 31, 1996 from 2.03% in the prior year. Addition-

ally, growth in second generation products, which in some cases

have modestly higher charge-off rates than first generation prod-

ucts, increased the amount of provision necessary to absorb credit

losses. In consideration of these factors, the Company increased the

allowance for loan losses by $46.5 million during 1996.

Funding

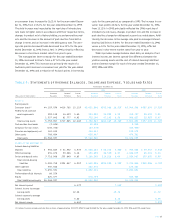

Table 9 reflects the costs of other borrowings of the Company as of

and for each of the years ended December 31, 1997, 1996 and 1995.

PAGE 29

Table 9: Other Borrowings

Maximum

Outstanding As Of Outstanding Average Average Year-End

(Dollars in Thousands) Any Month-End As Of Year-End Outstanding Interest Rate Interest Rate

1997

Federal funds purchased and resale agreements $ 999,200 $705,863 $ 503,843 5.54% 5.75%

Other 160,144 90,249 128,033 8.71 7.09

Total $796,112 $ 631,876 6.18% 5.90%

1996

Federal funds purchased and resale agreements $ 617,303 $445,600 $ 342,354 5.63% 6.26%

Other 207,689 85,383 112,545 8.20 6.43

Total $530,983 $ 454,899 6.27% 6.29%

1995

Federal funds purchased and resale agreements $1,146,678 $709,803 $ 747,350 6.14% 5.76%

Other 1,000,000 100,000 280,725 7.24 6.03

Total $809,803 $1,028,075 6.44% 5.79%

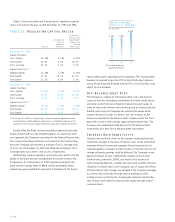

Table 10 shows the maturation of certificates of deposit in

denominations of $100,000 or greater (large denomination CDs)

as of December 31, 1997.

Table 10: Maturities of Domestic Large

Denomination Certificates—

$100,000 or More

December 31, 1997

(Dollars in Thousands) Balance Percent

3 months or less $ 97,363 42.62%

Over 3 through 6 months 43,523 19.06%

Over 6 through 12 months 49,210 21.54%

Over 12 months 38,332 16.78%

Total $228,428 100.00%

In September 1997, the Savings Bank completed the purchase of

the national retail deposit franchise of JCPenney National Bank.

Retail deposit balances acquired under the agreement were approx-

imately $421 million.The chart on page 31 indicates that during

1997 the Company increased its interest-bearing deposits to $1.3

billion as of December 31, 1997 from $.9 billion in the prior year.